Weekly Institutional Insights — ETH ETFs Could Start Trading Next Tuesday. Outperformers: ENA, DYM and PEPE

Jul 22, 2024: Our weekly Institutional Insights explores the latest market developments, including market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks, aiming to supercharge your crypto trading.

Enjoy our weekly take on the market!

Macro Overview — Data Bolsters Fed’s Confidence

Source: Bloomberg

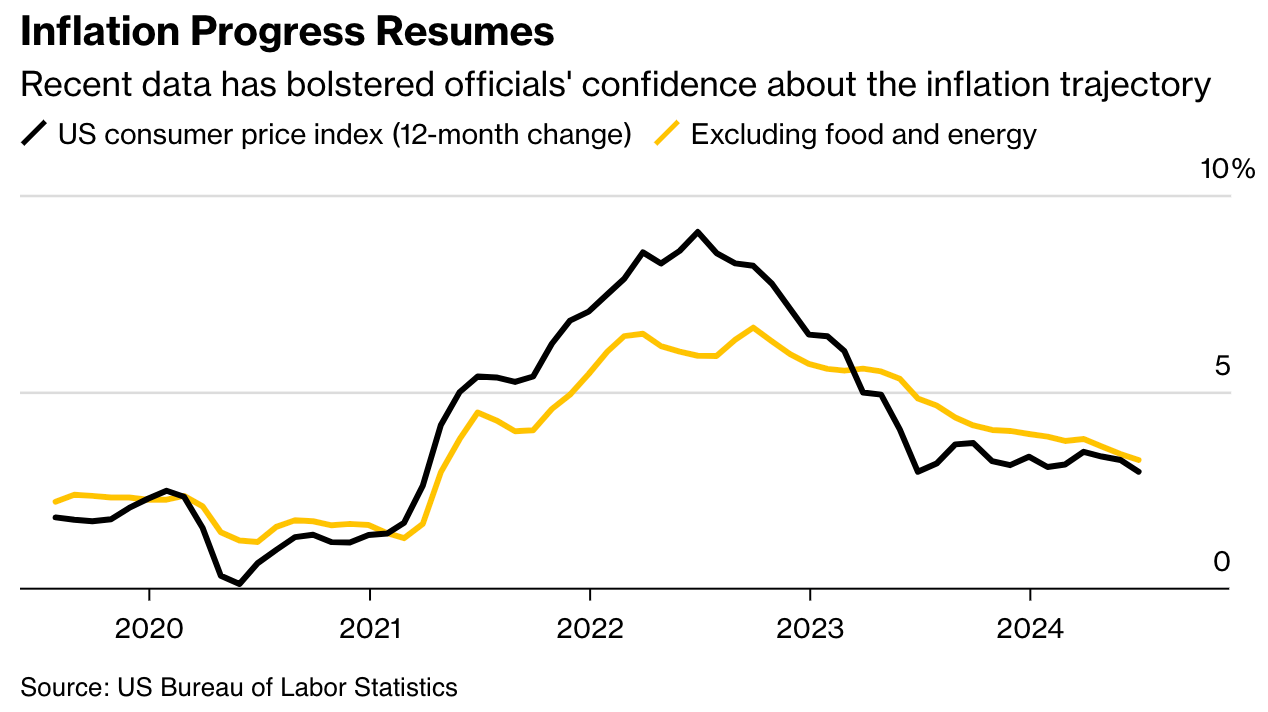

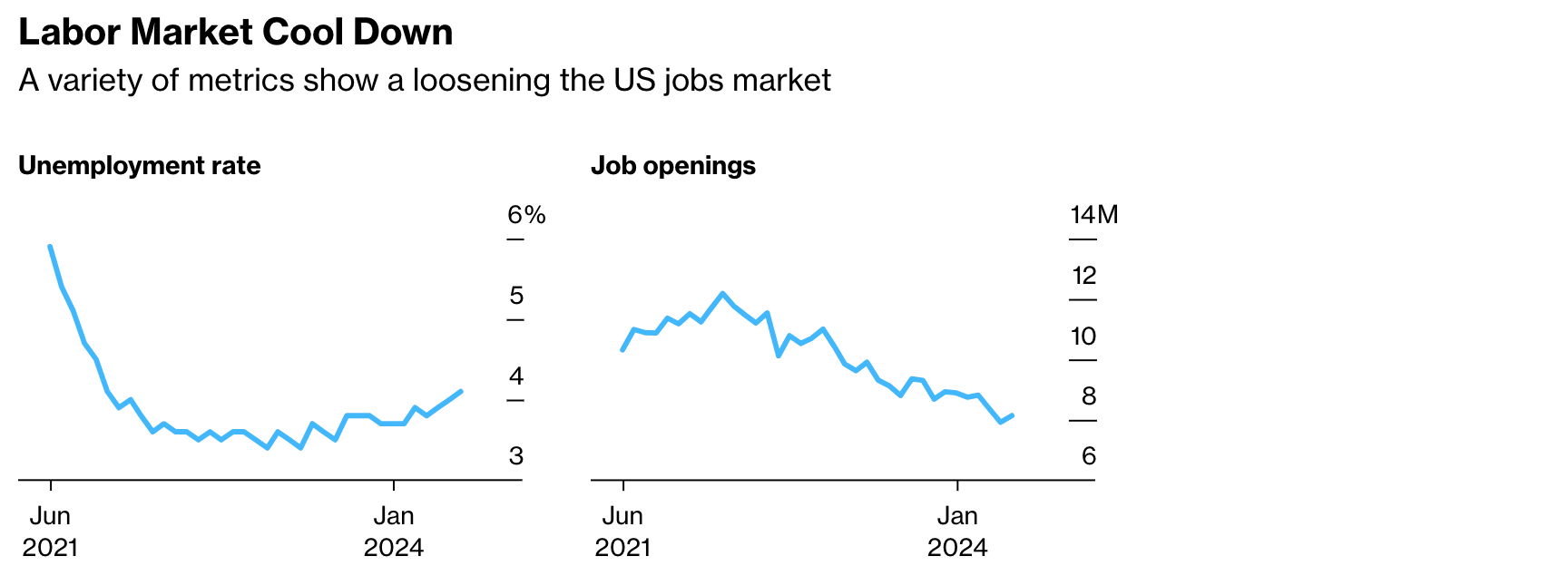

For over two years, inflation has been the Federal Reserve's primary concern. However, this is poised to change as central bankers prepare to cut interest rates in September. Officials have expressed growing confidence that price stability is within sight, while risks to the labor market have increased.

Recent data has bolstered the Fed's confidence in the inflation trajectory, with the preferred gauge easing to 2.6%. Meanwhile, the once-overheated labor market has cooled, with a decline in job openings and a gradual rise in unemployment. This "sweet spot" has policymakers determined to avoid letting the labor market falter substantially.

While officials haven’t specified the exact timing, their comments have been interpreted as signaling a September rate cut. This shift reflects their desire to stick a "soft landing" for the economy, which is showing signs of cooling consumer spending and slowing growth. Policymakers emphasize they need more data before committing, but the momentum appears to be building toward a September rate reduction.

