Straddle Options Strategy: How to Consistently Make Profits

The best part about trading neutral options strategies is that you can be undecided about going bullish or bearish on your latest crypto options trade and still profit. This is thanks to the potential rise in implied volatility (IV) that comes from an impending catalyst that may cause a larger-than-expected move in the price of the coin or token. Interested in learning about such options strategies that let you play both sides?

Enter the straddle strategy — a neutral options scheme that lets traders leverage on upcoming volatility and earn a tidy profit, regardless of whether the overall price goes up or down. From the setting up of a straddle options strategy to referencing an example of executing the straddle strategy in the crypto market, here’s all you need to know when it comes to unraveling the secrets of making a profit with long and short straddles in the crypto options market.

Key Takeaways:

- A straddle is a price-neutral options strategy that involves the trading of call and put options for an asset, with the same strike price and expiration date.

- The straddle options strategy allows traders to take advantage of changes to an underlying asset’s implied volatility.

- Crypto options traders can choose from two types of straddle strategies: long and short.

What Is a Straddle Options Strategy?

A straddle is a price-neutral options strategy that involves the trading of call and put options for an asset, with the same strike price and expiration date. Traders employ straddles to take advantage of changes to an underlying asset's implied volatility. When an asset’s price moves more than expected, the option’s premium will surge more than expected as well, leading to profit for straddle options traders.

Types of Straddle Options Strategies

There are two types of straddle strategies for crypto options traders to choose from:

- Long Straddles — A trader buys both a call and a put contract at the same strike price, and benefits when IV rises (long strategy).

- Short Straddles — A trader writes both a call and a put contract at the same strike price, and benefits when IV falls (short strategy).

To initiate a long straddle, you buy a call option and a put option with the same strike price and expiration date. For the strategy to make money at expiration, the price of the underlying asset must deviate from the strikes (in either direction) by an amount greater than the total premium you’ve paid.

For a short straddle, the opposite applies. Here, you sell a put and call with the same strike price and expiration date. To profit at expiration with this approach, the underlying asset must not deviate from the strikes by more than the total amount of premium collected.

What Is Implied Volatility?

Before even diving into executing straddles, it’s crucial to first understand what drives the premiums of options contracts besides options Greeks.

Implied volatility (IV) effectively represents the amount of uncertainty or risk in the market for a particular asset. Implied volatility is derived from option prices themselves by measuring the expected market price movements in an options contract. It indicates how much a trader believes an asset will move over the life of the option, which helps them to decide whether buying or writing an options contract is optimal when executing a straddle options strategy.

Traders expecting more price movement in the near term should execute a long straddle strategy, since they expect the price of the option to appreciate closer to the catalyst. Conversely, options traders expecting less volatility in price should write a short straddle strategy, as they expect contract prices to be less volatile closer to expiration.

How to Set Up a Straddle Option Strategy

Whether it’s a long or short position, three things apply when setting up a straddle:

- The call and put option must be tied to the same underlying asset.

- Both options must have the same expiration date.

- You must use the same strike price for both the put and the call.

Long Straddle Setup

Let's see how a long straddle strategy can be used to profit from growing volatility across various coins and tokens.

Crypto Options Example

Let’s take a hypothetical scenario: In two weeks' time, a major blockchain upgrade is taking place on Ethereum’s network, and all the major social media websites are talking about it. You predict it could result in a major price move for ETH, but you’re unsure in which direction. Taking all of this into account, a long straddle options strategy might help you profit.

Underlying ETH Price: $1,600.00

- Buy one contract of a $1,600.00 put option, with 25 days to expiration (DTE), paying a 0.0241 ETH premium.

- Buy one contract of a $1,600.00 call option with 25 DTE, paying a 0.0473 ETH premium.

This example uses at-the-money (ATM) strikes (equal to the underlying security's price). Alternatively, out-of-the-money (OTM) strikes can be implemented to give the trade a bullish or bearish bias. The combined cost of this strategy is a net debit of 0.0714 ETH, which adds up to about $114.24. This also acts as the maximum potential loss for this long straddle options strategy.

For this trade to be profitable, ETH’s price must be above $1,714.24 (call strike + total premium paid) or below $1,485.76 (put strike − total premium) at expiration.

