State of Stablecoin: Can Ethena’s USDe Tackle What UST Failed to Solve?

Key Highlights:

This well-curated report by Bybit looks at the current state of stablecoin, dives into the development of USDe, and sheds light on whether USDe can tackle what UST failed to solve.

USDT extends its position as the market leader, with some leading stablecoins experiencing a contraction in supply. USDe stands out and has become one of the top 4 stablecoins in a short period of time.

USDe's high yield is one feature that sets it apart. We explore its mechanism and discuss whether it is sustainable in the long term. Additionally, we compare USDe to UST and explore whether USDe can tackle what UST failed to solve.

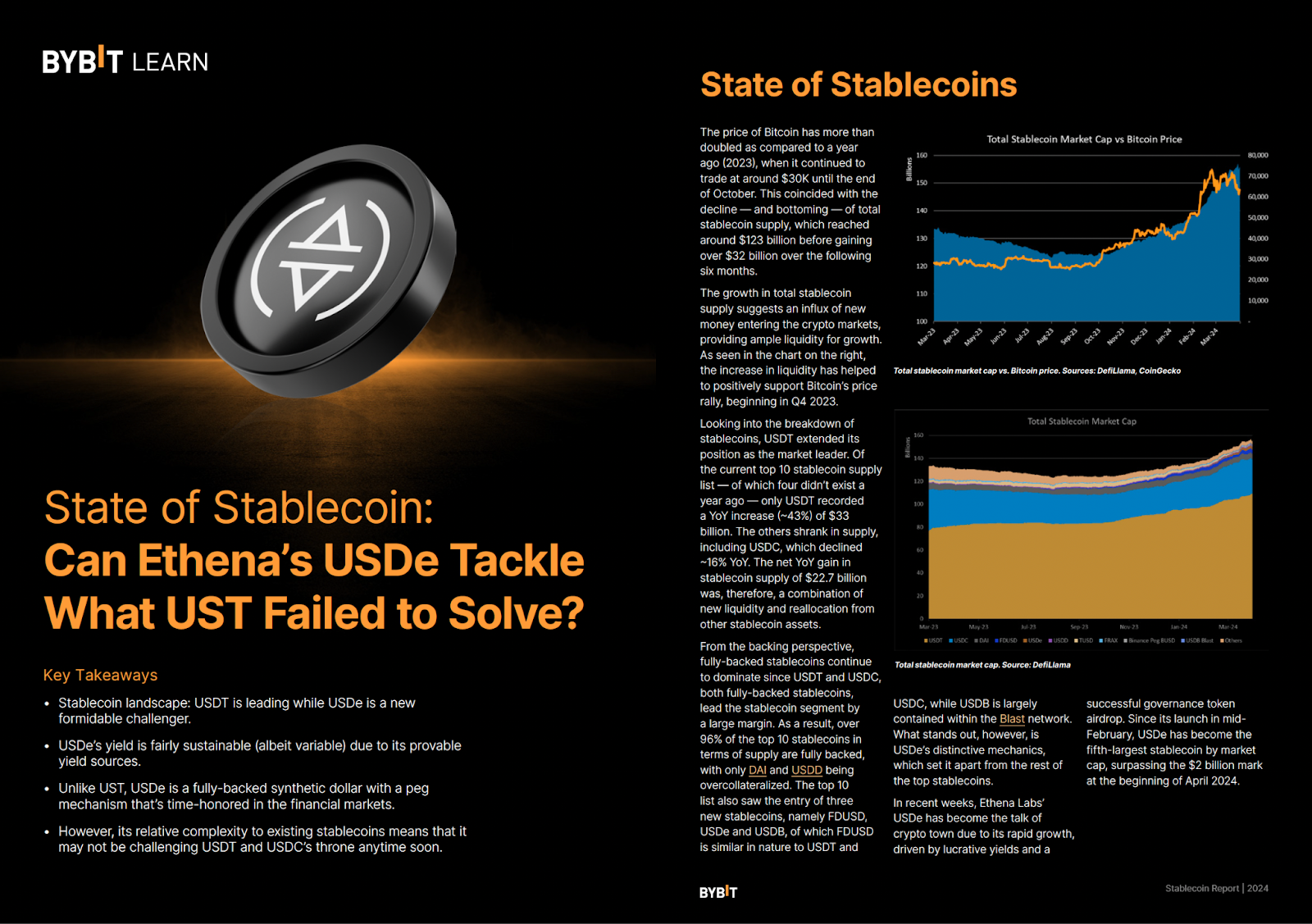

State of Stablecoins

USDT extended its position as the market leader. Of the current top 10 stablecoin supply list — of which four didn’t exist a year ago — only USDT recorded a YoY increase (~43%) of $33 billion. The others shrank in supply, including USDC, which declined ~16% YoY. The net YoY gain in stablecoin supply of $22.7 billion was, therefore, a combination of new liquidity and reallocation from other stablecoin assets. Ethena Labs’ USDe has become the talk of the crypto town due to its rapid growth, driven by lucrative yields and a successful governance token airdrop. Since its launch in mid-February, USDe has become the fifth-largest stablecoin by market cap, surpassing the $2 billion mark at the beginning of April 2024.

What is USDe?

USDe is Ethena’s stablecoin on Ethereum, backed fully on-chain by Ethereum and Bitcoin. Through its unique mechanism, it aims to be dollar-pegged and sufficiently stable, scalable and resistant to censorship. What has sparked its growth, however, is a highly attractive variable yield for holders.Despite USDe being classified as a stablecoin, Ethena Labs claims that USDe isn’t in fact a stablecoin. Instead, the protocol calls it a “synthetic dollar.” Unlike USDT or USDC, USDe isn’t backed one-to-one by fiat currency (e.g., cash or short-term U.S. Treasury bills).

How Yield Is Generated? Is The Yield Sustainable?

The yield is derived from two components:

1. Staking rewards from the underlying Ethereum collateral

Part of the collateral that backs USDe is in the form of staked ETH. Ever since The Merge, ETH stakers have earned rewards to help maintain the security of the Ethereum network, typically at an annualized rate of 3–4%. At present, staked ETH forms approximately 15% of Ethena’s collateral base, with a weighted collateral yield of 0.66%.

In its early days, the Ethena team said that it would eventually include raw ETH as backing as Ethena grows in order to expand its collateral base properly, despite the resulting relatively lower yields. In fact, this — and more — has already happened with the inclusion of Bitcoin as collateral, justified by Ethena since the ETH staking yields of around 3% are rather insignificant during bull market periods.

