Bitcoin Bull Rally Persists, Likely Due to Institutional Accumulation; Bitcoin Might Outperform Ether Near-Term

Key Takeaways:

Bybit data shows INS still favors BTC over ETF despite Ethereum ETF approval.

The market may have underestimated the impact of Q1’s 13F disclosures

TradFi institutions could continue to accumulate Bitcoin ETFs in the coming quarters.

Ether Spot ETFs may push the BTC-ETH ratio to bottom out, but are unlikely to reverse the trend in the near term.

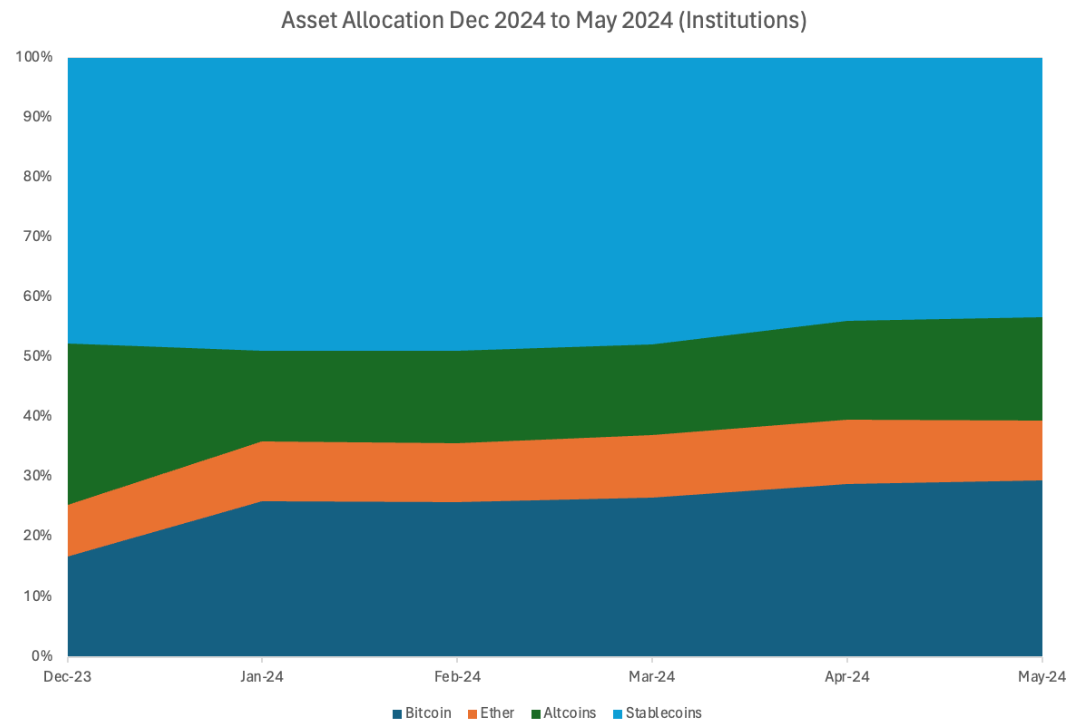

Bybit Data: Institutions Continue to Favor Bitcoin

Source: Bybit

Following the approval of Bitcoin Spot ETFs on January 10, 2024, Bitcoin’s price saw a 46% increase in February 2024 and peaked in mid-March with an all-time high of $73.7K. Despite the pullback in April and rebound in May, institutional holdings of Bitcoin continued to increase persistently throughout the half-year period.

On the other hand, Ether’s position by institution saw a surprising decrease in May 2024, dropping from 10.8% on April 30, 2024, to 9.9% on May 31. Institutions have been acting as the smart money this time, with their Ether positions increasing in April as the market lost faith in the SEC’s ETF approval, and reducing in the wake of the approval.

In short, institutions still favor Bitcoin over Ether, even though the latter is likely getting a green light from the SEC for its Spot ETFs. The reasons behind this are likely a combination of TradFi’s accumulation of Bitcoin and the subdued attraction of Ether Spot ETFs.

