How to Trade Futures: Best Futures Trading Strategies to Use

Futures trading is where financial enthusiasts speculate on the future prices of various assets, notably cryptocurrencies like Bitcoin and Ether. Unlike traditional spot trading, futures trading offers the potential for profit regardless of whether the asset's value is on the rise or experiencing a decline.

Let’s delve into the intricacies of the futures market, including how it works and its key trading strategies. This article will also give you insights into the distinctions between futures and options, as well as the differences between futures contracts and perpetual contracts.

Key Takeaways:

Futures traders commit to buying or selling at an agreed-upon price and date, enabling them to capitalize on futures prices whether the asset's value rises (goes long) or falls (goes short).

Various strategies are employed in futures trading that cater to different objectives and market conditions, such as long and short positions, pullback trading, trend following, breakout trading and spread trading.

What Is Futures Trading?

Futures trading is a financial market activity in which traders speculate on the future prices of various assets, including cryptocurrencies like Bitcoin (BTC) and Ether (ETH). A futures contract is an agreement between two parties to buy or sell an asset at a predetermined price on a specified future date. This trading method allows traders to profit from price movements, whether the asset's value rises (goes long) or falls (goes short).

In the context of cryptocurrency futures, traders don't actually own the underlying asset. Instead, they trade on the price fluctuations of a given cryptocurrency. This can be an advantage as it allows traders to profit in both bull and bear markets. Futures contracts typically have standardized terms, including contract size, expiration date and agreed-upon price, making them a more structured and regulated form of trading than spot trading.

How Does Futures Trading Work?

Futures are a type of derivative contract agreement to buy or sell a specific asset or security at a future price on a set date. This means that until the future date arrives, you’re trading the price movement of the underlying asset, as opposed to the asset itself.

Traders enter into futures contracts by choosing their desired contract size, expiration date and position — i.e., whether they want to buy (long) or sell (short) the asset. Let's illustrate how it works with a simple example.

Suppose you believe that the price of Bitcoin (BTC) will increase over the next three months. You can enter into a BTC futures contract at the current price. If the price rises by the time of the contract's expiration, you profit from the price difference. On the other hand, if the price falls, you incur a loss.

Futures are traded on exchanges. Each exchange will have its own trading hours during which the crypto can be traded. Leverage is typically available in futures trading, whereby only a portion of the contract's value is set aside as margin to hold the trade open. Futures can be actively traded before their contracts expire, so you don't have to keep a position open until the time of expiration.

Top 5 Futures Trading Strategies

There are countless futures trading strategies you can implement in order to capitalize on price trends. Below, we review five of the more common trading strategies.

Go Long

Going long is how traders describe owning a price rally. In essence, the long trader is anticipating the price of the contract will rally to its expiration date. This term can be applied to any market, such as crypto, forex, commodities and stocks. The term doesn’t refer to the time frame, but rather the exposure the trader has.

For example, traders with a long-term bullish bias on crypto will commonly "go long." A trader can also go long for a short period of time, such as a single day.

The opposite of going long is called going short (or “shorting”). Short traders anticipate that the value of the contract will fall to its expiration, allowing them to profit from falling prices.

Pullback

Pullback trading is one of the most popular futures strategies and can be coupled with the “long” strategy above. Essentially, the pullback is a swing trading strategy based on the futures trader’s belief that the value of the contract will rise over time. However, recognizing the asset’s current high cost, the trader will patiently wait for a pullback — a short-term correction in price — before going long.

Many technical indicators can be used to determine when a market is oversold and might therefore be ready to rally. Some of the more common indicators are RSI, MACD and stochastic. In addition, traders may use trend lines to indicate future levels of support where sellers will stop selling and buyers will rush in.

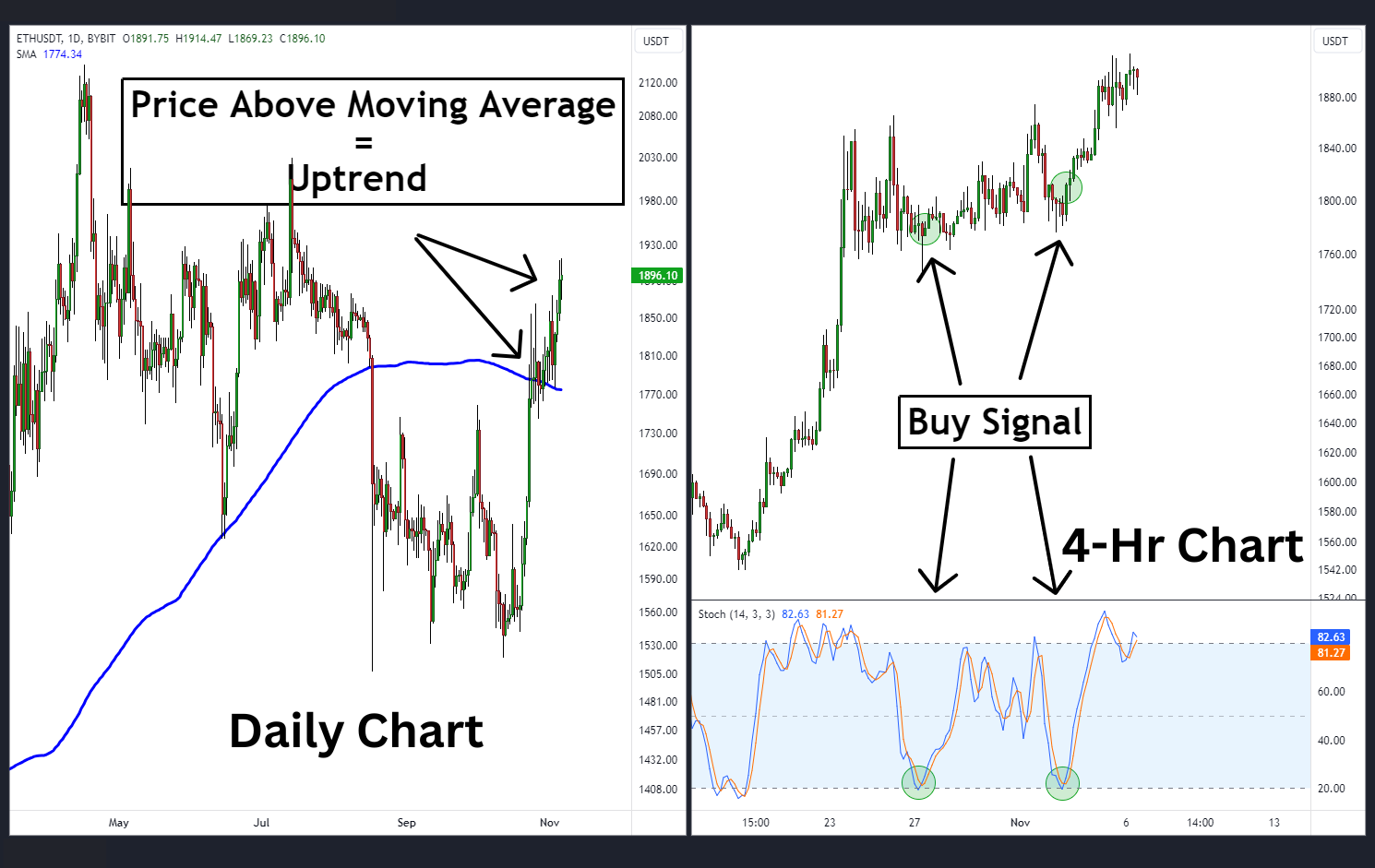

On the chart above, a trader might draw the blue trend line connecting the swing low points indicated by the green circles. If the price corrects down to the blue support trend line, the pullback trader may decide to enter long.

Trend Following

Trend following, sometimes called momentum trading, is a strategy that seeks to place trades in the direction of a longer trend. Momentum trades can be found in a variety of ways. Traders might simply assess the price action, and look to buy after a series of increasing highs and higher lows. Also, a trader might use momentum indicators like MACD or RSI, or take signals from long-term moving averages.

One popular futures trading strategy for trend following is to use multi–time frame analysis. This starts with a trader assessing the long-term trend in the market, typically with a 200-period simple moving average on a daily chart. If the price is above the moving average, then the trend is considered up. If the price is below the moving average, the trend is regarded as downward.

Then, the trader will scale down to a smaller time frame chart, such as a 4-hour price chart, to fine-tune an entry in the direction of the broader trend. For example, if they use a stochastic indicator, they’ll filter it for buy-only signals when the overarching trend is up, or for sell-only signals when the prevailing trend is down.

Breakout

Breakout trading is a popular futures strategy employed by more advanced traders. At first, breakout trading appears counterintuitive. You buy at a high price and sell at a low price. However, advanced traders understand the market sentiment below the surface.

For example, when there’s strong resistance in the market, stop-losses on short trades and buy orders for breakout trades hover just above. Therefore, when the price breaks above resistance, the buy orders tend to overwhelm the sell orders, propelling the market price upward in search of a new equilibrium.

In the example above, there’s a defined resistance level. When prices break above it, notice how the price accelerates higher as the imbalance of buyers outnumbers the sellers.

A breakout strategy can also be applied to downtrending markets. The key to the success of a breakout strategy is heightened volatility. When volatility is high, breakouts are more likely to succeed because the volatility tends to provide sufficient momentum for the support and resistance levels to break.

Spread

In spread trading, you buy and sell two different but related contracts, the goal being to make a profit on the spread.

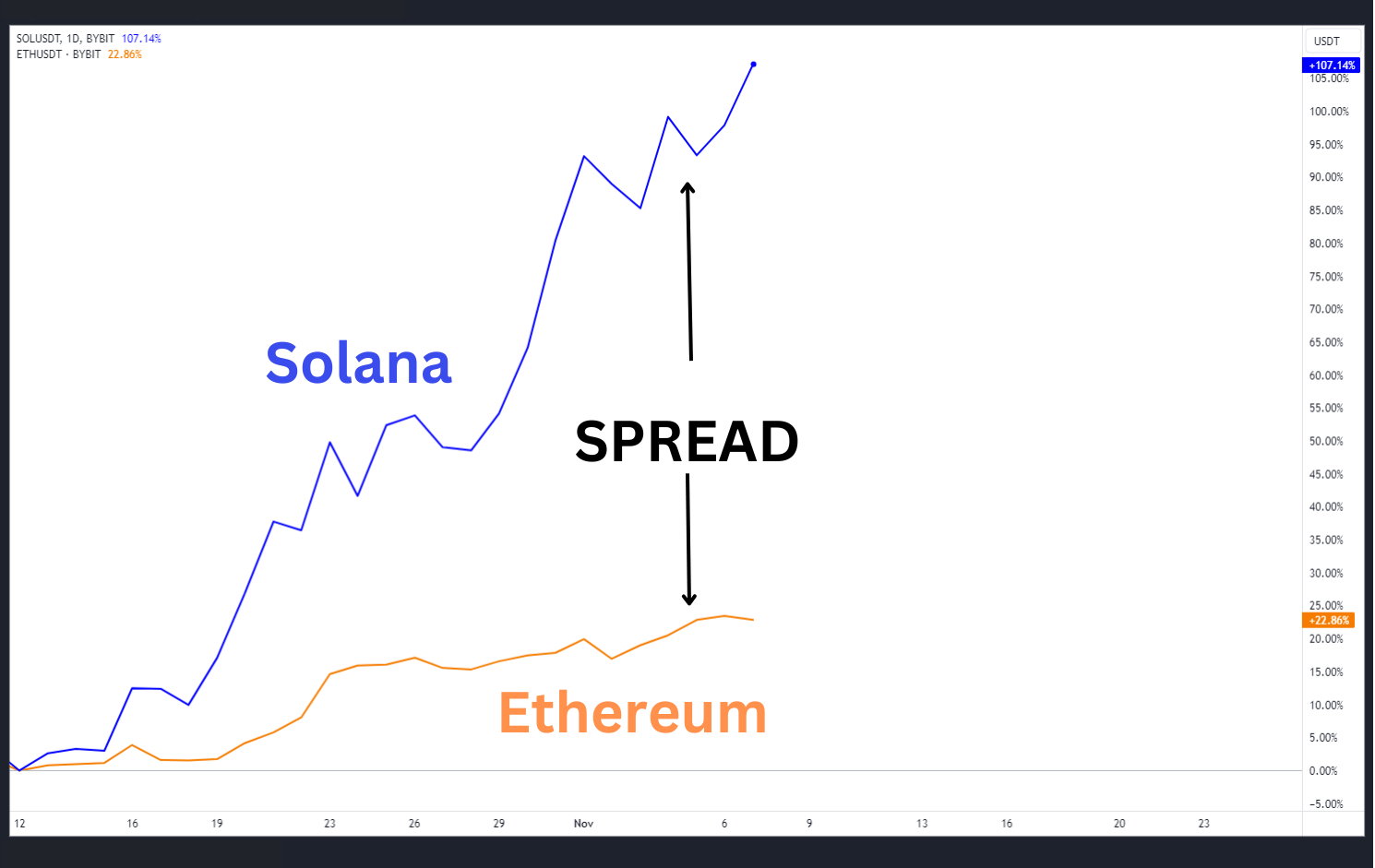

For example, Solana has often been seen as an “Ethereum killer,” which means many investors believe Solana is potentially a future replacement for Ethereum. If you’re anticipating Solana's outperformance, you would buy SOL while simultaneously selling ETH. This way, if both assets move higher, you’re betting that SOL’s price will rise faster than that of ETH. Or, if both assets decline, you’re betting that SOL’s price declines slower than ETH’s.

In the chart above, beginning October 12, SOL has drastically outperformed ETH. SOL rises 107% as compared to 23% for ETH. Traders going long on the SOL-ETH spread would have made a profit, whereas those who opted to short their positions would have found themselves in a losing scenario.

This type of strategy is used to capitalize on shorter-term disparities between pricing when day-trading futures.

Futures vs. Options

Futures and options are both derivative financial instruments, but they differ in terms of structure and trading strategies.

Futures

Obligation: When you enter into a futures contract, you have an obligation to buy or sell the underlying asset at the agreed-upon price and date. This means you’re committed to the trade, regardless of whether or not it's profitable.

Flexibility: Futures are typically used for speculative purposes or to hedge existing positions. They provide a straightforward way to bet on the future price movement of an asset without the complexity of options.

Margin Requirements: Futures are traded on margin, which is a percentage of the contract’s value. The margin requirements for futures contracts are often higher than the premiums to buy options contracts.

Options

Right, but not obligation: Options give you the right — but not the obligation — to buy (call) or sell (put) the underlying asset at a predetermined price within a specific time frame. This flexibility is valuable because it allows you to choose whether or not to exercise the option.

Risk Management: Options are commonly used for risk management. They can be employed to protect an existing portfolio from adverse price movements.

Premium Costs: Buying an option requires the payment of a premium, which is typically lower than the margin required for futures. This makes options a more cost-effective way to gain exposure to an asset's price movement.

Futures | Options |

Obligation to buy or sell the underlying asset on the contract date | The right, but not the obligation, to buy or sell the underlying asset on the expiration date |

Straightforward pricing | Several complex calculations that affect the premium |

Traded on margin, a percentage of the total contract value | Premium is paid when buying an option, and is typically lower than margins for futures |

Futures vs. Perpetual Contracts

Perpetual contracts, also known as perpetual swaps, are a relatively recent innovation in the cryptocurrency trading world. There are many similarities between futures and perpetual contacts, as well as a couple of key differences.

Similarities

Let’s first look at the similarities.

Derivatives: Both futures contracts and perpetual contracts are derivative financial instruments, meaning they derive their value from an underlying asset, such as a cryptocurrency like Bitcoin.

Leverage: Both types of contracts allow traders to leverage their positions, which means they can control a more substantial position size with a relatively smaller initial investment. This amplifies both potential profits and losses.

Long and Short Positions: Traders have the flexibility to assume long (speculating on price increases) and short (betting on price decreases) positions in both futures and perpetual contracts, enabling them to profit from both rising and falling markets.

Margin Trading: Both contracts require traders to post an initial margin as collateral to cover potential losses. Margin requirements can vary, but are a common feature in both futures and perpetual contracts.

Risk Management: Traders can use both futures and perpetual contracts for risk management purposes. These instruments can be employed to hedge existing positions in the spot market, helping protect against adverse price movements.

Differences

While futures contracts and perpetual contracts may seem alike at first glance, a closer look reveals some crucial distinctions between the two.

Expiration Date: Futures have a set expiration date, while perpetual contracts do not. Futures contracts require traders to roll over or close positions before the expiration, whereas perpetual contracts allow for continuous trading.

Settlement: Futures contracts settle at the expiration date, with the physical delivery of the underlying asset or a cash settlement. Perpetual contracts don’t have a settlement date, making them suitable for traders who want continuous exposure to an asset's price movements.

Contract Size and Standardization: Futures contracts are typically standardized in terms of size, expiration date and terms. Perpetual contracts may offer more flexibility in these aspects, allowing traders to choose positions that align better with their specific trading objectives.

Understanding these differences is essential in order for traders to make informed decisions when choosing between futures and perpetual contracts.

Feature | Futures Contracts | Perpetual Contracts |

A derivative financial instrument | Yes | Yes |

Can leverage positions | Yes | Yes |

Can assume long and short Positions | Yes | Yes |

Initial margin is required for collateral | Yes | Yes |

Used for risk management and hedging | Yes | Yes |

Has expiration date | Yes | No |

Has settlement date | Yes, either with physical delivery or cash settlement | No |

Contract size and standardization | Standardized in size, expiration and terms | More flexibility in size and terms |

Closing Thoughts

Futures trading empowers traders to speculate in dynamic assets such as cryptocurrencies, and offers a structured way to profit from price movements. Understanding the various trading strategies can be pivotal in achieving success. Furthermore, comprehending the distinctions between futures contracts and options contracts — and between futures contracts and perpetual contracts — can aid traders in selecting the most suitable instruments for their specific trading goals and risk tolerances. Armed with this knowledge, traders can navigate the markets with unwavering confidence.

#Bybit #TheCryptoArk