IntentX (INTX): A Revolutionary OTC Derivatives Exchange

Decentralized trading platforms often struggle with liquidity and efficiency, leaving traders facing high slippage and slow transactions. This not only hampers the trading experience but also undermines the trust in decentralized systems.

IntentX addresses these critical issues head-on with its innovative intent-based trading architecture, providing deep liquidity, rapid execution and lower fees, all while ensuring a secure and transparent environment for traders worldwide.

Key Takeaways:

IntentX pioneers intent-based trading in decentralized derivatives, aiming to deepen liquidity and boost efficiency while ensuring a secure and transparent environment.

Its exchange optimizes price discovery and offers high capital efficiency with an innovative automatic market for quotations (AMFQ) mechanism and LayerZero integration, setting a new standard for decentralized exchanges (DEXs).

- Looking to trade IntentX tokens? Bybit now offers the INTX/USDT Spot trading pair. To celebrate this, Bybit is holding an exclusive event where you can earn a share of the 400,000 INTX and 40,000 USDT prize pools!

What Is IntentX?

IntentX is a next-generation, intent-based decentralized derivatives exchange that provides deep liquidity and efficient trading. It uses a special process to analyze traders' intentions, and matches these with the best possible trading conditions.

History of IntentX

The IntentX project is driven by a team of innovators who recognized the need for a new approach to tackling the liquidity issues plaguing the on-chain derivatives trading space. IntentX launched in 2023 with funding from a group of seasoned digital investors led by Magnius Capital. The project set out to be a decentralized, intent-based perpetual futures trading protocol that leverages a unique architecture to provide deep liquidity and cheap user fees.

Inspired by the failure of traditional automated market maker (AMM) and order book–based systems to effectively address the liquidity concerns in on-chain derivatives trading, the team at IntentX came up with a completely novel mechanism, built upon the request for quote (RFQ) system used by platforms such as CoW Swap, UniswapX and 1Inch.

The IntentX team is committed to creating a sustainable and long-term-focused project, as evident in their tokenomics design. The proposed INTX is a liquid token with no encumbrance. Holders can trade, transfer or use it within the IntentX ecosystem freely, without facing any additional fees or restrictions tied explicitly to the token itself. Staking INTX converts it to xINTX.

The utility of staking xINTX is designed to incentivize long-term stakers and reward them with increased trader incentives, referral program rewards, and access to unique strategies and products. This approach seeks to balance short-term user movements with long-term stability and growth, benefiting the entire community.

What Does IntentX Aim to Achieve?

IntentX primarily addresses the lack of deep liquidity in decentralized exchanges (DEXs). Existing DEXs, such as those using AMM or order-book models, suffer from scalability issues, limited liquidity and high fees. These limitations make it difficult for users to achieve a centralized exchange (CEX)-like experience on-chain, which is characterized by deep liquidity, low fees and high trading speeds.

IntentX further seeks to bridge the gap between CEXs and DEXs by promoting a secure and efficient trading environment that doesn’t rely on oracles. Oracles connect blockchains to external systems, enabling smart contracts to interact with external information, such as price feeds. However, oracles are prone to security vulnerabilities and central points of failure, which are typical when decentralized systems rely on centralized systems for information.

Tackling these issues enables IntentX to provide a more user-friendly, efficient and competitive experience when compared to traditional DEXs and CEXs.

How Does IntentX Work?

IntentX builds upon the request for quote (RFQ) system used by platforms like CoW Swap, UniswapX and 1Inch. In this system, a trader expresses their intent to long or short a derivatives contract by defining a price, order type (limit or market order), trade size and the desired leverage. Market makers (solvers) then respond with tailored quotes, and the trader chooses the best quote to execute the trade.

IntentX enhances this RFQ system by introducing an automatic market for quotations (AMFQ). Instead of traders manually choosing from quotes, the AMFQ continuously streams quotations in advance, showing them the best available quotes at all times. This mechanism circumvents the inefficiencies of traditional RFQ systems, adapting it for on-chain derivatives trading.

The IntentX system consists of two main parties: traders and solvers. Solvers are market makers for IntentX. The two parties are connected by the IntentX trading engine, which facilitates these RFQ-like trades.

