Aark (AARK): Advancing Perpetual Trading With Full Leverage

Leveraged trading is a high-end investment strategy that was originally available only to institutional investors. However, the growth of the DeFi landscape has allowed retail investors to take advantage of advanced trading solutions. Services such as Aark allow investors to borrow funds and take advantage of bullish market trends with ease. How does Aark bolster liquidity for so many investors without putting its assets at risk? Explore this guide to see how Aark's design offers unparalleled high-leverage trading to everyone.

Key Takeaways:

Aark is a decentralized exchange (DEX) that offers leverage opportunities to both amateur and institutional investors.

Aark is the first DEX to allow for complete leverage while also amplifying yields on staked Ethereum. It also prides itself on its low slippage rates and lack of gas fees.

Looking to trade Aark tokens? Bybit now offers the AARK/USDT Spot trading pair.

What Is Aark?

Aark is a decentralized exchange (DEX) that offers leverage opportunities to both amateur and institutional investors. It’s the first DEX to allow for complete leverage while amplifying yields on staked Ethereum. Aark also prides itself on its low slippage rates and lack of gas fees.

History of Aark

Aark was founded by a pseudonymous developer known as Eden, who’s been working in the DeFi landscape since 2016 and has worked with hedge funds, DApps, Ethereum mining and more. During their years of interacting with crypto trading, Eden realized there was a need for more trader-friendly exchanges, and designed Aark to provide a full suite of services for traders with technology that provides the best possible rates for leveraged trading. Since Aark's founding in 2023, it has secured over $6 million in funding from Cypher Capital and other venture capitalists interested in the on-chain derivatives industry.

What Does Aark Aim to Achieve?

Aark was greatly inspired by the fall of the FTX exchange. The Aark team noticed that many leading perpetual DEXs struggled to provide a resilient, transparent decentralized trading infrastructure. They hope to create an exchange that hearkens back to the original principles of decentralization. Aark's goals are to create an exchange that serves users fairly, prioritizes user autonomy and provides unparalleled security and service.

How Does Aark Work?

The basic structure of Aark starts with a giant liquidity pool. Unlike many other exchanges, which have separate liquidity pools for each type of asset, Aark bundles all loaned assets into a single pool. Aark even allows lenders to include liquid restaking tokens (LRTs) and liquidity provider tokens from other exchanges. LRT liquidity integration and other features on Aark are managed through the Arbitrum network and its own proprietary set of algorithms.

This broad pool of liquidity for leveraged trading is protected through two mechanisms.

First, an insurance fund covers extreme losses due to high amounts of liquidation. Funds in the insurance pool are provided by users, but they’re locked for long periods of time so market fluctuations can’t result in drastic losses.

Aark also uses a reflective market maker that automatically seeks arbitrage opportunities. When users make a leveraged trade in one position, the market makers are capable of taking the opposition position to hedge the trade and ensure profit is achieved no matter the outcome.

Features of Aark

Aark's innovative exchange model consists of multiple features for traders to try.

Perpetual DEX

The main feature driving Aark's significant market growth is its perpetual DEX. This type of exchange uses peer-to-peer trading without any intermediary. Perpetual DEXs surpass other trading methods because they provide 24/7 trading without high fees. Depending upon the trading mode, users only have to pay between 0.01% and 0.05% in trading fees on Aark. Its perpetual DEX also offers high-leverage trading opportunities. By leveraging LRT assets and other forms of crypto, traders can temporarily bolster liquidity and make even larger trades.

AALP

AALP is the Aark liquidity-providing service. Users can deposit any asset they want into AALP, and over time, they'll earn yields. AALP is somewhat unique in the fact that it lets users provide liquidity in the form of any asset. People can even start leveraging LRT assets from other leveraged trading services. This flexible service also allows users to specify the size of their position, and to decide exactly how they want to set up their liquidity provider account.

Earn

Earn provides an option to receive rewards from staking. Stakers can choose to temporarily lock their tokens and help secure the network, in exchange for which they earn a variety of rewards, worth from 50% to 25% of their token value. Users can also claim more tokens in various airdrops. Depending upon the form of staking you choose, you can unlock your tokens at any time or wait a longer amount of time for your tokens to vest.

