Dive Into Meme Tokens — Bybit Institutional Report Reveals More Than Double in Meme Position by Retail

Introduction

In the ever-evolving world of cryptocurrency, meme coins have become a topic of intense fascination and debate. Once dismissed as mere novelties, these digital assets have now captured the attention of crypto enthusiasts and investors alike. With the potential for outsized returns and the allure of the "next big thing," meme coins have become a focal point for those seeking to capitalize on the latest trends in the crypto market.

Our Bybit Institutional research provides remarkable insight into the trading behavior and asset allocation of retail and institutional investors regarding unconventional crypto assets. Covering the period from January 1 through May 1, 2024, this comprehensive report offers a unique window into the strategies and preferences of different investor groups navigating the meme coin landscape.

Read the full report here.

Institutions’ Shift in Mindset Toward Meme Tokens

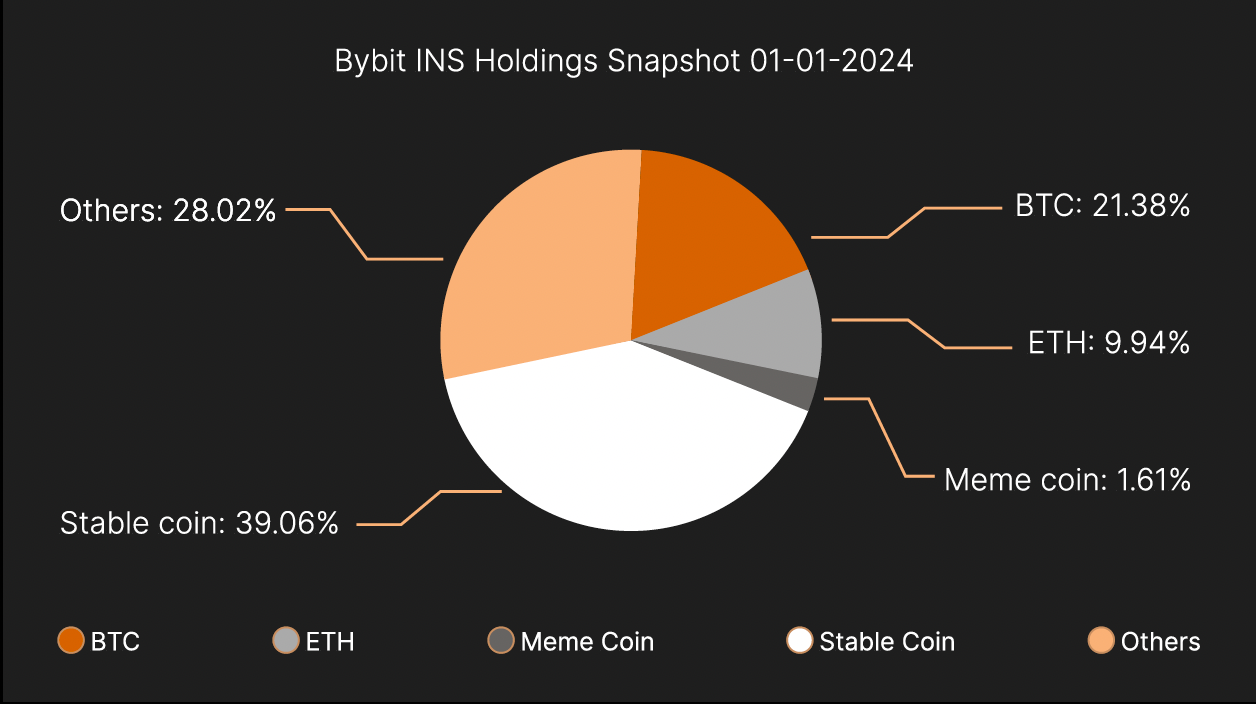

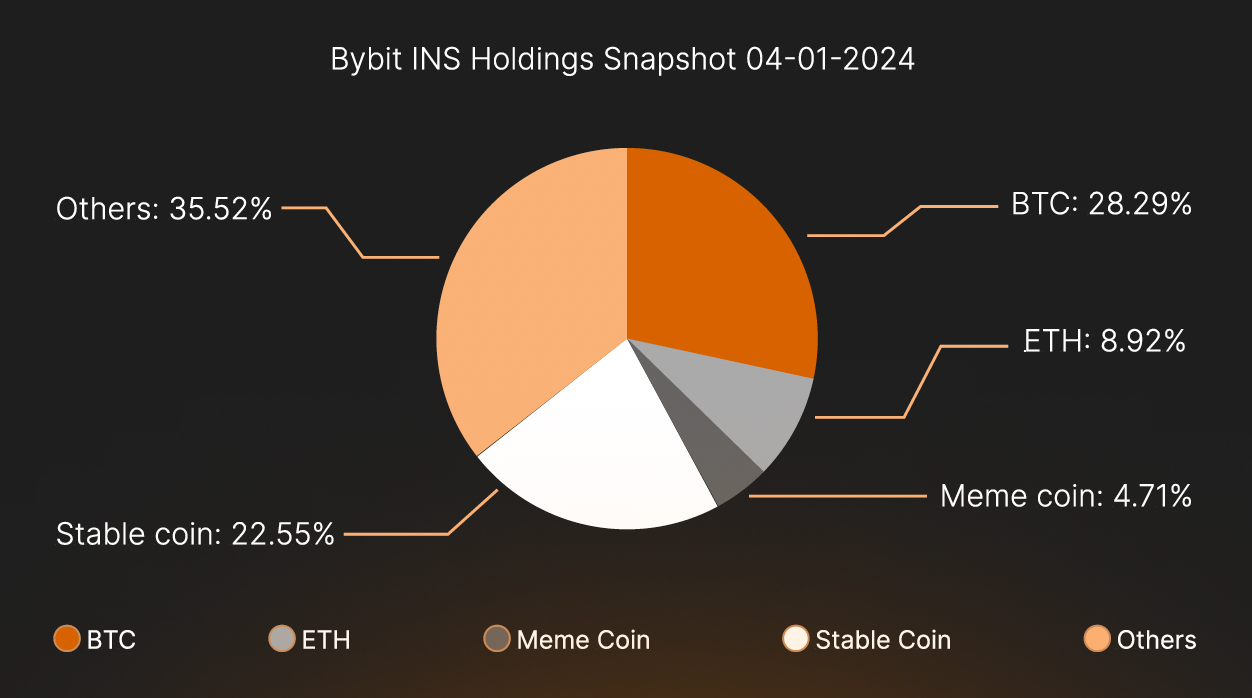

Bybit INS holdings on January 1, 2024 and May 1, 2024.Source: Bybit

One of the report's key findings is the growing prominence of meme coins in institutional investors' portfolios. Traditionally, institutions have been viewed as risk-averse and conservative in their investment approaches. However, the data reveals a dramatic shift in this mindset, as institutions significantly increased their meme coin allocations during the period examined.

In fact, institutional meme coin holdings surged 226% from February to March 2024, reaching a peak of $293.7 million in April. This aggressive embrace of meme coins by institutions challenges the notion that these assets are exclusively the domain of retail investors. The report suggests that institutions are willing to take on the inherent risks associated with meme coins, driven by the promise of outsized returns and the fear of missing out (FOMO) on the next big trend.