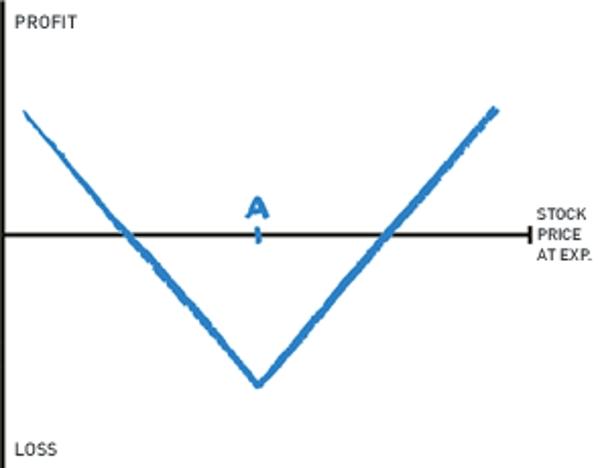

The payoff diagram below features an example of stock prices and illustrates the long straddle's risk profile at expiration. You'll notice the maximum loss occurs when the asset expires equal to the long strikes.

Thanks to the neutral nature of long straddle strategies, options traders have the potential to profit on both the upside and downside as long as ETH’s price moves more than accounted for with the option contract’s IV.

Short Straddle Setup

Let's see how a short straddle strategy can be used for coins and tokens to profit from volatility that’s expected to fall over time.

Crypto Options Example

Using Ether as an example again, let’s see how we can benefit from a short straddle and from writing the same call and put contracts.

In this case, if you don’t expect ETH to move much in terms of price, and expect the volatility to fizzle out over time, then it makes sense to write call and put contracts to open a short straddle options strategy. This effectively lets you take advantage of the high volatility of the options contracts and write the contracts at a high premium, while expecting the price of ETH to remain flat in spite of the major blockchain network upgrade.

Underlying ETH Price: $1,600.00

- Write one contract of a $1,600.00 put option with 25 days to expiration (DTE), paying a 0.0241 ETH premium.

- Write one contract of a $1,600.00 call option with 25 DTE, paying a 0.0473 ETH premium.

The combined premium credit to be received from this strategy is a net of 0.0714 ETH, which adds up to about $114.24. This also acts as the maximum potential gain for this short straddle options strategy.

For this trade to be profitable at the date of expiration, ETH’s price must stay within $1,714.24 (call strike + total premium paid) and $1,485.76 (put strike − total premium).

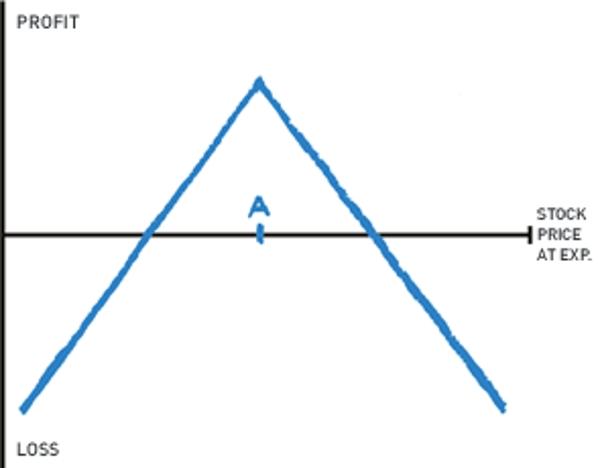

Unlike the long straddle, which has limited risk (premium paid), the short straddle has limited profit potential (premium received) and significant risk.

The payoff diagram below depicts a short straddle achieving maximum profit when both strikes expire ATM. There’s unlimited loss potential on the upside, and significant loss potential on the downside.

Straddle vs. Strangle Options

The straddle and strangle share many similarities. They’re both price-neutral and structured to benefit from changes in IV. However, while a straddle uses ATM strikes, a strangle combines two OTM options.

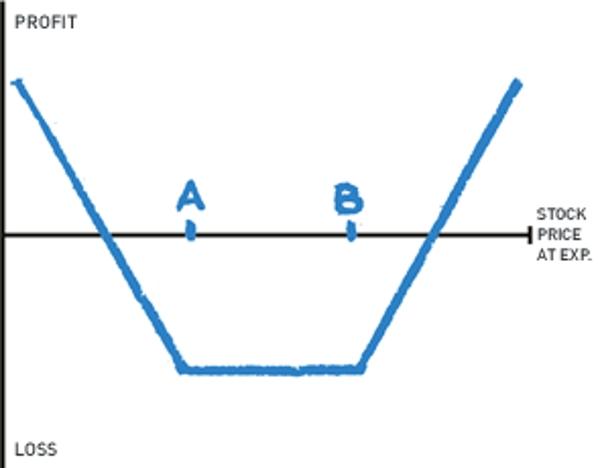

For a long strangle, you purchase an OTM put option and an OTM call option on the same underlying asset, with the same expiration date.