Weekly Crypto Highlight — Excitement Around ETH ETFs Continues to Build

As suggested by SEC Chair Gary Gensler, ETH Spot ETFs are expected to be approved in summer 2024. The market gained more visibility of this approval on Jul 16, 2024, as the SEC reportedly had no further comments on the applications of some ETH Spot ETF proposals. Meanwhile, it’s anticipated that Ethereum Spot ETFs will start trading as early as next Tuesday, Jul 23, 2024.

There are fewer applicants for ETH Spot ETFs than the 11 applicants there were for Bitcoin Spot ETFs. Hashdex, Valkyrie and WisdomTree® haven’t proceeded to launch their ETH Spot ETFs, which may suggest fierce price competition among the issuers to gain market share. This also indicates that the issuers foresee relatively less demand for ETH Spot ETFs as compared to Bitcoin Spot ETFs.

How much capital will flow into ETH Spot ETFs?

| AUM |

Bitcoin Spot ETFs (U.S.) | $57.8 billion |

ETH Spot ETFs (U.S.) | $8–20 billion |

Bitcoin Spot ETFs (HK) | HK$2,450 million |

ETH Spot ETFs (HK) | HK$350 million |

Source: Bybit (data as of Jul 16, 2024)

In our estimate, we expect the total assets under management (AUM) of ETH Spot ETFs in the U.S. market to be between $8 billion and $20 billion. In the optimistic scenario, we expect a cap of $20 billion in inflows to these ETFs, assuming that the inflows to ETH ETFs don’t have a significant cannibalization effect on the Bitcoin Spot ETFs, and that all the new money is directed toward these investments.