Impact of TradFi’s Accumulation of Bitcoin

BTC Positions From Top Hedge Funds Are Quite Small

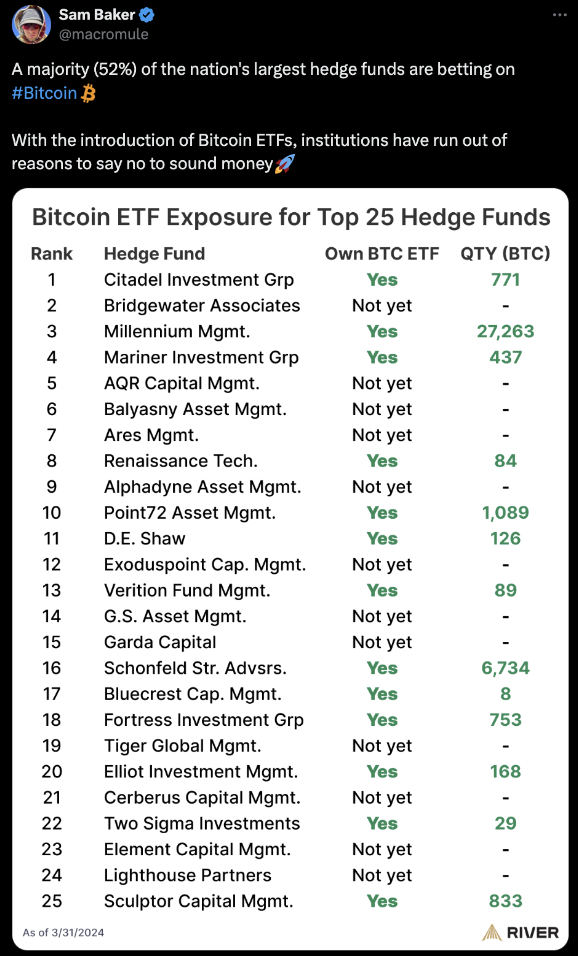

Following Bitcoin Spot ETF approvals in January 2023, the 13F reports for Q1 2024 are the first of their kind to be released that cover the position change for traditional asset managers.

Bitcoin ETF Exposure for Top 25 Hedge Funds. Source: X @SamBaker

It’s surprising that over half of the top 25 hedge funds invested in Bitcoin Spot ETFs in the first quarter of 2024.

Hedge Fund Management | Asset Under Management (AUM) | Bitcoin Holding as % of AUM (assume $70K) |

Citadel | $62.3 billion | 0.09% |

Millennium | $61.1 billion | 0.3% |

Top Hedge Funds’ Bitcoin Position % as AUM. Source: Bybit

While Bitcoin wasn’t dominant, its presence in the portfolios of major hedge funds is still significant. For example, at Millennium Management, Bitcoin Spot ETFs, including IBIT and FBTC, account for the 18th-largest position in the firm's portfolio, comprising over 0.3% of its total assets under management (AUM).

This suggests that even traditional, non-crypto-focused hedge funds are starting to view Bitcoin as an attractive investment. Known for their flexibility and embrace of volatility, hedge funds may be drawn to Bitcoin due to its potential for outsized returns as compared to more traditional asset classes.

Prior to the recent disclosure of these 13F filings, crypto-native hedge funds had been the primary institutional buyers of Bitcoin. However, the fact that mainstream, non-crypto hedge funds are now accumulating Bitcoin positions speaks to the growing market optimism around Bitcoin Spot ETFs.

These ETFs provide established asset managers with regulated investment vehicles to gain exposure to Bitcoin, which offers unique investment characteristics, such as its limited supply and lack of correlation with other asset types. As such, Bitcoin is clearly gaining recognition among a wider range of institutional investors — even if it remains a relatively small part of their overall portfolios for now.

Once Traditional Asset Classes Are Starting to Invest in Bitcoin — And It Won't Be a One-off Event

It's unlikely that investors have already allocated their full targeted exposure to Bitcoin in the first quarter of 2024. The true extent of their positions will likely become clearer when the next round of 13F filings is released in mid-August.

Traditional hedge funds, in particular, probably haven’t invested their entire desired Bitcoin allocation so far this year. This is especially true given that Bitcoin has continued to set new all-time highs, making current investment costs less appealing from a trading perspective.

Instead, the Bitcoin positions we've seen reported so far in Q1 2024 are likely just initial stake-building by these institutional players. Hedge funds, with their typical 5-year investment horizons, are usually more focused on buying low and selling high to maximize returns; they aren’t the HODLers that some other crypto investors have become. In particular, the lowest Bitcoin price point observed so far in Q1 2024 has only been around $58,000. This relatively mild drawdown may not have provided a sufficiently attractive entry point for these sophisticated investors to deploy their full intended allocations.

We'll likely get a better sense of hedge funds' true Bitcoin exposures and strategies when the next round of regulatory filings is disclosed in mid August. The current data only provides a partial glimpse into institutional crypto adoption trends.

Long-Term Capital Enters Bitcoin

When it comes to Bitcoin Spot ETF investments, we believe pension funds stand out as some of the most impressive institutional players. As long-term, risk-averse investors, pension funds are poised to be the true HODLers in this space.

Based on the latest 13F filings, Wisconsin Investment Board appears to be one of the few pension funds that’s been allocated to Bitcoin Spot ETFs so far. This makes sense, as pension funds generally have much longer investment horizons as compared to more active traders, such as hedge funds.

Similar to the way that hedge funds are approaching Bitcoin, we don't believe Wisconsin's investment in the Bitcoin Spot ETF is a one-off. Just as Warren Buffett gradually built up Berkshire Hathaway's position in Apple over 2016 and 2017, we expect pension funds to increase their Bitcoin exposure methodically over time.

Corporate Investment in Bitcoin

Another potentially significant source of long-term Bitcoin investment could come from corporate America. While early movers like MicroStrategy and Tesla have already allocated corporate treasury funds to Bitcoin, we may see more firms follow suit and use Bitcoin Spot ETFs as a way to hold the cryptocurrency.

For example, Semler Scientific recently announced that it’s allocated 65% of its over $62 million cash balance to direct Bitcoin holdings, rather than through an ETF. However, holding Bitcoin via a Spot ETF could be an easier option for many corporations looking to reduce custody and counterparty risks.

| Cash Held | % of Bitcoin market cap |

Cash held by Corporate America | $6,900 billion | NA |

5% in Bitcoin | $345 billion | 25.5% |

10% in Bitcoin | $690 billion | 51.0% |

Cash held by Corporate America (Feb 2024). Sources: Harvard Business Review, Bybit

The data presented in the table above suggests that if corporate America were to allocate just 5% of its aggregate cash reserves into Bitcoin, that would be equivalent to 25.5% of Bitcoin's total market cap. This highlights the sheer scale of the potential demand that could be unleashed if more major corporations start treating Bitcoin as a treasury reserve asset, in a similar fashion to early movers like MicroStrategy and Tesla.

Will Bitcoin Continue to Outperform Ether?

Bitcoin Dominance Halts Since 19b-4 Approval of Ether Spot ETFs

ETHBTC ratio from Sep 2023 to Jun 2024. Source: Bybit

The ETHBTC ratio has been in a downtrend since September 2023, likely due to anticipation of Bitcoin Spot ETF approvals. It briefly bounced above 0.05 in January after the BTC ETF launch, as investors betted on an upcoming Ether Spot ETF.

However, the ratio has since continued falling, only recently bottoming out as Ether Spot ETFs near approval. At 0.053, the current ETHBTC level remains well below historical averages, indicating Bitcoin's outperformance.

Ether Spot ETFs Are Unlikely to Repeat Bitcoin Spot ETFs’ Success

| Return from October 1, 2023 to May 31, 2024 |

Bitcoin | +153% |

Ether | +123% |

Bitcoin and Ether return. Source: Bybit

Approval of 19b-4 documents by the SEC was an initial step toward the eventual approval of Ether Spot ETFs. The market expects the SEC will need to sign off on the registration statements, known as S-1s, submitted by the fund issuers, likely sometime this summer.

The key question is whether we'll see another rally in Ether and other cryptocurrencies after the expected ETF approval in July 2024.

In the lead-up to the SEC's green light, Ether jumped from $3,000 to $3,700 — a 20% increase as compared to just an 11% rise in Bitcoin over the same period. This narrowed the performance gap between the two largest cryptocurrencies.

In our view, the market has largely priced in the approval of an Ether Spot ETF, as there are no major uncertainties surrounding this imminent event. Compared to Bitcoin's gains since Q4 2023, Ether has only about 30% room to catch up.

However, the SEC's specific classification of Ether as a commodity or security in its official ETF approval could still fuel another rally, as the market may then anticipate approval of similar ETFs for Solana, XRP or other altcoins.

It's also worth noting approved Ether Spot ETFs will likely lack a staking feature, per the revised application forms. This may drive some traditional financial institutions to consider holding Ether directly through regulated custodians, rather than a Spot ETF.

Final Thoughts

In our view, both Bitcoin and Ether will continue to see price appreciation as more crypto ETFs launch, with the broader crypto market likely remaining highly correlated.

A recent report from Bybit Institutional suggests that Bitcoin and Ether are the mainstay assets in institutional portfolios. Therefore, the slight outperformance of Bitcoin against Ether may not make a huge difference to the overall returns of these diversified crypto holdings.

Looking ahead, Bitcoin may likely continue to be the preferred choice for traditional finance (TradFi) institutions newly entering the crypto market, given its status as digital gold.

In contrast, Ether's positioning as the "app store" of the crypto ecosystem may not be as unique an attribute for these TradFi players. Many Web 2.0 companies have stronger fundamentals than those of applications built on Ethereum, which also faces intensifying competition from other Layer 1 protocols.

Ultimately, TradFi portfolio allocation is still heavily inspired by risk-return considerations. Bitcoin's return profile and lower correlation against traditional assets can make it an attractive addition to diversified crypto portfolios for institutional investors.