Like the long straddle, a long strangle benefits when volatility increases. The key difference between the two is that by using OTM strikes, you need a larger move in the underlying asset for the strangle to turn a profit. The payoff is that, all things equal, two OTM options should cost less than two ATM options.

Like the long straddle, a long strangle is low-risk (total premium), with unlimited profit potential on the upside and considerable potential gains on the downside.

The payoff diagram below shows the trade is unprofitable in a wider range than the straddle, becoming profitable when the underlying asset price moves beyond either strike by more than the total premium cost.

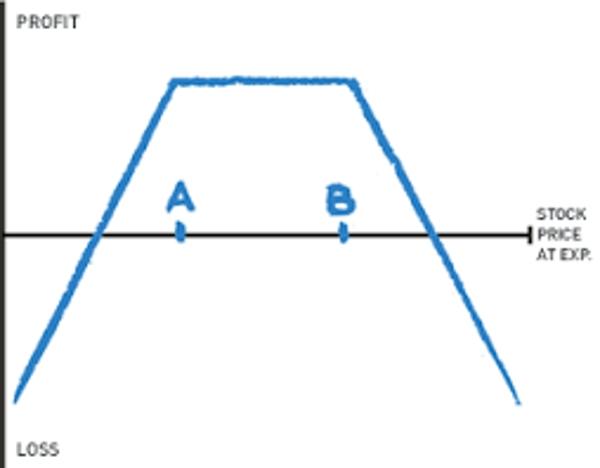

A short strangle, pictured below, is a mirror image of the long strangle strategy. While you collect a lower amount of premium by selling OTM options, the range where the trade is in profit is wider than when selling a straddle.

Who Can Use the Straddle Strategy?

Because the long straddle is a low-risk strategy, it's appropriate for investors of all levels of experience. In contrast, the short straddle is better suited to experienced traders with a high tolerance for risk. This is because of the risk of unlimited loss that may occur when the price of the underlying asset veers too much in either direction, such that the options premiums received are unable to compensate for the price volatility.

When to Use a Straddle

The best time to employ a straddle is when you expect volatility to rise and the underlying asset to record a “sufficiently large” movement (by more than the amount of premium received).

Options traders often use the straddle to coincide with potential market-moving events, such as economic data releases and regulatory hearings, or simply when their technical analysis forecasts an impending breakout.

Breakeven Point

Both long and short straddles have two possible breakeven points at expiration — when the market settles in either direction, equal to the amount of premium either paid or received.

Example 1

A long BTC straddle centered at the $20,000 strike price, with a combined premium cost of $1,000, will break even at either $19,000 or $21,000 on the expiration date. At both levels, the trade neither makes nor loses money (strike price − settlement price +/− premium paid).

Example 2

A short straddle centered at the $20,000 strike price generating $1,000 in premium also breaks even at $19,000 or $21,000 (strike price − settlement price +/− premium received).

Short Straddle Sweet Spot

The sweet spot for a short straddle is when the options expire with the underlying price equal to the strikes. Using the above example, the sweet spot is $20,000 at expiration. Because both options are ATM, they expire worthless and you get to keep the entire premium.

Adjustments to Make in Bearish Markets

As mentioned earlier, the straddle is designed to profit from both bullish and bearish markets. However, you can modify the strategy if your market view changes during the trading process. Here, we look at two ways you can switch the strategy from price-neutral (horizontal) to directional (diagonal).

Sell the Long Call Option (Bearish)

Removing the long call converts the straddle into a bearish long put. Although the risk remains limited (put premium +/− the cost of closing the call), the trade now has a bearish bias and doesn't profit if the underlying asset moves above the long call's breakeven price.

Sell the Long Put Option (Bullish)

Selling the long put flips the straddle to a bullish long call. Similar to removing the put option, the trade's risk is limited (call premium +/− the cost of closing the put), but no longer profits if the market moves below the closed long put's breakeven point.

