Ethereum ETFs Launch with Over $1 Billion in Trading Volume Despite Stable ETH Prices

Daily Top Performer — Convex Finance (CVX)

The SPX index was down by 0.16% amidst a broader sentiment affected by both positive and disappointing earnings results from major companies. The broader cryptocurrency market was down, with Bitcoin and Ether dropping by 4.03% and 0.09%, respectively in the past 24 hours.

Today's top performer is CVX, which surged 18.2% following F(x) Protocol's distribution of over $85K in 10th round of gauge incentives.

Convex Finance (CVX), launched in May 2021, is a DeFi protocol that boosts yields for Curve protocol users on Ethereum. It allows for staking to earn CRV and CVX tokens and provides voting rights on token allocations. The f(x) Protocol announced the completion of the 10th round of gauge incentives, distributing $85,798.11 to voters of various tokens and pools across multiple platforms including Aave, Convex Finance, Inverse Finance, Alchemix, Stake DAO, Abracadabra, and Zunami Protocol. Additional incentives totaling $86,797 were distributed through Paladin, Votium, and Stake DAO's Votemarket. Participants in these pools can monitor their APYs and claim further rewards from newly concluded initiatives, such as the GENESIS period for $cvxUSD, through the f(x) Protocol’s website.

Check Out the Latest Prices, Charts, and Data of CVXUSDT Perp!

Talk of the Town:

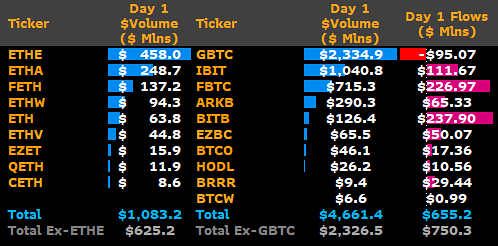

Ethereum exchange-traded funds (ETFs) launched with a substantial trading volume exceeding $1 billion on their first day, despite Ethereum's price remaining unchanged at $3,479. The ETFs, approved by the SEC in May, saw significant activity, with Grayscale’s Ethereum Trust leading with $461 million in traded shares. Other notable funds included BlackRock's iShares Ether Trust and Fidelity's Ethereum Fund, among others. This volume is notably less compared to the $4.5 billion trading volume of Bitcoin ETFs during their debut, indicating a more modest but still robust market interest in Ethereum ETFs.

Check Out the Latest Prices, Charts, and Data of ETHUSDT Perp and ETH/USDT Spot!

Bitcoin Spot ETF Flows:

Category | Flow (millions) |

GBTC | (27.3) |

Non-GBTC | (122.6) |

Total | (149.9) |

Bitcoin (BTC) dropped by 2.52% to $65,895 on July 23, impacted by Mt. Gox distributing 5,110 BTC to creditors, influencing US BTC-spot ETF market flows. This repayment is part of the resolution from Mt. Gox's 2014 collapse, with concerns about potential oversupply affecting market sentiment. US BTC-spot ETFs reported significant outflows, indicating investor caution.

Check Out the Latest Prices, Charts, and Data of BTCUSDT Perp and BTC/USDT Spot!

Airdrop to Watch:

Catizen is running a free airdrop available through its Telegram game, where users generate and merge cats to level up. The game, reminiscent of 2048, allows for optional purchases such as an auto-merge feature, but playing remains entirely free.

Check Out the Latest Prices, Charts, and Data of TONUSDT Perp and TON/USDT Spot!