Zeta Markets (ZEX): Revolutionizing Perpetual Futures Trading on Solana

The arrival of early token-swap and lending protocols signified the emergence of the decentralized finance (DeFi) industry in 2017–2018. However, it didn't take long for more advanced forms of trading — including derivatives trading — to appear on the menu. Decentralized derivatives platforms flourished, quickly becoming a prominent niche within the DeFi ecosystem. Fast-forward to mid-2024, and the derivatives category of the DeFi market is approaching a total value locked (TVL) of $4 billion.

Yet, despite all this growth, many decentralized derivatives platforms operate as if it's still 2018. With Ethereum (ETH) the largest blockchain hosting DeFi protocols, derivatives exchanges are encumbered with tardy settlement times and exorbitant gas fees. Additionally, onerous overcollateralization requirements are still the reality for many blockchain-based derivatives trading platforms.

One project within the space is notably different, though. Zeta Markets is a decentralized derivatives trading protocol on the Solana (SOL) blockchain that features lightning-fast sub-second transaction settlement times, minimal gas fees and the ability to trade via undercollateralized positions. The platform owes many of its benefits to Solana's stellar technical parameters. Others, however, are a function of the protocol's unique architecture.

Key Takeaways:

Zeta Markets is a Solana-based crypto derivatives exchange that offers DeFi traders several distinct advantages — nominal gas fees, sub-second order settlement, undercollateralized trading, and a highly efficient and familiar central order book model.

The platform leverages its fast settlement times, pricing oracles, collateral system and dynamic liquidation mechanism to provide trading opportunities that are unique and undercollateralized.

Its native token, ZEX, is used for staking, governance and user incentivization. ZEX can be bought on Bybit as a Spot pair (ZEX/USDT).

What Is Zeta Markets?

Zeta Markets (ZEX) is a Solana-based crypto perpetuals exchange that offers users speedy order settlement times and meager fees while providing a noncustodial, fully on-chain trading environment. Thanks to the technical efficiencies of the Solana blockchain, the Zeta Markets platform features order processing times of less than one second and gas fees that are typically small fractions of a cent. As a public blockchain network, Solana also helps Zeta offer complete order transparency.

The protocol features a central limit order book (CLOB), a setup familiar to many DeFi traders using centralized exchange (CEX) platforms and traditional markets. At the same time, it remains fully decentralized and is based on a blockchain ethos of community ownership.

Platform users place their perpetual futures trades from the same unified account, and account and order funding use the USDC stablecoin. Zeta’s decentralized exchange (DEX) boasts one particularly vital feature — the ability to place undercollateralized trades. The platform's overall setup (particularly its margin system, discussed below) makes undercollateralized trading possible. This starkly contrasts with many other DeFi protocols, including perpetuals platforms that often require overcollateralization of accounts. For many DeFi users, this could be a critical factor, making Zeta Markets the best crypto perpetuals exchange for their trading needs.

How Does Zeta Markets Work?

Margin System for Undercollateralized Derivatives Trading

Zeta Markets' unique margin system allows it to offer undercollateralized trading opportunities. The system has three key elements: pricing oracles, a collateral framework and a liquidation mechanism.

Zeta leverages Pyth as the primary oracle to source up-to-date pricing data on crypto assets traded on the platform, with Chainlink as its backup oracle. Thanks to Solana's swift transaction-processing capabilities (supported by 400 millisecond block times), pricing data is incorporated into Zeta Markets in intervals of less than one second.

The collateral framework also works to support the margin system. While Zeta boasts undercollateralized opportunities, maintaining adequate collateral levels is important for ensuring the overall health and operations of its platform.

Finally, Zeta’s liquidation mechanism is also critical to protecting its system and making undercollateralized trading viable for the entire trader community. Network users willing to act as liquidators check the health of other accounts, liquidating those that fail below a certain maintenance margin. This is a permissionless process, and any entity on the platform can opt to act as a liquidator. Liquidators earn rewards in the form of 30% of the maintenance margin for the liquidated account. Note, however, that acting as a liquidator is a high-risk activity with no guarantee of being profitable.

Central Limit Order Book (CLOB)

Unlike many other decentralized derivatives platforms, which typically use the automated market maker (AMM) trading model, Zeta is based on the CLOB system of order matching, which is usually found on CEXs. CLOB is based on directly matching buy and sell orders, rather than executing trades against an AMM liquidity pool. While AMMs shine for token swap trades, the CLOB model might be superior for crypto derivatives trading.

Compared to an AMM, the CLOB setup allows for better price discovery, often features more significant insights into market depth and is more efficient at supporting high-frequency trading. These factors are all critical for derivatives trading. Additionally, trigger orders — one of the main order types on Zeta Markets — are also better supported by a CLOB trading mechanism.

Given all these advantages of a CLOB over an AMM in the area of derivatives trading, the project has made an intelligent choice to base its primary trading model on the former.

Funding Rates

Since perpetual futures have no expiration dates, funding rates are used to ensure that these contracts maintain value close to the underlying asset's spot market price at all times. A positive funding rate indicates that the price of the perpetual futures contract is currently higher than the underlying asset's price. In turn, a negative funding rate means that the futures contract is traded at a lower price than that of the underlying asset.

