ETH Spot ETFs Could Absorb 35% of Exchange Reserves and Lead to Liquidity Squeeze

Key Takeaways:

Bybit estimates capital inflows in the first six months after ETH Spot ETF launches could absorb 35% of exchange reserves, leading to a possible liquidity squeeze and sending a tailwind to Ether’s price action.

ETH options saw an outsized call-option volume compared to put options, suggesting a bullish tilt from derivative traders.

What’s Happening Now With ETH Spot ETFs?

As suggested by SEC Chair Gary Gensler, ETH Spot ETFs are expected to be approved in summer 2024. The market gained more visibility of this approval on Jul 16, 2024, as the SEC reportedly had no further comments on the applications of some ETH Spot ETF proposals. It’s anticipated that ETH Spot ETFs will start trading as early as next Tuesday, Jul. 23, 2024.

Currently, there are eight applicants for Ethereum Spot ETFs:

Grayscale Ethereum Trust

Bitwise Ethereum ETF

Blackrock's iShares Ethereum Trust

VanEck Ethereum Trust

ARK 21Shares Ethereum ETF

Invesco Galaxy Ethereum ETF

Fidelity Ethereum Fund

Franklin Ethereum ETF

There are fewer applicants for ETH Spot ETFs than the 11 applicants for Bitcoin Spot ETFs. Hashdex, Valkyrie and WisdomTree® haven’t proceeded to launch their ETH Spot ETFs, which may suggest fierce price competition among the issuers to gain market share. This also indicates that the issuers foresee relatively less demand for ETH Spot ETFs as compared to Bitcoin Spot ETFs.

Impact of ETH Spot ETFs

How much capital will flow into ETH Spot ETFs?

| AUM |

Bitcoin Spot ETFs (U.S.) | $57.8 billion |

ETH Spot ETFs (U.S.) | $8–20 billion |

Bitcoin Spot ETFs (HK) | HK$2,450 million |

ETH Spot ETFs (HK) | HK$350 million |

Source: Bybit (data as of July 16, 2024)

In our estimate, we expect the total assets under management (AUM) of ETH Spot ETFs in the U.S. market to be between $8 billion and $20 billion. In the optimistic scenario, we expect a cap of $20 billion in inflows to these ETFs, assuming that the inflows to ETH ETFs don’t have a significant cannibalization effect on the Bitcoin Spot ETFs, and that all the new money is directed toward these investments.

This estimate takes into account the typical asset allocation patterns of crypto investors, as outlined in Bybit's asset allocation report. In our view, investors will likely choose to invest in either Bitcoin or Ethereum, rather than diversifying their exposure across multiple cryptocurrencies. As the report suggests, investors intend to focus their investments on the largest blue-chip crypto assets.

|

| $20 billion (as of % of total) |

Market Cap | $415 billion | ~5% |

Exchange reserves | $57.4 billion | ~35% |

Non-staked ETH | $302 billion | ~6.6% |

Source: Bybit (data as of July 16, 2024)

The $20 billion inflows are estimated to take up 5% of Ether’s market capitalization. What is striking is that $20 billion could take up 35% of the total exchange balance, which would likely lead to a liquidity crunch.

Ether Exchange Reserves. Source: CryptoQuant (data as of June 16, 2024)

Additionally, data from CryptoQuant suggests that cryptocurrency exchange reserves have been declining. This is likely due to the tendency for exchange outflows driven by the staking rewards that decentralized liquid staking protocols offer. As a result, the liquidity squeeze is expected to intensify further.

This poses a potential challenge for ETH Spot ETFs, as they rely on centralized cryptocurrency exchanges — particularly Coinbase — to facilitate their subscription and redemption activities. The decreasing liquidity in these exchanges could make it more difficult for these ETFs to efficiently manage their operations and maintain their tracking of the underlying Ether spot price.

Will Ether Spot ETFs affect the approval of Solana Spot ETFs?

Currently, only VanEck and 21Shares have filed for Solana Spot ETFs in the U.S. market. However, influential financial institutions like Blackrock's iShares or Fidelity haven’t made similar filings, which are often seen as indicators of potential approval.

The SEC is unlikely to make a decisive move on Solana Spot ETFs before the U.S. presidential election in November. The deadline for the SEC to reach a decision is mid March 2025.

