Definition: Fill or Kill Order (FOK)

Fill or kill (FOK) is a type of time in force order that must be filled immediately, or entirely, or be canceled. They can be filled at the limit price or better, but cannot be only partially filled.

It is similar in nature to an all or nothing (AON) order, which is commonly used in stock trading. The only fundamental difference between the two orders is that a FOK order focuses on the immediacy of the order being filled or not, while an AON order does not have any time focus.

FOK is generally used by day traders looking to scalp or take advantage of small price differences over a short duration of time. It is commonly offered on cryptocurrency exchanges, including Bybit.

They are also used when traders don’t want orders to be partially filled. A trader may place several FOK orders at once, and when one is executed, he or she will then cancel the other orders.

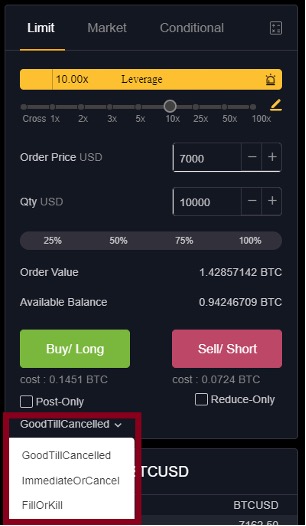

On Bybit, the FOK order is offered in addition to two other time in force orders: good till cancelled (GTC), and immediate or cancel (IOC). These orders are different to FOK in how they executed.

A GTC order will remain valid until it is executed in full or cancelled by the trader. A IOC order on the other hand must be filled immediately, either at the order price or better.

Where a FOK order can be placed on Bybit (along with the other time-in-force orders)Let’s take a look at how a FOK order works:

John decides to immediately place an order, buying 10,000 BTCUSD contracts at an order price of $15,000, and he sets a FOK limit buy order at $15,000.

Scenario one: There are only 8,000 BTCUSD contracts available at that price. Therefore, John’s FOK order is immediately canceled.

Scenario two: There are 20,000 BTCUSD contacts available at $15,000. Therefore, John’s FOK order is filled completely.

Along with the other time in force orders, a FOK order gives more flexibility for a trader when placing an order. It takes away the need to set orders manually, as it will be automatically placed if certain stipulations are met.