Bybit Futures Combo: Enhancing Trading With Automatic Portfolio Rebalancing

The landscape of cryptocurrency trading is continually evolving, necessitating tools that streamline processes and bolster decision-making. Bybit is at the forefront of this evolution with the introduction of the Futures Combo, a pioneering feature unique to the industry. This first-of-its-kind tool automates the complex process of portfolio management and rebalancing, allowing traders to execute strategies with precision and less direct oversight. Throughout this article, we’ll explore Bybit Futures Combo’s functionalities, its operational mechanics, the benefits it offers to traders and guidelines on how to integrate this tool into trading practices.

Key Takeaways:

Bybit Futures Combo stands out as an industry first, offering an automated solution for managing multiple diverse Futures contracts within a single portfolio.

Futures Combo users can automatically set up a diversified portfolio of futures contracts.

What Is Bybit Futures Combo?

Bybit Futures Combo stands out as an industry first, offering an automated solution for managing multiple diverse Futures contracts within a single portfolio. It enables traders to create portfolios of anywhere from two to 10 different Futures contracts, and automatically adjusts their holdings to maintain preset allocation ratios despite market fluctuations. This automation is aimed at optimizing portfolio performance according to the trader’s predefined preferences.

How Does Bybit Futures Combo Work?

Bybit Futures Combo lets you set up a diversified portfolio of Futures contracts automatically. You can use AI strategies for optimized trading decisions, or choose to manually enter your strategy. Bybit Futures Combo uses parameters you set to manage the portfolio, such as which contracts to include and in what proportion, desired leverage and the conditions under which rebalancing should occur. This could be at regular time intervals, or in response to a percentage change in the value of one contract relative to others.

For instance, consider the following user’s portfolio:

- Allocation: BTCUSDT (long, 30%) and ETHUSDT (short, 70%)

Leverage: 1x

Rebalance Condition: 10% deviation

Investment: 100 USDT

If the BTCUSDT contract shifts to 40% or falls below 20%, the system will trigger rebalancing to restore the allocation to BTCUSDT at 30% and ETHUSDT at 70%. This process ensures that the portfolio aligns with the user’s strategic goals without requiring constant monitoring and adjustment by the user.

Benefits of Using Bybit Futures Combo

The key benefits of using the Bybit Futures Combo include the following:

Automatic Rebalancing: Futures Combo keeps your portfolio's target allocations in check without the need for constant monitoring.

Diversification: Users can create portfolios of two to 10 Futures contracts with customizable allocation ratios.

Enhanced Efficiency: Futures Combo reduces the manual workload on traders by automating complex trading strategies.

Flexibility for Various Strategies: Adapts your trading approach to different market conditions with a wide range of parameters, such as contract selections, position directions, leverage and rebalancing settings.

AI-Powered Optimization: Optionally, traders can use AI-driven strategies to enhance decision-making, based on historical data and projected market movements.

How to Get Started With Bybit Futures Combo

Now that you know more about Bybit Futures Combo, let’s explore how to get started with it. Before proceeding with Futures Combo, ensure you have an active Bybit account. If you haven't set one up yet, sign up for a Bybit account and refer to our registration guide for more details.