Solana remains significantly different from both the Bitcoin and Ethereum blockchains. In terms of the number of stakeholders, Solana is perceived by some to have a higher degree of centralization risk as compared to Ethereum. Solana's development and network activities are largely driven by the Solana Foundation, which is believed to exert a more powerful influence over the network than the Ethereum Foundation does on the Ethereum network. Additionally, Solana has around 1,500 validators, while Ethereum has approximately 1.5 million. A higher number of validators suggests a higher level of decentralization.

The SEC is particularly concerned about the risk of market manipulation in the cryptocurrency space. Therefore, there are no clear signs that the SEC will approve Solana Spot ETF applications in the near future.

Ether might outperform Bitcoin, as it‘s not subject to selling pressure from Mt. Gox

As Bitcoin continues to surge toward its all-time high, the potential selling pressure from the Mt. Gox seized assets could exert some downward pressure on the largest cryptocurrency. Ether may face similar selling pressure, which could push its performance to outperform Bitcoin in the near future.

Mt. Gox, the defunct cryptocurrency exchange, is estimated to hold around $9 billion worth of Bitcoin. It’s likely that the gradual release or sale of these Bitcoin holdings by the Mt. Gox rehabilitation trustee could lead to another short-term headwind for Bitcoin, similar to what was observed in June 2023 when the German government sold its seized Bitcoin holdings.

We shouldn’t forget the mid August deadline for 13F, which might disclose further institutional interests

Since the approval of Bitcoin Spot ETFs in January 2024, the Q1 2024 13F filings have surprised the market, as detailed in a report from Bybit. As a highlight, 52% of the largest hedge funds have established Bitcoin positions through these newly launched Bitcoin Spot ETFs in the U.S. market after just one-quarter of their availability.

Not only short-term–focused hedge funds, but also long-term capital from institutions like the State of Wisconsin Investment Board (SWIB), a public pension fund that’s made allocations to the largest cryptocurrency, have shown interest. Additionally, corporate America has demonstrated a broader interest in holding Bitcoin as part of its treasury reserves.

Bybit believes the upcoming Q2 2024 13F filings, which will be released in mid August, might further fuel market sentiment if there are more prominent investments into Bitcoin Spot ETFs. As highlighted in Bybit’s report, even a 5% allocation of corporate cash balances to Bitcoin could represent 25% of Bitcoin's total market capitalization, not to mention the potential impact on exchange reserves.

In our view, within a few weeks after the approval of ETH Spot ETFs any positive news regarding institutional allocations to Bitcoin could boost the hope of similar institutional interest in Ether Spot ETFs. The true extent of institutional interest in Ether Spot ETFs may not become fully apparent until the Q3 2024 13F reports are released in mid November.