Referrals

To help accelerate LRT liquidity integration, Aark has a program to help get more new users into their system. Users can refer their friends and acquaintances to the Aark system. Once your referred users start trading on Aark, you earn rewards and rebates.

Classic Trading Competition

Another way that Aark is boosting LRT liquidity integration is through its classic trading competition. To get more people trading on the platform and adding liquidity to their pools, Aark hosts regular tournaments in which people compete to see who has the highest trading volume. The biggest traders earn exciting rewards worth between $50,000 and $500,000.

Aark Road Map

Aark's journey began with attracting investment funding from Cypher Capital, and launching a testnet on which users could experiment with Aark’s exchange. Since then, Aark has expanded its ecosystem with advanced trading solutions and the release of the AARK token.

In 2024, Aark’s road map is focused on providing more useful features for perpetual traders to try. It hopes to launch a mobile trading app, create customized chats and release more trading pairs. Developers witnessing Aark's continued growth also point out plans to include multichain support, integration with more DApps and more staking services.

AARK Tokenomics

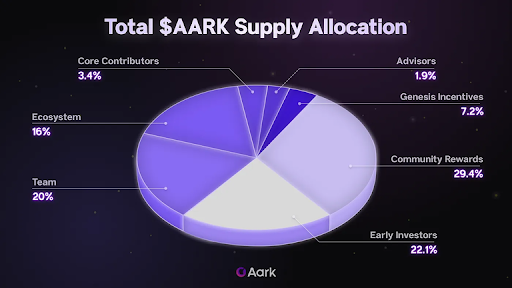

AARK is the governance and utility token for Aark's unparalleled high-leverage trading system. Built on the Arbitrum network, it's a standard ERC-20 token. AARK’s total supply is 1 billion tokens, and its initial liquid supply is 44 million. The token will be allocated according to the following plan:

Community rewards: 29.4%

Early investors: 22.1%

Team: 20%

Ecosystem: 16%

Genesis incentives: 7.2%

Core contributors: 3.4%

Advisors: 1.9%

AARK Price Prediction

Since debuting in June 2024, AARK's price has declined slowly yet steadily. Having initially sold for around $0.09, prices have plummeted to about $0.02. Despite this drop in price, significant market growth is possible. Some investors believe that the coin is undervalued, and may end up rising in price soon as more traders become interested in the on-chain derivatives industry. CoinCodex predicts that AARK will remain bearish until July 2024, when bullish market trends may take over. CoinCodex reports that prices may reach $0.11 by 2025.

Where to Buy AARK

Looking to trade Aark tokens? Bybit now offers the AARK/USDT Spot trading pair. To get started, you’ll first need to create a Bybit account, fund it with cryptocurrency and navigate to the AARK/USDT Spot trading page.

Is AARK a Good Investment?

Witnessing Aark's continued growth, this token looks like a somewhat intriguing opportunity. Though AARK prices have declined lately, Aark has done a decent job of getting people interested in its high leverage trading and attracting investment funding. Some industry experts believe perpetual DEXs surpass other types of trading, and may even be the future of the crypto industry. This could eventually lead to some bullish market trends that might make AARK appeal to certain investors. If you like underrated coins with growth potential, AARK is worth exploring.

Aark's innovative exchange model bodes well for its project. Nevertheless, although it's introducing DeFi innovations, it may struggle to stand out from the leading perpetual DEXs. Other potential red flags include a large percentage of coins being given to team members and investors, a last-minute airdrop change that greatly inflated token numbers and the lack of a detailed white paper showcasing Aark's supposed technical advancements. Unless Aark can successfully release all of the features that would help it differentiate itself from other exchanges, AARK may not experience sustained growth. Any investors choosing to purchase AARK need to do their research and remain cautious.

Closing Thoughts

Aark's goal of appealing to perpetual traders and introducing DeFi innovations has resulted in plenty of interest from the DeFi community. This exchange does some very unique things, such as providing scalable liquidity and offering yields on staked tokens. However, the project is struggling to turn its industry hype into a profitable crypto token. Only time will tell whether the AARK token can recover and investors can start capitalizing on the Aark project's promise.

#LearnWithBybit