Retail Investors Are Actually the ‘Smart Money’ Behind Meme Coins

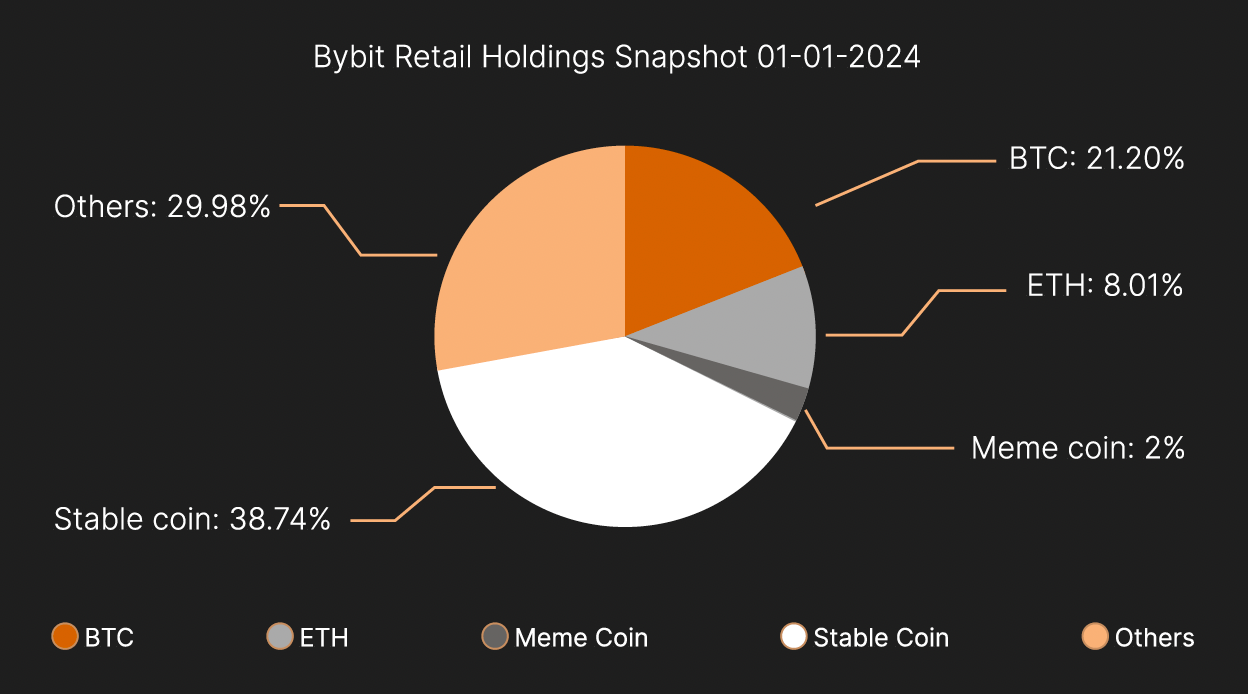

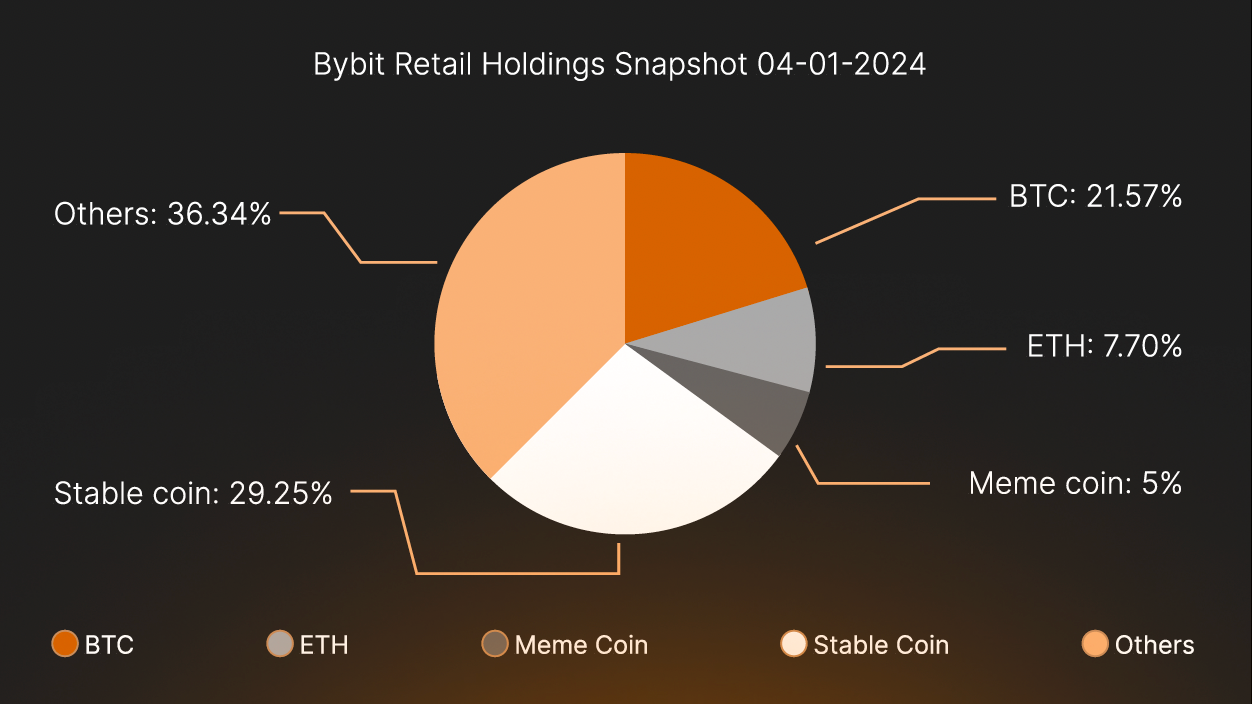

Bybit retail holdings on January 1, 2024 and May 1, 2024.Source: Bybit

Interestingly, the report also highlights the dynamic nature of retail investor behavior. Contrary to the stereotypical view of retail investors as "dumb money," the data reveals that retail investors on the Bybit platform made strategic adjustments to their portfolios in response to market conditions. Retail meme coin holdings skyrocketed 478% from February to April 2024, only to subside as market sentiment shifted, demonstrating a nuanced approach to investment decision-making.

DOGE Still The Favorite Of Both INS and Retail

The report delves deeper, providing insights into the specific meme coins that have dominated the portfolios of both retail and institutional investors. Dogecoin (DOGE) remained the clear leader, with institutions allocating a larger proportion as compared to retail investors. Other popular meme coins included Shiba Inu (SHIB) and Pepe (PEPE), with retail investors holding higher allocations than institutions. Notably, the newly prominent BONK meme coin gained significant traction among retail investors, who allocated $136 million to it, while institutions allocated $74.5 million.

Final Thoughts

In the meme coin market recently we’ve seen increased institutional adoption, retail investor sophistication, diversification of coins, regulatory challenges and persistent volatility. Successful navigation will require advanced risk management as meme coins cement their place in the evolving crypto ecosystem, reshaping investment strategies and challenging traditional assumptions about digital assets.