Weekly Institutional Insights — Bitcoin Climbs Back to $58K, Solana ETF Excitement Might Be Next Catalyst for Another Rally

Jul 15, 2024: Our weekly Institutional Insights explore the latest market developments, including market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks, aiming to supercharge your crypto trading.

Enjoy our weekly take on the market!

Macro Overview — U.S. Inflation’s Unexpected Drop Supports Risky Assets

U.S. inflation cooled broadly in June 2024, reaching the slowest pace since 2021 due to a long-awaited slowdown in housing costs. This sends a strong signal that the Federal Reserve may soon be able to cut interest rates.

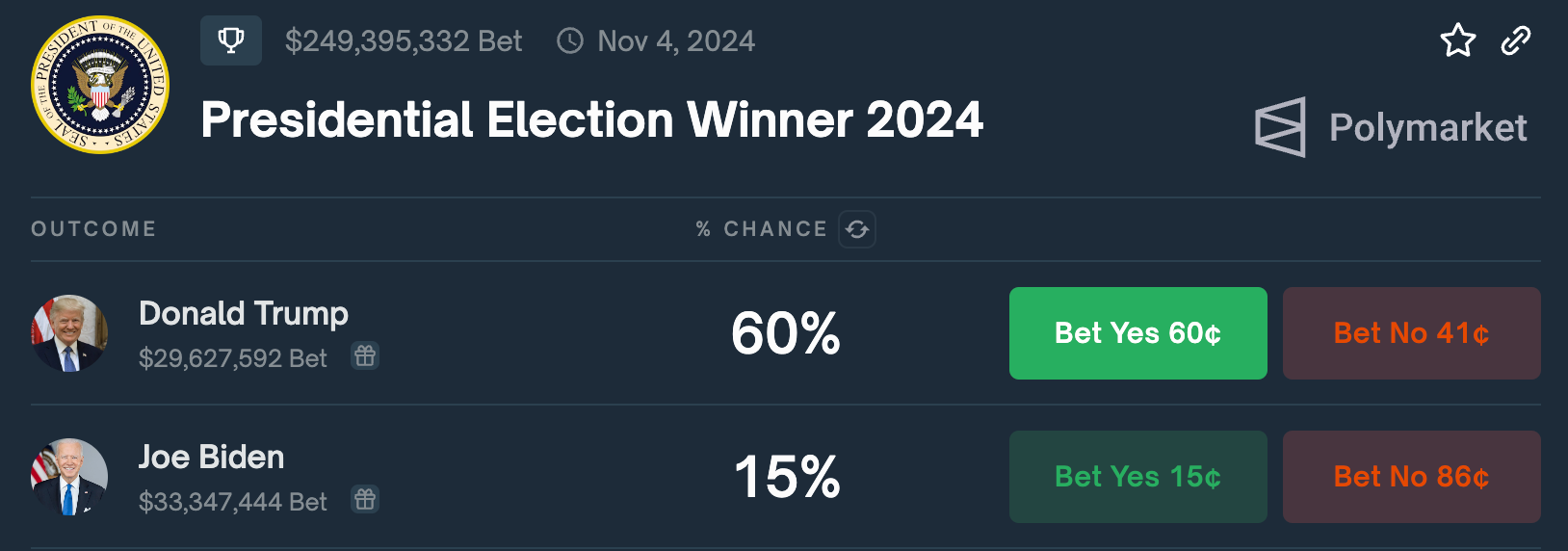

U.S. Consumer Price Index YoY. Source: investing.com

According to Bureau of Labor Statistics data, the core consumer price index, which excludes food and energy, rose just 0.1% from May — the smallest increase in three years. The overall CPI measure even fell for the first time since the Covid-19 pandemic began, driven by cheaper gasoline prices.

This deceleration in inflation boosts the odds of a Federal Reserve rate cut in September. The June CPI reading, along with the "really good" May 2024 report that Fed Chair Jerome Powell described, should give the central bank the confidence needed to start cutting rates soon. Policymakers may signal this possibility when they meet in July, especially as unemployment has risen for three straight months.

While in recent testimony Powell avoided signaling the timing of rate cuts, economists believe the path is now open for the Fed to cut them in September. Treasury yields rallied, and traders priced in September and December rate cuts after the CPI report.

The data also provided encouraging news for President Biden, as he faces calls from Democrats to step aside. Shelter prices, the largest CPI category, had their smallest gain since 2021, and services inflation more broadly cooled. Goods prices have also been declining for most of the past year, providing relief to consumers.

However, the June CPI data still showed inflation running above the Fed's 2% target, with the core CPI up 3.3% year-over-year. However, the broad-based slowdown, particularly in housing, suggests that the path to the Fed's goal is becoming clearer.

Weekly Crypto Highlight — SOL ETF Boosts Market Sentiment; Bitcoin Climbs Back to $59K Ahead of CPI Data

It’s reasonable to expect that the unexpected drop in June’s U.S. CPI print was priced in before its actual release, as both the cryptocurrency market and broader equity markets had experienced a strong rally prior to Thursday's data announcement.

The highly anticipated approval of ETH Spot ETFs in July hasn’t led to a noticeable outperformance of Ether against Bitcoin. The market believes that Ether will only attract around one-third as much capital as Bitcoin following the official ETF approval.

However, the potential approval of a Solana Spot ETF is still worthy of anticipation due to Solana's long-standing status as an "altcoin." Bitcoin and Ether have always been regarded as commodities by major regulators, including the Commodity Futures Trading Commission (CFTC). Even Gary Gensler, the current Chair of the Securities and Exchange Commission (SEC), didn’t object to such a classification earlier in his career. Furthermore, ETH Spot ETFs have already been approved in regions such as Hong Kong and Canada. As such, the prospect of Solana Spot ETFs is seen as more "unexpected" than ETH Spot ETFs.

The potential impact of a Solana Spot ETF listing could be profound, as it could potentially pave the way for the approval of Spot ETFs for many other altcoins.

Yet, it’s still too early to reach any definitive conclusions. Currently, only two issuers have filed for a Solana (SOL) Spot ETF — VanEck on June 27, 2024, and 21Shares on June 28. There hasn’t been any clear indication or hint from the regulator on a potential green light for these filings. When reflecting on the past, the approval process for ETH Spot ETFs experienced a notable U-turn when an abrupt change in attitude from the regulator transformed the seemingly impossible event into a solid approval. Given this precedent, it would be premature to make any firm predictions about the outcome of the pending Solana Spot ETF applications. The final decision by the SEC remains uncertain at this stage.