This estimate takes into account the typical asset allocation patterns of crypto investors, as outlined in Bybit's asset allocation report. In our view, investors will likely choose to invest in either Bitcoin or Ethereum, rather than diversifying their exposure across multiple cryptocurrencies. As the report suggests, investors intend to focus their investments on the largest blue-chip crypto assets.

|

| $20 billion (as % of total) |

Market cap | $415 billion | ~5% |

Exchange reserves | $57.4 billion | ~35% |

Non-staked ETH | $302 billion | ~6.6% |

Source: Bybit (data as of Jul 16, 2024)

The $20 billion inflows are estimated to take up 5% of Ether’s market capitalization. What is striking is that $20 billion could take up 35% of the total exchange balance, which would likely lead to a liquidity crunch.

Ether Exchange Reserves. Source: CryptoQuant (data as of Jun 16, 2024)

Additionally, data from CryptoQuant suggests that cryptocurrency exchange reserves have been declining. This is likely due to the tendency for exchange outflows driven by the staking rewards that decentralized liquid staking protocols offer. As a result, the liquidity squeeze is expected to further intensify.

This poses a potential challenge for ETH Spot ETFs, as they rely on centralized cryptocurrency exchanges — particularly Coinbase — to facilitate their subscription and redemption activities. The decreasing liquidity in these exchanges could make it more difficult for these ETFs to efficiently manage their operations and maintain their tracking of the underlying Ether spot price.

Will Ether Spot ETFs affect the approval of Solana Spot ETFs?

Currently, only VanEck and 21Shares have filed for Solana Spot ETFs in the U.S. market. However, influential financial institutions like Blackrock's iShares or Fidelity haven’t made similar filings, which are often seen as indicators of potential approval.

The SEC is unlikely to make a decisive move on Solana Spot ETFs before the U.S. presidential election in November. The deadline for the SEC to reach a decision is mid March 2025.

Solana remains significantly different from both the Bitcoin and Ethereum blockchains. In terms of its number of stakeholders, Solana is perceived by some to have a higher degree of centralization risk as compared to Ethereum. Solana's development and network activities are largely driven by the Solana Foundation, which is believed to exert a more powerful influence over the network than the Ethereum Foundation does on the Ethereum network. Additionally, Solana has around 1,500 validators, while Ethereum has approximately 1.5 million. A higher number of validators suggests a higher level of decentralization.

The SEC is particularly concerned about the risk of market manipulation in the cryptocurrency space. Therefore, there are no clear signs that the SEC will approve Solana Spot ETF applications in the near future.

Ether might outperform Bitcoin, as it‘s not subject to selling pressure from Mt. Gox.

As Bitcoin continues to surge toward its all-time high, the potential selling pressure from the Mt. Gox seized assets could exert some downward pressure on the largest cryptocurrency. Ether may face similar selling pressure, which could push it to outperform Bitcoin in the near future.

Mt. Gox, the defunct cryptocurrency exchange, is estimated to hold around $9 billion worth of Bitcoin. It’s likely that the gradual release or sale of these Bitcoin holdings by the Mt. Gox rehabilitation trustee could lead to another short-term headwind for Bitcoin, similar to what was observed in June 2024 when the German government sold its seized Bitcoin holdings.