How to Create a Futures Combo Bot

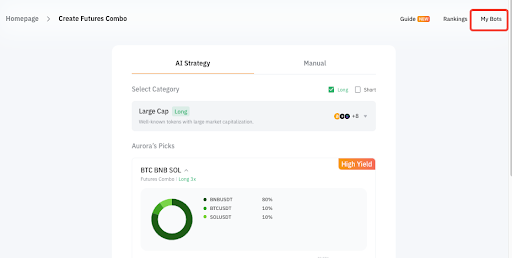

Creating an AI Strategy

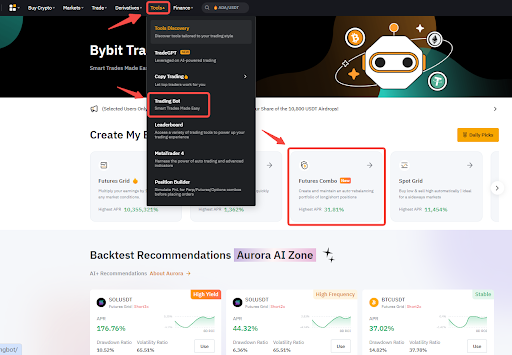

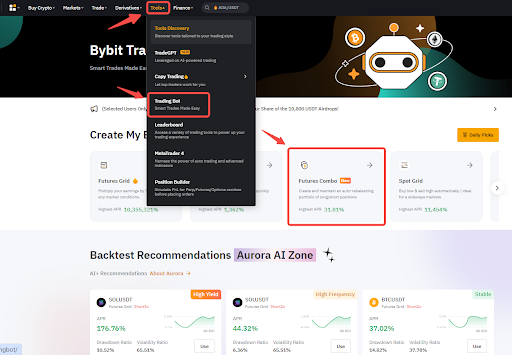

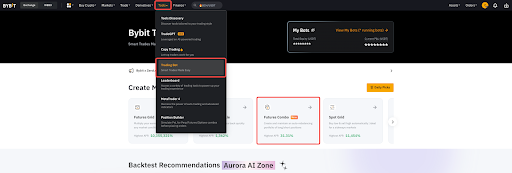

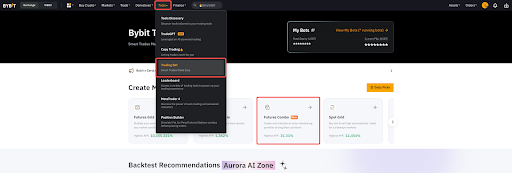

Step 1: Log in to your Bybit account and hover your cursor over the Tool tab on the navigation bar at the top of the page. Then, click on Trading Bot.

Step 2: Click on Futures Combo.

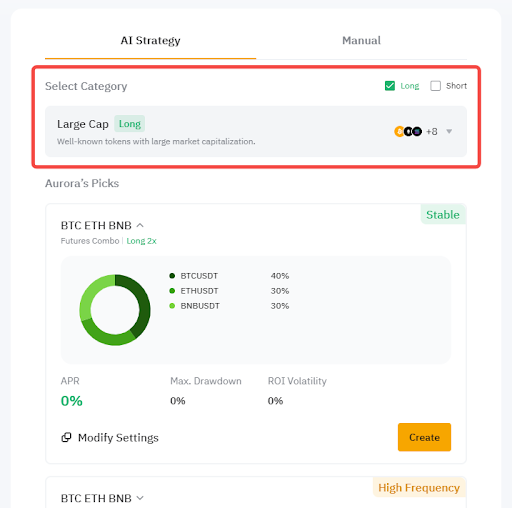

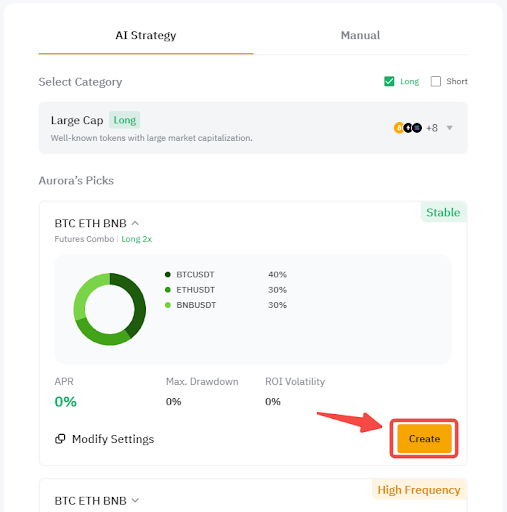

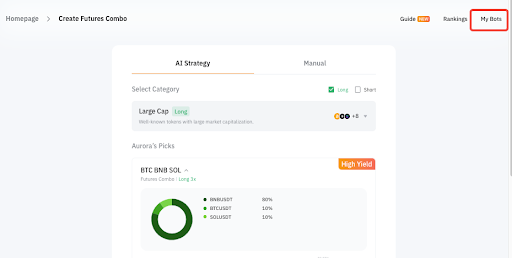

Step 3: Under AI Strategy, check your trading direction (long, short or both) and the category of contracts you wish to trade from the drop-down list.