2. Delta hedging strategy provides funding payments and basis spread

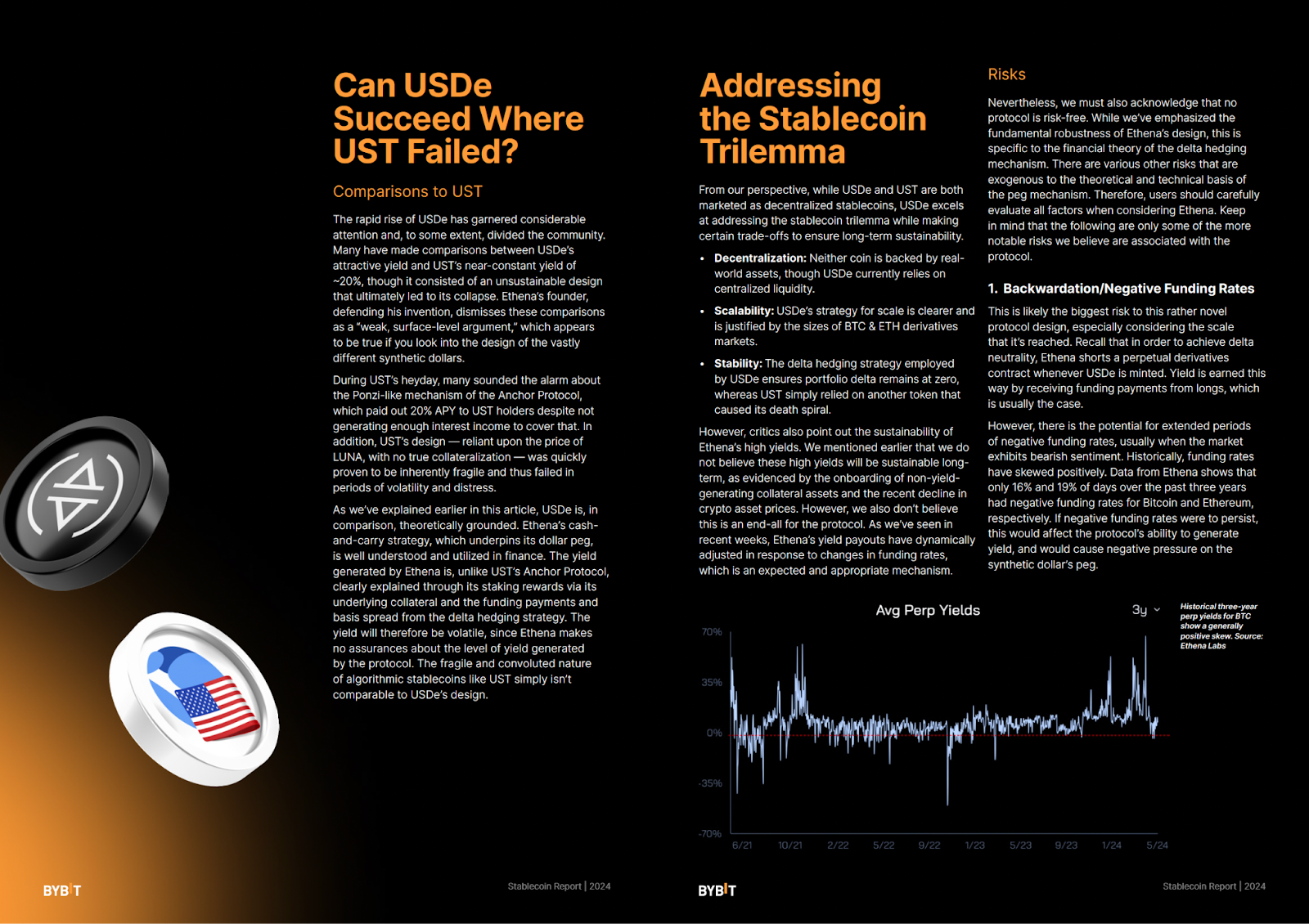

The remainder of USDe’s attractive double-digit yield is achieved through its delta hedging strategy, which involves perpetual futures. In the perpetual market, funding rates are paid by long position holders to short position holders, or vice versa, in order to minimize the spread between the futures and spot price (more on funding rates here).

Since crypto markets have historically been long-biased, short positions (e.g., Ethena’s delta hedging strategy portfolio) receive funding payments, thus providing Ethena with frequent outsized yield. Additionally, Ethena profits from the basis spread, a pricing inefficiency whereby there’s a price difference between the spot and futures markets.

Theoretically speaking, the sources of yield are sound. The yield generated from staking Ethereum is fundamentally rooted in the premise of a proof of stake (PoS) network, and the delta-neutral trade strategy is a well-established practice in TradFi and crypto markets, as addressed above.

However, the yield from funding payments and basis spread has declined in recent weeks as the markets have weakened (i.e., lessened demand for ETH long positions), leading to a drop in USDe yield. Additionally, it’s theorized that as market efficiency in crypto improves, the basis spread should tighten, potentially reducing the yield further.

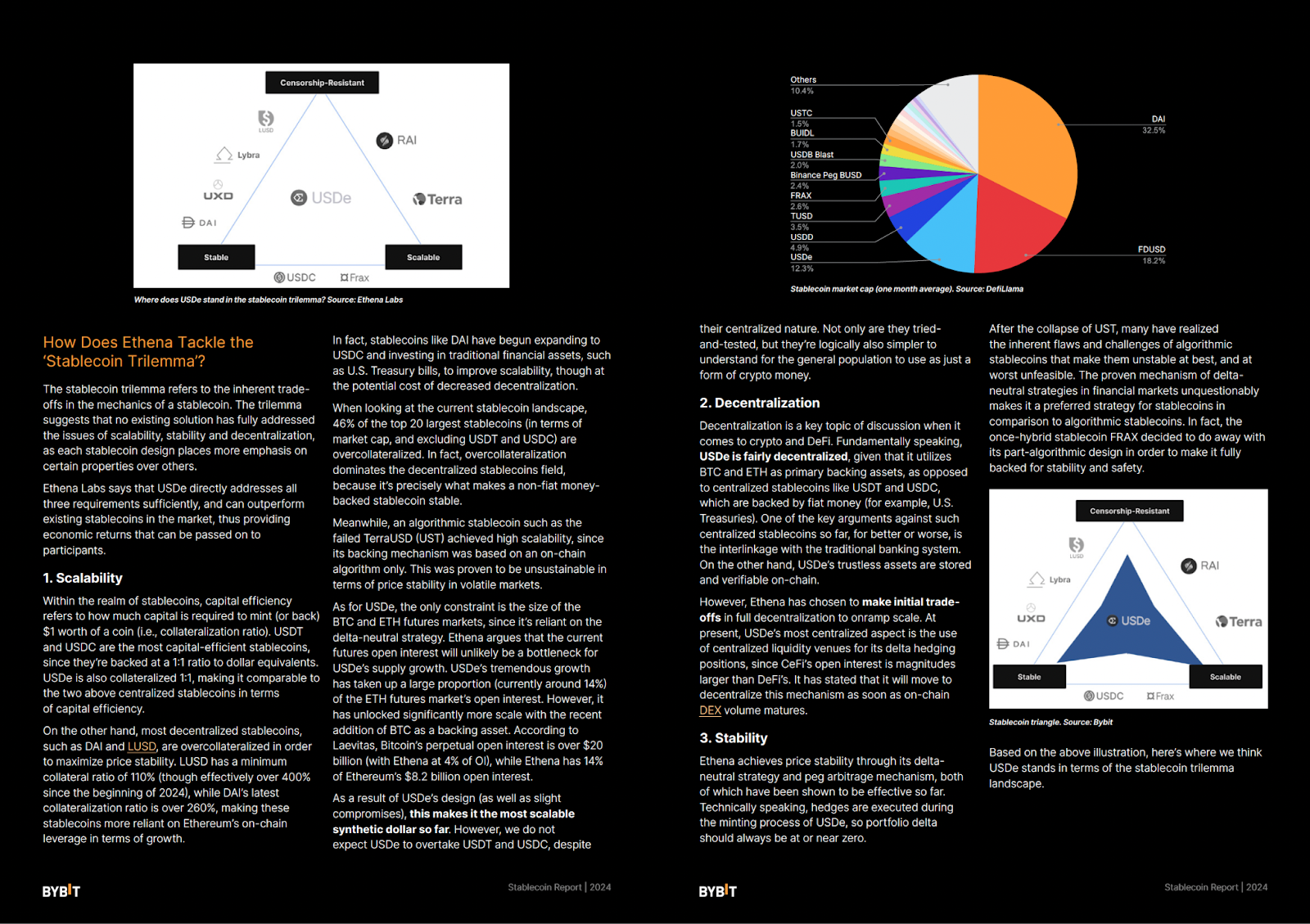

How Does Ethena Tackle the Stablecoin Trilemma?

The stablecoin trilemma refers to the inherent trade-offs in the mechanics of a stablecoin. The trilemma suggests that no existing solution has fully addressed the issues of scalability, stability and decentralization, as each stablecoin design places more emphasis on certain properties over others.

Ethena Labs says that USDe directly addresses all three requirements sufficiently, and can outperform existing stablecoins in the market, thus providing economic returns that can be passed on to participants.

Can USDe Succeed Where UST Failed?

The rapid rise of USDe has garnered considerable attention and, to some extent, divided the community. Many have made comparisons between USDe’s attractive yield and UST’s near-constant yield of ~20%, though it consisted of an unsustainable design that ultimately led to its collapse. Ethena’s founder, defending his invention, dismisses these comparisons as a “weak, surface-level argument,” which appears to be true if you look into the design of the vastly different synthetic dollars.

During UST’s heyday, many sounded the alarm about the Ponzi-like mechanism of the Anchor Protocol, which paid out 20% APY to UST holders despite not generating enough interest income to cover that. In addition, UST’s design — reliant upon the price of LUNA, with no true collateralization — was quickly proven to be inherently fragile and thus failed in periods of volatility and distress.

As we’ve explained earlier in this article, USDe is, in comparison, theoretically grounded. Ethena’s cash-and-carry strategy, which underpins its dollar peg, is well understood and utilized in finance. The yield generated by Ethena is, unlike UST’s Anchor Protocol, clearly explained through its staking rewards via its underlying collateral and the funding payments and basis spread from the delta hedging strategy. The yield will therefore be volatile, since Ethena makes no assurances about the level of yield generated by the protocol. The fragile and convoluted nature of algorithmic stablecoins like UST simply isn’t comparable to USDe’s design.

