Weekly Institutional Insights — Crypto Reels From Seizure Selling; RWA Adoption Continues to Shine

Jul 8, 2024: Our weekly Institutional Insights explore the latest market developments, including market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks, aiming to supercharge your crypto trading.

Enjoy our weekly take on the market!

Market Overview — Bitcoin Drops Below $60K, Circle Secures MiCA Approval

The crypto markets have seen some volatility recently, with Bitcoin dropping from around $63,000 to a low of $54,000. Other major cryptocurrencies have also experienced price declines, with top meme tokens like Dogecoin (DOGE) and Shiba Inu (SHIB) falling more than 20% in a week, and leading Layer 1 tokens shedding around 15% as well.

Interestingly, Bitcoin Spot ETFs have exhibited an unusual negative correlation with Bitcoin's price movement. In the past week, positive inflows into these ETFs have coincided with declines in the Bitcoin price.

On the regulatory front, there has been some notable progress. Circle has become the first issuer to gain approval under Europe's new Markets in Crypto-Assets (MiCA) regulatory framework. This is seen as a long-term boost for the cryptocurrency ecosystem, as regulatory breakthroughs by stablecoin issuers can play a critical role in onboarding new users.

Regarding the approval of Ethereum ETFs, the process is taking a bit longer than the market had anticipated. The SEC has commented on the S-1 forms and requested resubmissions by July 8, 2024. According to analyst opinions, this new timeline means that the launch of Ethereum Spot ETFs could be postponed until mid to late July.

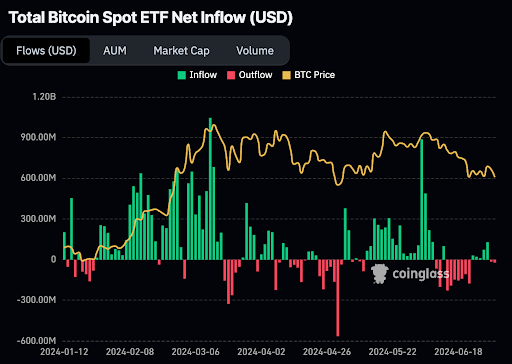

Bitcoin Spot ETF Flows

Total Bitcoin Spot ETF flows.Source: CoinGlass, as of June 28, 2024

The past few weeks have seen an unexpected negative dynamic emerge between Bitcoin's price and Bitcoin ETF flows. Over the past six months, there had been a positive correlation, as Bitcoin price rallies were followed by inflows into Bitcoin Spot ETFs, and vice versa.

However, this relationship appears to have broken down in the past week. Despite seeing positive inflows into Bitcoin ETFs, support for Bitcoin’s price failed as it dropped below the psychologically important $60,000 level.

This decoupling of Bitcoin's price from the flows into Bitcoin-linked ETFs is surprising, as these funds were previously seen as a key source of buy-side pressure for the leading cryptocurrency. The reasons behind the shift in this dynamic aren’t entirely clear, but it suggests that other factors may now be exerting a stronger influence on Bitcoin's short-term price movements.

Investors and analysts will be closely watching to see if this negative correlation between Bitcoin price and the ETF flows persists — or if the previous positive relationship reasserts itself in the coming days and weeks. Understanding the drivers behind this change in market dynamics could provide valuable insights into the evolving Bitcoin ecosystem.

Weekly Highlight (Ending July 5, 2024)

Real World Asset

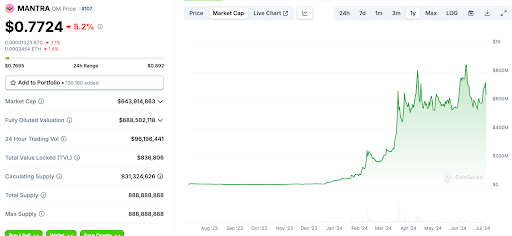

OM Price Chart. Source: CoinGecko, as ofJuly 4, 2024

Crypto projects focused on real-world assets (RWA) have continued to gain traction, sparking speculation about a potential "RWA Summer" in the market. A noteworthy example is MANTRA (OM), a project that’s collaborating with Dubai developer MAG to tokenize real estate projects worth $500 million. As a relatively new project, OM has been one of the top-performing tokens in 2024, driven by the anticipation of increased RWA adoption among traditional Web 2.0 players.

In our view, real-world assets are poised to rise in prominence, particularly amid the backdrop of ETF-induced crypto rallies. The January 2024 approval of Bitcoin Spot ETFs in the U.S. has generated greater interest in Bitcoin and broader cryptocurrency assets, not only from crypto-native investors but also from Web 2.0 businesses. As the connection between decentralized finance (DeFi) and traditional finance deepens, we’ve observed a corresponding rise in the adoption of real-world-asset integrations within the crypto ecosystem.

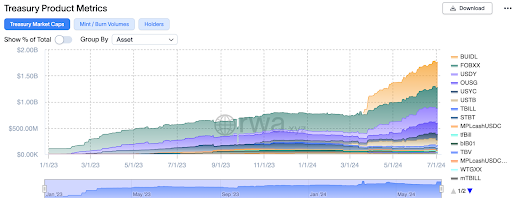

Treasury Product RWA. Source: rwa.xyz

Another prominent RWA project that’s gained traction this year is BlackRock's BUIDL initiative. In the six months since its debut, the BUIDL project has accumulated $486 million in total value locked (TVL). Combined with other treasury product RWA initiatives, the RWA adoption category has seen a total of $1.6 billion in capital inflows.

Beyond real estate and treasury products, experimentation with blockchain technology is exploring the integration of various other real-world-asset categories, such as insurance and commodities, among others. The growing adoption of real-world assets is expected to benefit the broader cryptocurrency ecosystem, since it drives demand for robust stablecoin infrastructure. This, in turn, could facilitate the onboarding of new Web 2.0 users into the web3 space and provide them access to a wider range of DeFi projects beyond just RWA applications.

Other Top Performing Tokens

Tokens | Catalyst |

AltLayer (ALT) | AltLayer's MACH enhances Arbitrum One with sub-10-second finality and improved security. Read more here. |

ZKsync (ZK) | Following its 3.0 upgrade, ZKsync has introduced its vision for an Elastic Chain, a unified ecosystem of interconnected Layer 2 rollups. Read more here. |

Mantle Network (MNT) | Mantle Network has launched its Metamorphosis campaign on its Ethereum Layer 2 platform, rewarding mETH stakers with "Powder" points that can be converted into its upcoming governance token, COOK. Read more here. |

Ethereum Name Service (ENS) | ENS has unveiled its new brand, which is scheduled for an upcoming exclusive event in Brussels. Read more here. |