Derivatives Suggest Investors Have Geared Up Ahead of ETH Spot ETF Approvals

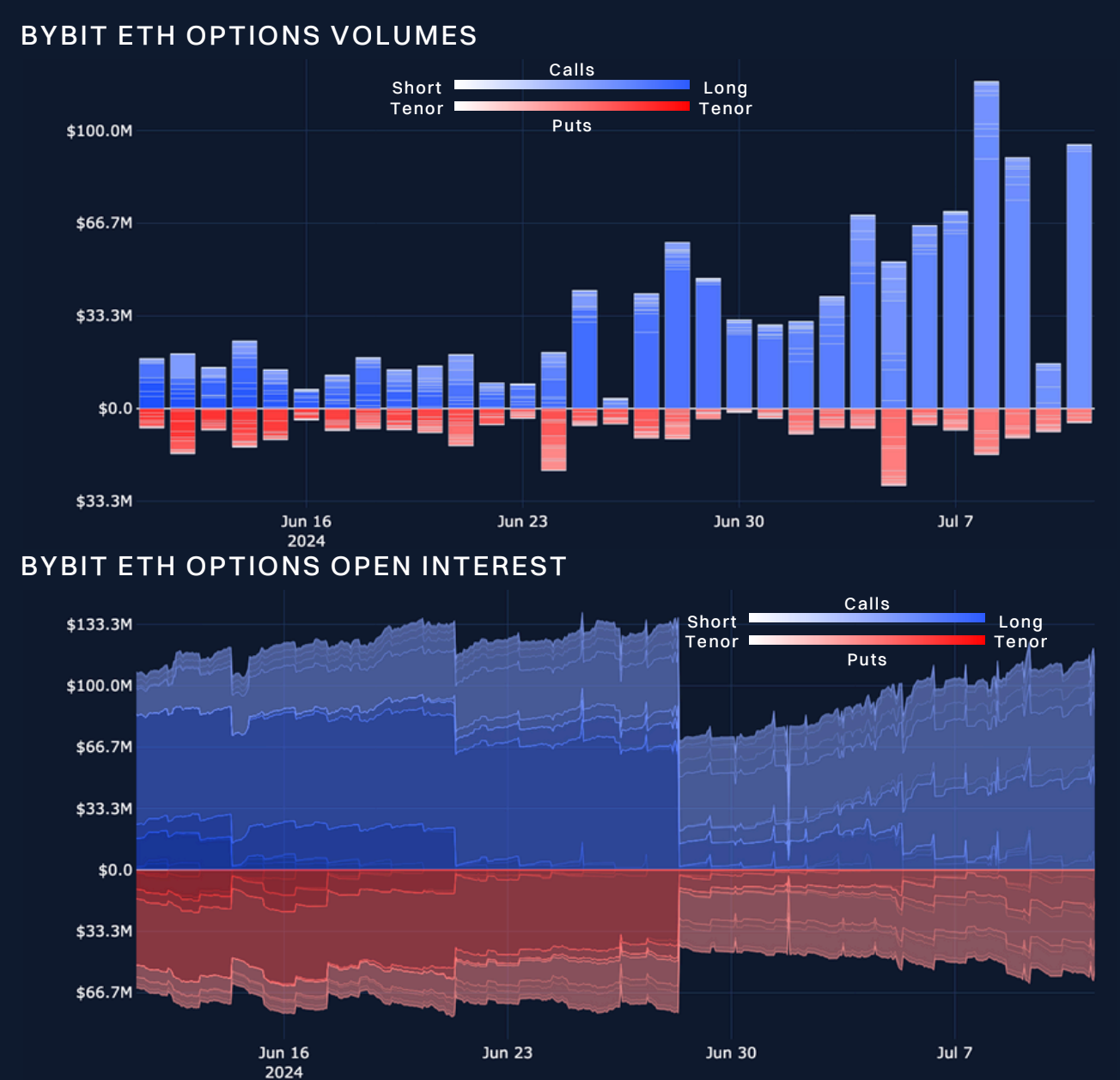

Bybit ETH Options Volume. Sources: Bybit, Block Scholes

The derivatives market has also expressed its views on the potential approval of ETH Spot ETFs. A recent report jointly released by Block Scholes and Bybit highlights that Ether options trading activity has shown an outsized volume of call options as compared to put options, suggesting a strong bullish tilt from investors. This contrasts with the options trading activity observed for Bitcoin, which didn’t exhibit a similar bullish skew.

However, the volatility premium of Ether options remains elevated as compared to Bitcoin options, since the market is currently safeguarding against a possible "sell the news" scenario once the ETH Spot ETFs go live. This cautious stance is informed by the immediate price drawdown experienced by Bitcoin after the listing of the first Bitcoin Spot ETF in January 2024.

The derivatives market's positioning, with its bullish bias in ETH options and elevated volatility premium, suggests that investors are anticipating a positive response to the potential approval of ETH Spot ETFs, while also being cautious about potential short-term volatility or a sell-off upon the launch of these products.

Final thoughts

Bybit is excited at the potential milestone for the cryptocurrency industry with the anticipated approval of ETH Spot ETFs. However, some analysts have expressed concerns about the possibility of underwhelming demand for these products, due to their lack of staking features.

The targeted user base for ETH Spot ETFs is quite different from that of decentralized staking protocols. Institutional investors, who are the primary intended users of ETH Spot ETFs, are generally more concerned about self-custody risks than reduced returns. Currently, Ether's staking yields are only around 3.42%, which is less than that of traditional treasury products. Institutions may not be primarily interested in investing in ETH Spot ETFs solely for the purpose of passive yield generation.

Despite these potential headwinds, Bybit remains optimistic about the positive impact that the launch of ETH Spot ETFs could bring to the industry. This optimism is reinforced by several other tailwinds facing the cryptocurrency market, including the higher chances of crypto-friendly candidates winning elections and the sustained global trend of approvals for listed Bitcoin or Ether investment products, such as the recent approval of Bitcoin Spot ETFs in Australia.

You can trade the pairs listed below with Bybit: