Weekly Institutional Insights — Polymarket Continues to Gain Traction as the US Election Approaching

July 1, 2024: Our Weekly Institutional Insights explore the latest market developments, including market performance, industry news, ETF flows, trending topics, upcoming events, and token unlocks, aiming to supercharge your crypto trading.

Enjoy our weekly take on the market!

Market Overview

The past week began with news from Mt. Gox announcing plans to distribute repayments in July, which led to a 5-7% decline in both Bitcoin and Ethereum. Ethereum quickly recovered, likely buoyed by the ETF narrative, while Bitcoin showed a modest recovery with minimal volatility. Meanwhile, meme coins remained one of the best-performing sectors, with coins like PEPE, WIF, BONK, and BRETT seeing notable surges.

In a significant move, Vaneck, a global investment management firm, filed for the first Solana ETF in the US last Thursday. Previously, the SEC had categorized SOL as a security. However, Matthew Sigel, head of digital assets research at Vaneck, expressed on X that SOL should be considered a commodity, similar to Bitcoin and Ethereum. This filing may prompt other issuers to consider similar actions, and it remains to be seen how the SEC will respond.

Additionally, the highly anticipated Blast airdrop occurred on June 26, distributing 17 billion tokens. Of these, 7% were allocated to Blast Points holders, 7% to Blast Gold, and 3% to the Blur Foundation. The second phase of the airdrop has also commenced, with 10 billion BLAST designated for distribution over a period ending in June 2025. Half of the Phase 2 rewards are earmarked for Blast Points holders, with the remaining half to Blast Gold.

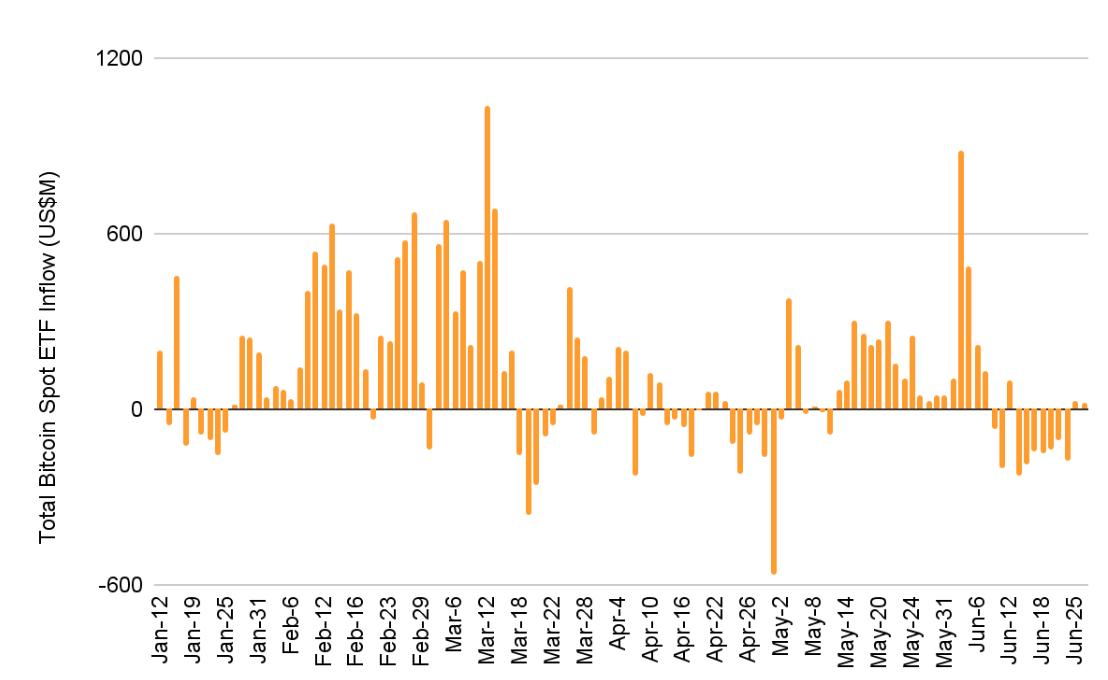

Bitcoin Spot ETF Flows

Total Bitcoin Spot ETF flows. Source: CoinGlass, as of June 28, 2024

Bitcoin spot ETFs saw a mixed performance last week. Despite the continuous outflows from mid-June saw an end

Weekly Highlight (Ending June 28, 2024)