To simplify the user experience, IntentX combines the power of LayerZero and account abstraction. LayerZero is a communication primitive (basic operation in a programming system used to share information) that enables seamless communication between different chains, while account abstraction allows for assets to be held in smart contracts, rather than in externally owned accounts (EOAs). This synergy elevates wallets to smart contracts, unlocking new functionality and improving the on-chain user experience.

IntentX will initially be deployed on the Base L2 chain, along with tokens, contracts and other elements. The core trading functionality and related contracts will be natively deployed on potentially multiple EVM-compatible chains.

Benefits of IntentX

High Capital Efficiency

IntentX offers high capital efficiency via its just-in-time (JIT) liquidity architecture, which allows solvers to provide liquidity without committing capital across different books or liquidity pools. This approach results in roughly 100 times more capital efficiency as compared to existing vAMM derivatives exchanges based on OI/TVL.

Omnichain Deployment

IntentX is deployed on multiple chains, leveraging LayerZero for seamless communication between different chains. Users enjoy a unified trading experience across various platforms, enhancing the overall efficiency and accessibility of the platform.

Optimized Price Discovery

IntentX's intent-based architecture and AMFQ mechanism ensure optimized price discovery. The continuous streaming of quotations in advance allows traders to reach calculated decisions based on the best available quotes at all times, reducing the risk of slippage and improving trading efficiency.

IntentX Road Map

IntentX has made significant strides in its journey to become the ultimate decentralized exchange for perpetuals. Following is a summary of its achievements and future goals.

Achievements

Beta phase: Since launching its Open Beta on Nov 15, 2023, IntentX has achieved significant milestones, including over $2.4 billion in total trade volume and more than 17,000 unique users.

New tradable pairs: IntentX has expanded its offerings by adding 94 new tradable pairs, increasing the total from 180 to 274.

Multi-chain deployments: IntentX has successfully deployed on three different blockchains (Base, Blast and Mantle Network), enhancing its reach and interoperability.

Trader incentives program: The introduction of a 250,000 MNT Incentives program has significantly boosted user engagement.

Funding: IntentX has secured $2.5 million in a seed round and $1.8 million in a strategic round from top industry partners.

Future Goals

Token Generation Event (TGE): The road map begins with the TGE, which will introduce a novel xINTX staking mechanism and a trader airdrop to incentivize early adopters.

Instant trades: In collaboration with SYMMIO, IntentX is piloting off-chain trading to drastically improve execution speeds, with early tests showing promising results.

Platform rebuild: IntentX is working on a complete redesign and rebuild of its platform, dubbed IntentX V2, to deliver superior performance and an enhanced user experience.

INTX Tokenomics

INTX is the utility token of IntentX, serving as the platform's backbone to capture value and align stakeholders. With a capped supply of 100 million tokens, INTX is non-inflationary, ensuring stability and long-term value.

Designed to be both valuable and scarce, INTX plays a crucial role in earning "real yield," and provides access to various services on the platform. This structure ensures that the token remains an attractive and essential asset within the ecosystem.

INTX distributes 85% of platform revenues to stakeholders through staking rewards. The longer tokens are staked, the greater the rewards, fostering a commitment to the platform's long-term success and aligning with dedicated stakeholders.

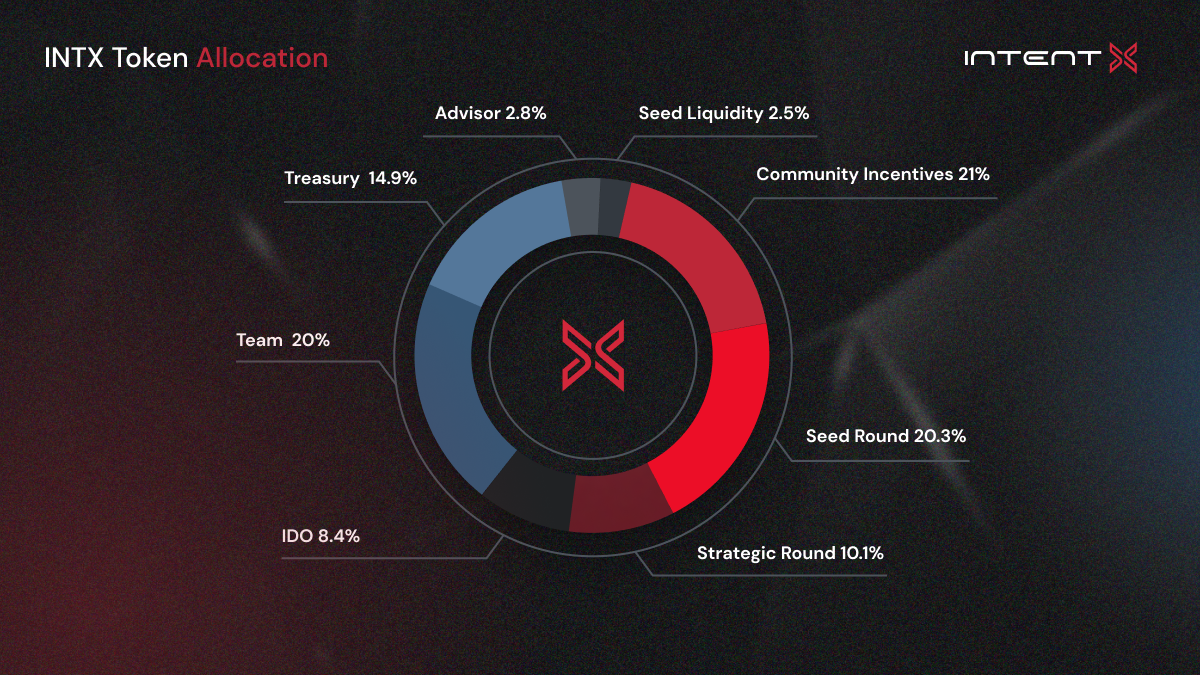

The total fixed supply of 100 million INTX tokens is carefully distributed across different rounds. Each segment follows tailored vesting schedules to ensure sustained engagement and alignment with the platform’s growth:

Community incentives: 21%

Seed round: 20.3%

Team: 20%

Treasury: 14.9%

Strategic round: 10.1%

IDO: 8.4%

Advisor: 2.8%

Seed liquidity: 2.5%

INTX Price Prediction

CoinArbitrageBot predicts that INTX’s price could be around $0.58 by the end of 2024, and might reach $1.43 one year later, with expectations for INTX to hit $3.37 by 2029.

Even more optimistically, CoinDataFlow analysts expect INTX to reach $1 by the end of 2024 and $2.70 by 2025, possibly hitting $2.51 in 2030.

However, noting the capricious nature of cryptocurrency markets, predictions can be uncertain. Do your own research before making investment decisions.

Where to Buy INTX

Looking to trade IntentX tokens? Bybit now offers the INTX/USDT Spot trading pair. To get started, you’ll first need to create a Bybit account, then fund it with cryptocurrency and navigate to the INTX/USDT Spot trading page.

To celebrate this listing, Bybit is holding an exclusive event in which you can earn a share of the 400,000 INTX and 40,000 USDT prize pools. The event takes place through Jun 14, 2024, 8:59AM UTC. Simply complete deposit or trading tasks listed on the Token Splash page to earn big. Rewards will be distributed on a first-come, first-served basis.

Is INTX a Good Investment?

Deciding whether to invest in INTX comes down to your personal risk tolerance and investment objectives. On the bright side, the project's mission to tackle liquidity and efficiency challenges in decentralized trading — along with its innovative intent-based architecture and non-inflationary tokenomics model — are definitely encouraging signs.

Nevertheless, the crypto market can be quite unpredictable. While there are promising aspects to consider, it's wise to approach an investment in INTX or any other token cautiously. Take note of your risk tolerance and conduct thorough research before proceeding.

Closing Thoughts

IntentX is a first-of-its-kind perpetual futures trading protocol. It offers a competitive trading experience through its unique architecture, high capital efficiency and optimized price discovery.

The project’s native INTX token features staking utility and a dynamic fee structure designed to incentivize long-term staking and reward loyal users. This tokenomics model suggests a promising investment opportunity. Bybit lists INTX for trading, providing users with an easy way to get in on the action.

#LearnWithBybit