Based on current funding rates, Zeta users make funding payments to keep the price of the futures contracts adjusted to the market. Long positions make funding payments to short positions when the funding rate is positive, and conversely, shorts pay longs at times of negative funding rates. The prevalent funding rates are recalculated on the platform every 10 seconds.

Trading Tools and Features on Zeta Markets

Perpetuals Trading

Zeta Markets DEX is the gateway to the platform's derivatives trading opportunities. Using it, you can open perpetuals contracts for some major high-cap cryptos, such as SOL, ETH, Bitcoin (BTC) and Arbitrum (ARB), as well as several smaller-cap coins, e.g., Tensor (TNSR), Jito (JTO) and Dymension (DYM). You can also find some seriously hyped-up Solana-based meme coins, such as Dogwifhat (WIF).

Traders can also take advantage of the leverage in most of these perps. Typically, leverages on major coins like SOL, BTC or ETH are up to x10, while perpetuals based on smaller-cap coins have ratios of around x4–x5. As noted earlier, you’ll need to fund your account using USDC before opening these futures contracts based on the cryptocurrency of your choice.

Rewards Programs

Zeta users can earn rewards in the platform's native token, ZEX, based on their trading activity. The rewards are based on the user's Z-score, which is largely determined by the amount of maker and taker fees paid by the account. The Z-score for each user and the rewards paid out are calculated once per epoch, with each epoch typically lasting 28 days.

What Is the Zeta Markets Token (ZEX)?

Zeta Markets’ native token, ZEX, was launched in late June 2024 on the Solana blockchain. The token's main functions include staking, governance and user incentivization.

Staking ZEX

Following ZEX's token generation event (TGE), users can now stake the crypto for up to four years. Staking ZEX offers benefits, such as a boost to the user's Z-score, which is crucial for the amount of ZEX rewards earned, eligibility for airdrops and the right to participate in on-platform governance processes.

Upon staking ZEX, users are assigned a gZEX score, which is determined by the amount and duration of staking.

Governance

The gZEX score mentioned above is critical for the user's influence on Zeta’s governance processes. Your voting power will depend heavily on this score. While the platform's governance processes are still maturing, it's expected that community members will actively participate in on-platform decision-making by discussing and voting on proposals for protocol changes, market listings, reward models and other parameters.

Incentives

For 90 epochs starting from ZEX's TGE in late June 2024, the platform will distribute 300 million ZEX tokens in incentive payments. Users' Z-scores (see above) will be critical for determining their reward allocations. With each epoch covering 28 days, this incentive program is expected to run until around mid-2031.

ZEX Tokenomics

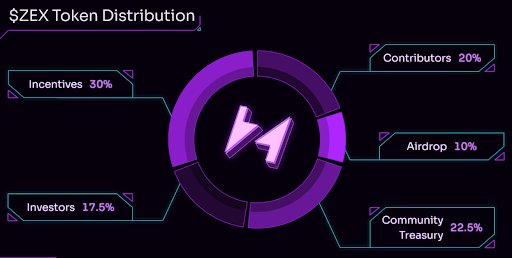

The ZEX token is a deflationary asset, with a maximum and total supply of 1 billion. Supply allocation shares are per the chart below:

ZEX Airdrop

The supply distribution chart above shows that 10% of ZEX tokens are allocated to community airdrops. The Round 1 airdrop has 8% of the total supply allocated to it. In it, early contributors to the platform will receive ZEX tokens following the TGE, with the majority of the allocation determined by the users' Z-scores.

The other 2% of the ZEX supply slated for airdrops will be distributed in Round 2, in which ZEX stakers will be eligible for token allocations based on their gZEX scores, which depend on the amount and duration of staking. The Round 2 airdrop is scheduled to start 28 days after the TGE, in late July 2024.

Where to Buy ZEX

The ZEX token is available on Bybit via the Spot market as a swap pair with USDT. Through Jul 11, 2024, three Bybit promotional events dedicated to the token give you the chance to grab a share of the 4,620,000 ZEX prize pool.

Event 1: This event requires new users either to accumulate a deposit volume of at least 1,000 ZEX, or deposit at least 100 USDT and trade 100 USDT worth of ZEX in their first trade with Bybit in order to earn from a 1,000,000 ZEX prize pool.

Event 2: The second event offers a 2,000,000 ZEX prize pool, with rewards capped at 100,000 ZEX per trader. Any user, whether existing or new, needs to trade at least 500 USDT worth of ZEX on Bybit's Spot market. The more you trade, the higher the share of the prize pool you can expect to receive.

Event 3: Earn a 100 ZEX bonus from a 1,620,000 ZEX prize pool for each friend you refer (up to ten successful referees). Referees must join Bybit with your referral code and participate in either of the abovementioned ZEX events.

Closing Thoughts

Zeta Markets offers derivatives aficionados a rare combination of insignificant costs and undercollateralized trading opportunities. Coupled with Solana's sub-second execution times and the CLOB setup that lends itself well to derivatives trading, Zeta stands out as a unique platform, both within the Solana ecosystem and the entire crypto industry.

Talk of Solana seriously challenging Ethereum in the DeFi space has been going on for years. However, despite the relative success of some Solana-based DeFi projects, no platform that would truly make it a reality has yet arrived. Zeta Markets may now try to mount such a challenge in one specific corner of DeFi — perpetuals trading. It won't be easy, but the project's numerous distinct advantages make this a task that’s not as far-fetched as some might think!

#LearnWithBybit