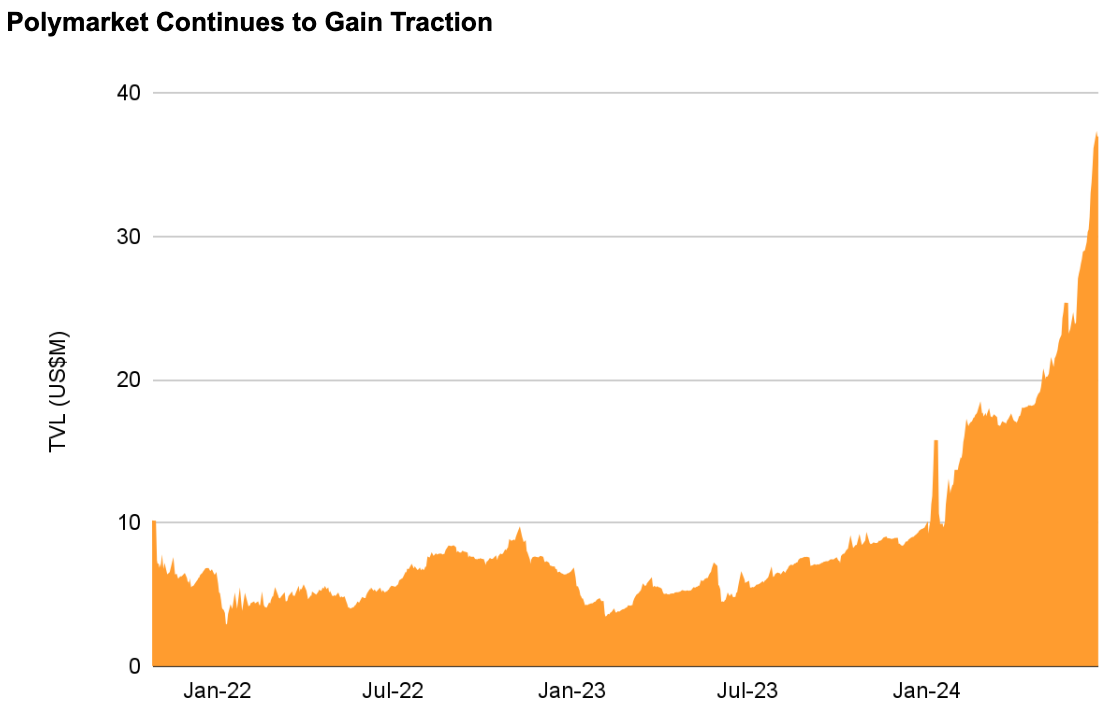

Polymarket TVL. Source: DeFiLlama, as ofJune 28, 2024

Polymarket, an Ethereum-based prediction market platform, has continued to gain traction as the US election approaches. According to data from DeFiLlama, the total value locked (TVL) on Polymarket reached an all-time high of US$38.63M last week. Furthermore, key metrics such as monthly volume, monthly active traders, and open interest also surpassed previous records. As of June 28, Polymarket's TVL represents 55% of the total for on-chain prediction market platforms, making it the largest among its peers.

The surge in Polymarket’s activity can be attributed to the intensifying US election and the European Football Championship, attracting significant wagers on the outcomes of these major events. Currently, the most wagered-on topics on the platform include the Presidential Election Winner 2024, attracting close to US$200M in bets, the Republican VP nominee with US$51M, and the Euro 2024 winner with US$ 2 million. In addition to political events and sports, Polymarket also enables users to place bets on events in the crypto, business, and science sectors, offering a diverse range of betting topics.

Last month, Polymarket secured US$45M in funding, led by Peter Thiel’s Founders Fund and including participation from Ethereum co-founder Vitalik Buterin. As the on-chain prediction market gains momentum and public interest increases, it will be interesting to observe how this sector evolves in the future.

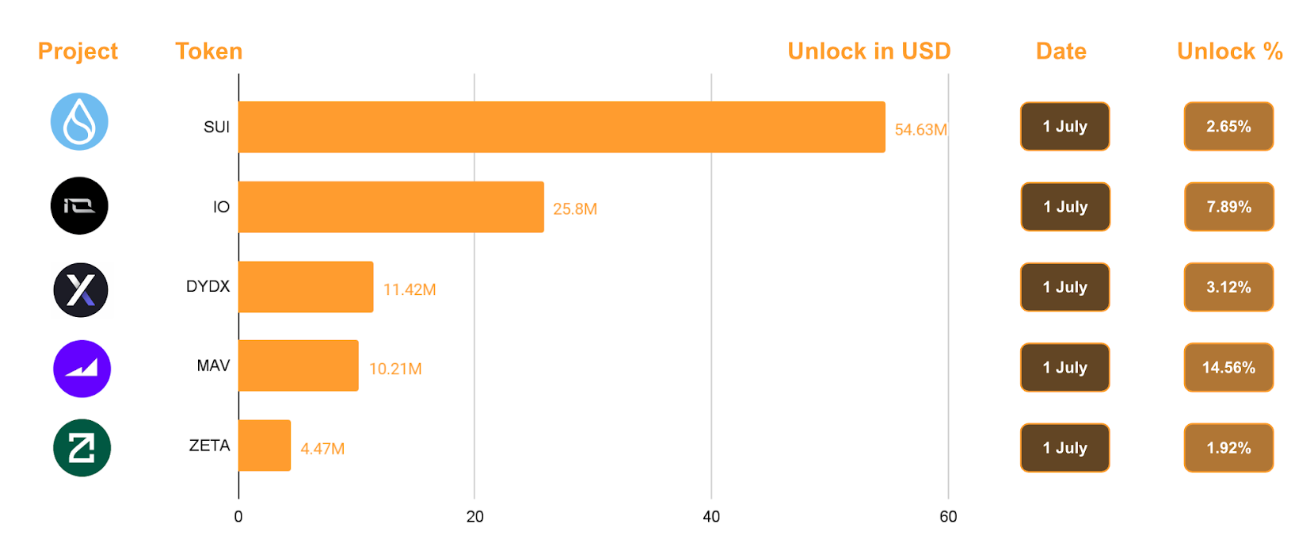

Upcoming Events and Token Unlocks

Date | Project | Event |

2024-07-01 | Mantle | Methamorphosis Debut |

2024-07-01 | Artificial Superintelligence Alliance | ASI Token Merger |

2024-07-04 | Loopering | $TAIKO Airdrop Claim Ends |

2024-07-04 | IVS2024 Kyoto | Crypto Conference |

2024-07-05 | SUI | Sui Academic Research Awards Application Ends |