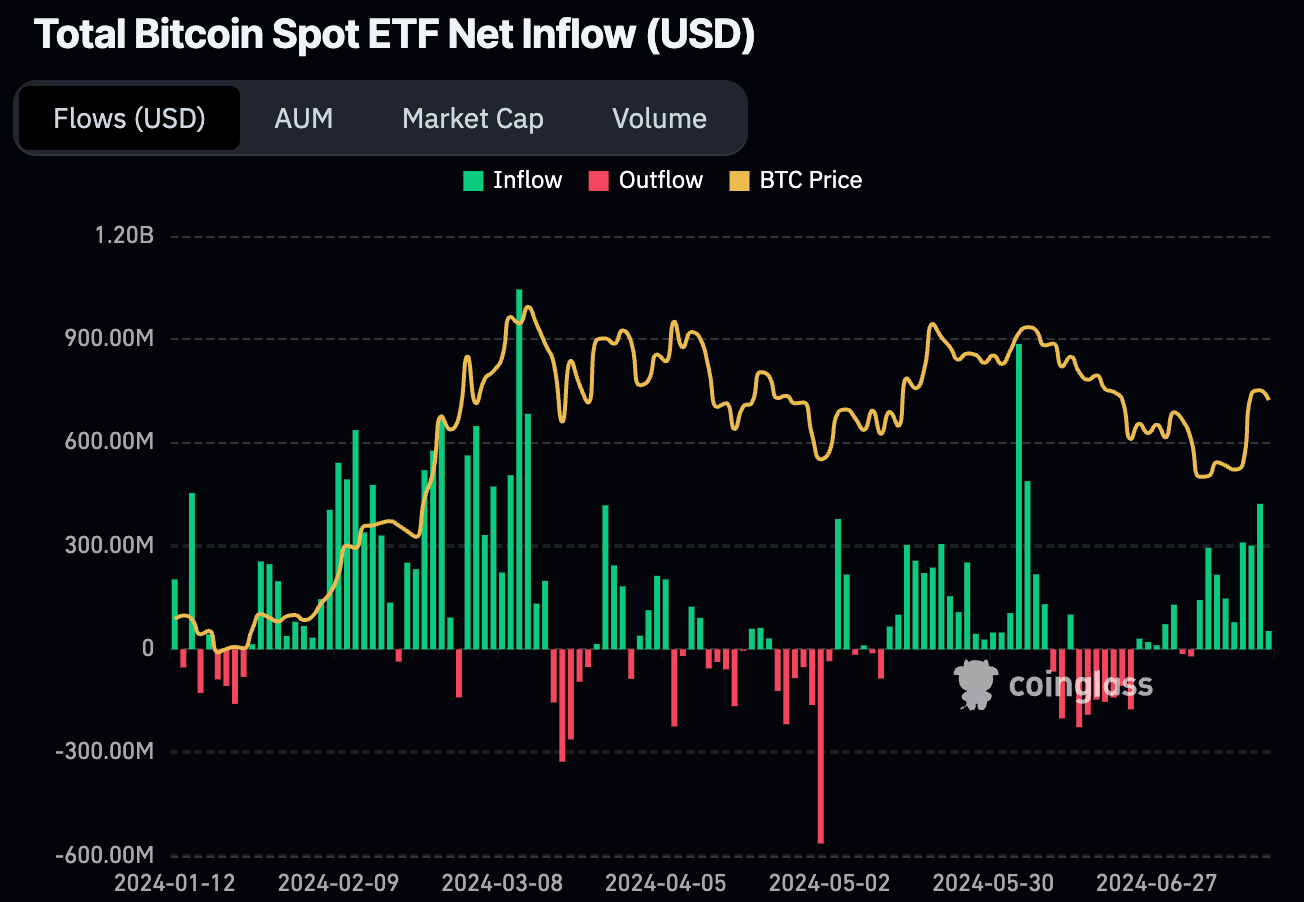

Bitcoin Spot ETF Inflows Support Bitcoin’s Rebound; $54K Might Be a Short-Term Floor

Total Bitcoin Spot ETF Flows.Source: CoinGlass, as of Jul 18, 2024

The increasing winning chance of crypto-friendly candidates has pushed the broader cryptocurrency market to recoup the majority of losses from June 2024’s sell-offs. Capital inflow streak from ETH ETFs has left investors anticipating another ATH in the coming months before November’s election.

Other Top-Performing Tokens

Token | Catalyst |

Ethena (ENA) | Lyra Finance and Ethena Labs have introduced a new Ethereum exposure strategy for sUSDe holders. Read more here. |

Dymension (DYM) | Dymension announced that Dymension Name Service (DymNS) is coming soon. Read more here. |

Pepe (PEPE) | Trump’s winning chances surged ahead of November’s presidential election, which led to a broader rally of meme tokens. Read more here. |