Straddle Tips

Here are three strategies to increase the likelihood of a long straddle turning profitable:

- Time your strategy to coincide with potentially market-moving events.

- Close the position if volatility spikes soon after entering the trade.

- Choose a strike price that represents a turning point on the price chart, such as a long-term resistance or support level.

Margin Requirements

One of the straddle's key advantages is its minimal margin requirement. Because the most it can lose is the cost of entry, there’s no need for further margin once you’ve paid the initial net debit.

In contrast, the margin requirement for a short strangle is considerably higher. That being said, Bybit traders with a minimum account balance of 1,000 USDC can choose to activate Portfolio Margin mode.

Portfolio Margin mode uses a risk-based approach similar to Standard Portfolio Analysis of Risk (SPAN) to determine the overall risk level of a crypto portfolio. Using this method, long and short exposures are netted against each other, thus reducing margin requirements for hedged portfolios. For this reason, an existing long or short position may reduce the margin requirement for a short straddle applied to the same underlying asset.

Theta Decay Impact

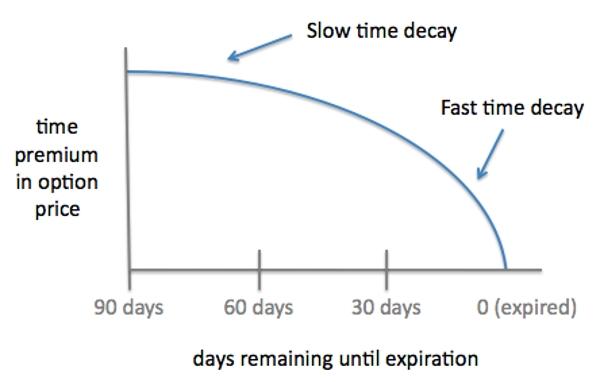

As we’ve explained, options premiums lose value (erode) over time. However, time decay isn't constant, and changes while the contract is active. The measure for gauging how much a premium will lose each day is theta.

Theta measures a premium's sensitivity to time. Because theta always reflects the amount by which an option will decline, it's always denoted as a negative number. For instance, all things being equal, a BTC option valued at $100.00 with a theta of −0.5 will be worth $99.50 the following day, whereas if the option had a theta of −0.9 it would be worth $99.10 the following day.

The theta curve below demonstrates that time decay is not linear. Since there’s less time for the option to realize or increase in value, the rate of erosion accelerates as the expiration date approaches.

Pros

- Long straddles are ideal if you anticipate a major move following news of an upcoming event, but are unsure of the direction it will take.

- The strategy's set cost means you can calculate your greatest possible loss.

- Profit potential is limitless on the upside and significant on the downside.

Cons

- Time decay works against this strategy.

- A drop in IV might make your trade unprofitable.

Risks

- The expected increase in IV may fail to materialize, causing both the put and call option to lose value.

- The underlying moves, but not by enough to offset the effects of time decay.

Is the Straddle Options Strategy Worth Trying?

Based on the cases and examples presented above, running straddle options strategies can help traders take advantage of volatile markets. However, there are pros and cons to consider before executing the strategy. On the plus side, the straddle strategy helps traders profit if they grasp the concept of implied volatility without forcing them to pick a side, since the strategy is price-neutral. This may be useful in situations where the trader anticipates a large movement in price direction, but is unsure of which way it will go.

Conversely, it can be difficult to gauge how profitable a straddle options strategy will be since the asset must move significantly for it to be profitable for traders executing a long straddle. Additionally, for those writing a short straddle options strategy, there’s always a risk of unlimited losses if the asset’s price moves more than expected in either direction.

All in all, we believe straddle strategies are certainly worth attempting, since they’re a tool that both experienced and beginning options traders can employ. This recommendation is based on the assumption that traders fully grasp options Greeks, and the effects of implied volatility.

In a Nutshell

Ultimately, long strangles and straddles are excellent, risk-averse strategies that you can use to profit from changes in implied volatility. As both methods are easy to apply, they can be used by less experienced traders looking for big returns.

Short strangles and straddles, on the other hand, are appropriate for more experienced traders, or those with a higher tolerance for risk who can mitigate it.

If you're still unsure whether straddles or strangles are right for you, take a look at Bybit Learn's free educational tools to discover more about the benefits of crypto options.

#Bybit #TheCryptoArk