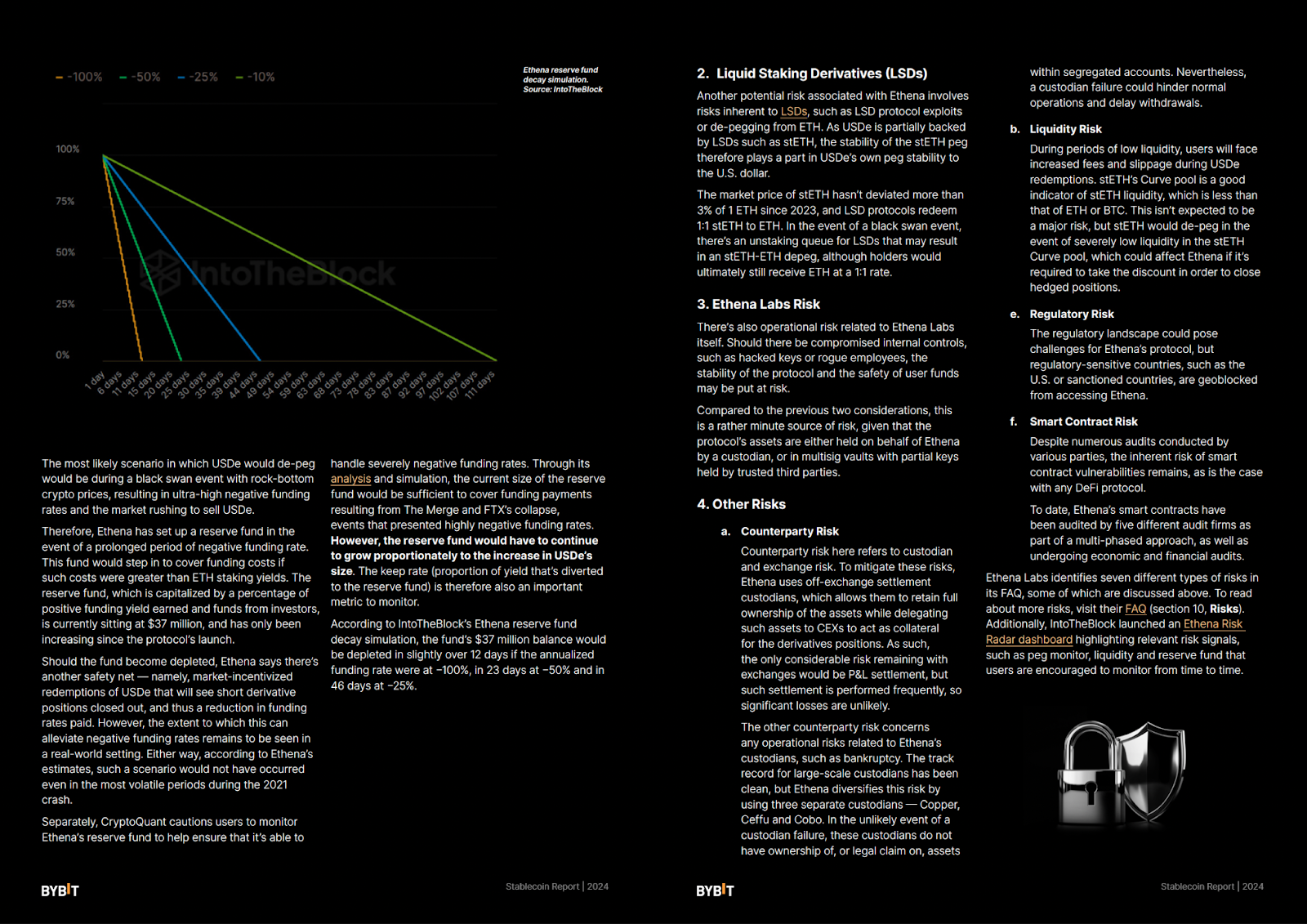

Nevertheless, we must also acknowledge that no protocol is risk-free. While we’ve emphasized the fundamental robustness of Ethena’s design, this is specific to the financial theory of the delta hedging mechanism. There are various other risks that are exogenous to the theoretical and technical basis of the peg mechanism. Therefore, users should carefully evaluate all factors when considering Ethena. Keep in mind that the following are only some of the more notable risks we believe are associated with the protocol.

Final Thoughts

Ethena’s USDs presents a novel approach to creating a sufficiently decentralized, stable and capital-efficient stablecoin. However, its long-term viability is still subject to scrutiny, as it has yet to undergo testing during severe market conditions. From a risk profile perspective, the bottom line is that USDe with its fully-backed nature is fundamentally safer than algorithmic stablecoins such as UST.

While USDe’s yield could hypothetically drop to zero, the yield sources are legitimate and sustainable. Ultimately, the mechanism design is inherently riskier than simple asset-backed models of USDT and USDC. Therefore, deciding which stablecoin to choose ultimately depends upon the trade-offs that one is willing to make.

#BybitInstititional #BybitResearch