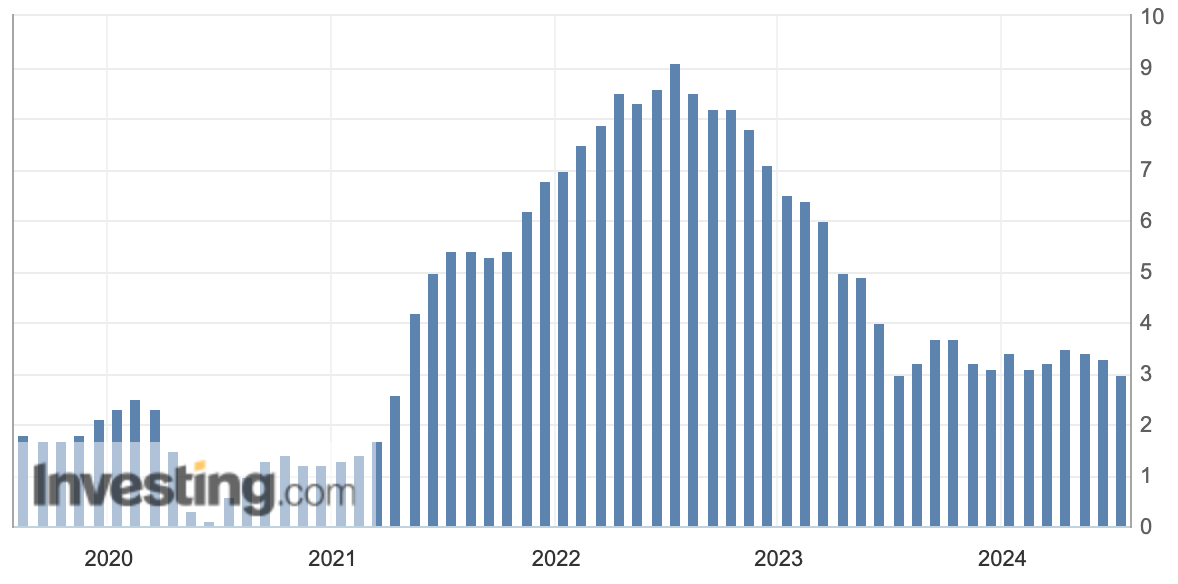

Presidential Election Winner 2024 Bet. Source: Polymarket

Why would the market still dare to dream about this prospect? According to Polymarket's betting ratios, Donald Trump was perceived to be the likely winner of the upcoming November presidential election. Trump is considered a pro-crypto candidate who accepts cryptocurrency donations for his political campaigns. With Trump potentially taking over the White House, the market believes that more crypto-friendly policies might emerge from the administration.

However, behind the hype, Solana remains significantly different not only from the Bitcoin blockchain but also from that of Ethereum. In terms of the number of stakeholders, Solana is perceived to have a much higher degree of centralization risk than Ethereum. Solana's development and network activities are largely driven by the Solana Foundation, which is believed to exert a more powerful influence over the network than the Ethereum Foundation does on the Ethereum network.

Regulators are primarily concerned about potential market manipulation risks. The token concentration of SOL is clearly higher than that of Ether. Although the top token holders of ETH are mostly exchanges and the Beacon Deposit contract, in our assessment, Solana has seen a much more concentrated pattern of token holdings, based on the current distribution and its relatively shorter history.

This heightened concentration in Solana's token distribution is likely to be a key consideration for regulators when evaluating the potential approval of a Solana Spot ETF. The concern over market manipulation stemming from such concentrated token holdings could pose a significant challenge for the Solana ETF applications.

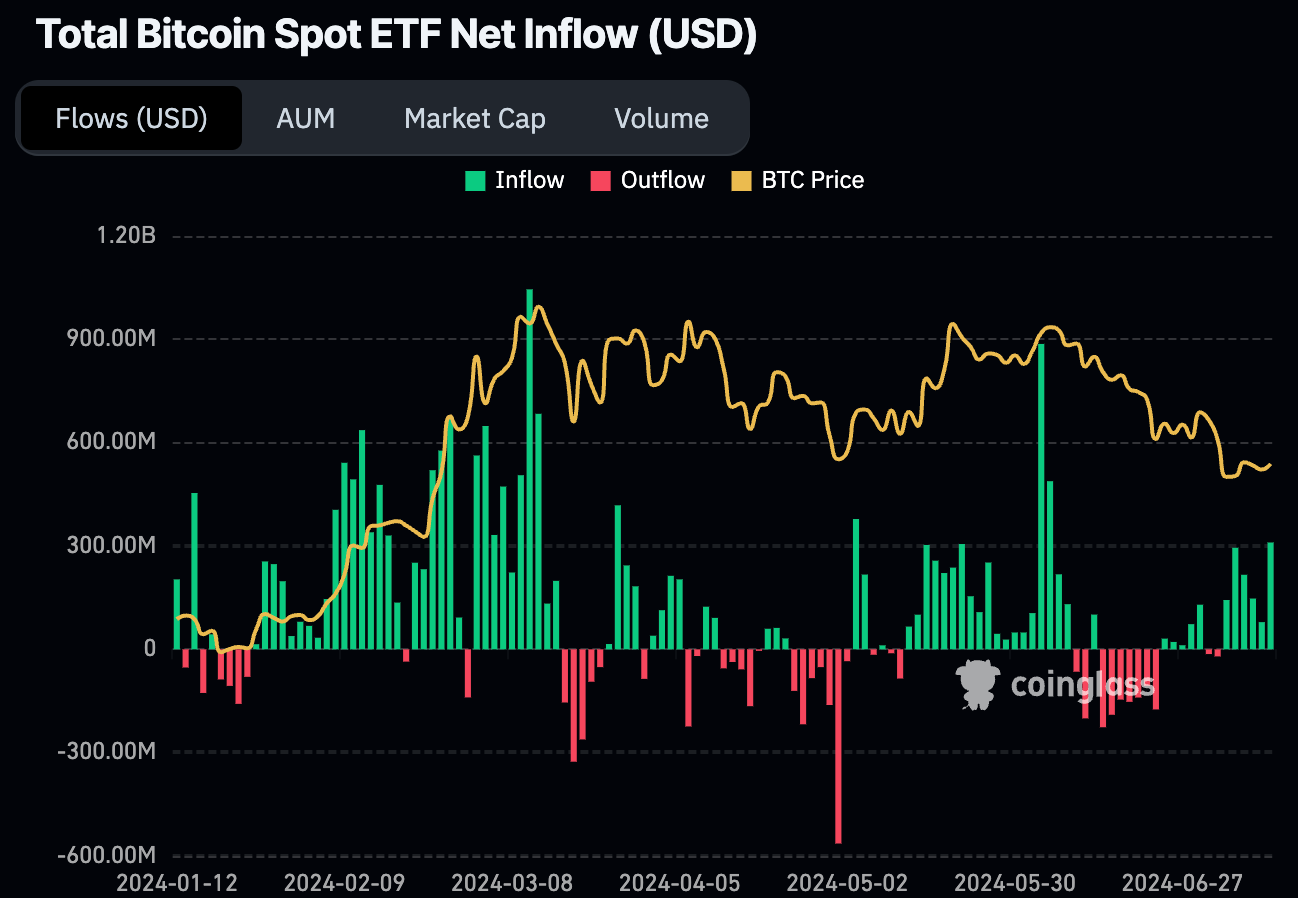

Bitcoin Spot ETF Inflows Support Bitcoin’s Rebound; $54K Might Be a Short-Term Floor

Total Bitcoin Spot ETF Flows.Source: CoinGlass, as of June 28, 2024

Continuous inflows have supported Bitcoin's rebound to $59,000 from a bottom of approximately $54,000. In mid-August, we’ll see whether such buy-the-dip behavior is driven by institutional investors.

Nevertheless, the imminent selling of Bitcoin from the Mt. Gox distribution, as well as the Bitcoin seized by the German and U.S. governments, will continue to put a strain on Bitcoin’s price trend, which may lead to a lower chance of another record-high in the medium term. However, strong inflows during Bitcoin's first correction below $50K in 2024 might indicate that the $54K level is very strong support, and any upcoming corrections down to this level could present a good entry opportunity for those who missed the early 2024 rally.

Other Top Performing Tokens

Token | Catalyst |

Heroes of Mavia (MAVIA) | Heroes of Mavia launched a new in-game feature, Ruby Battles, which saw strong user participation. Read more here. |

Celestia (TIA) | The market anticipates the upcoming Modular Summit 3.0, which will likely focus attention on the leading modular blockchain solution provider. Read more here. |

Saga (SAGA) | The announcement of the SAGA x BullRun Bonanza Tournament gives a boost to the native token, SAGA. Read more here. |

.jpg)