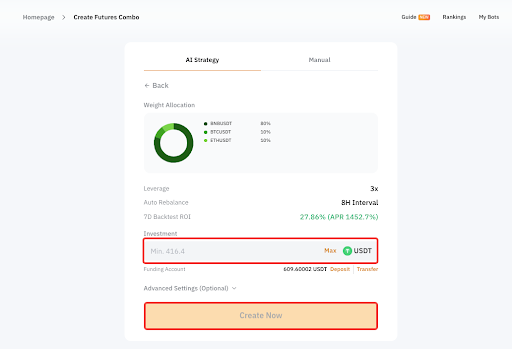

Step 4: Select your strategy based on the AI recommendations (Aurora’s Picks), and click on Create.

Step 5: Input the amount you would like to invest, and click on Create Now.

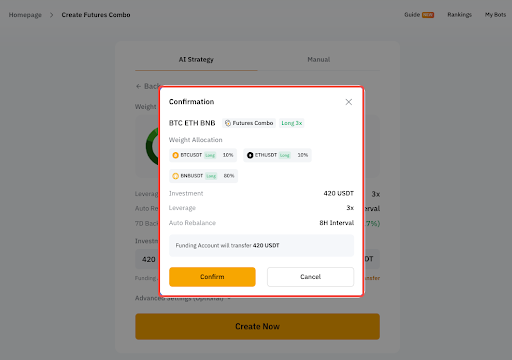

Step 6: Make sure that the Futures Combo bot details are correct. Then, click on Confirm.

Your Futures Combo bot has been successfully created.

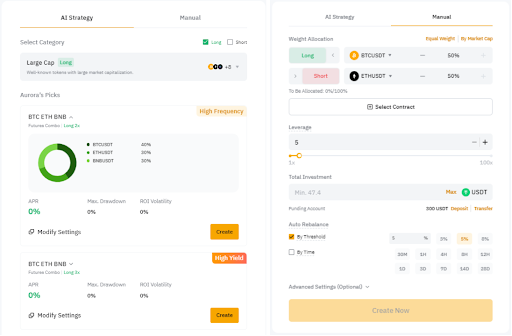

Creating a Manual Strategy

Step 1: Log in to your Bybit account and hover your cursor over the Tool tab on the navigation bar at the top of the page. Then, click on Trading Bot.

Step 2: Click on Futures Combo.

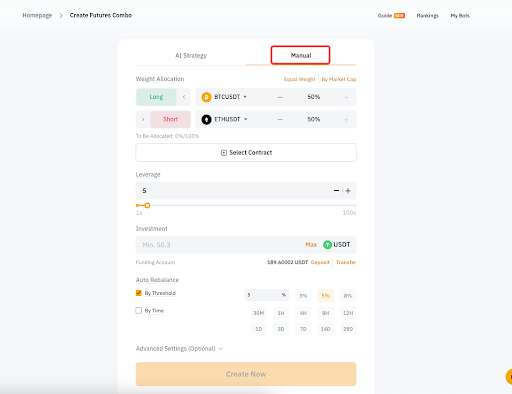

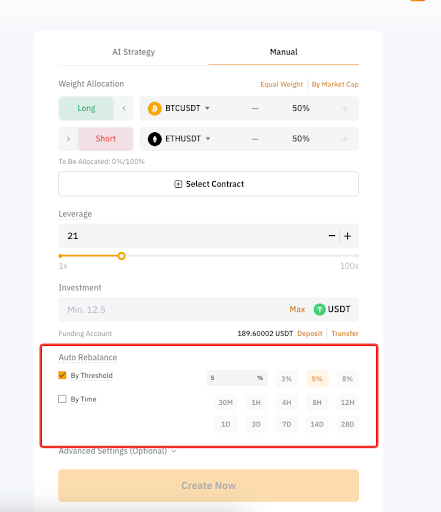

Step 3: Under Manual, add the contracts you wish to trade, and allocate a proportion to each contract. Choose your trading direction by sliding the Long/Short bar. You may also choose to allocate an equal percentage to all contracts by clicking on Equal Weight, or a weighted proportion based on each coin’s market cap by clicking on By Market Cap.

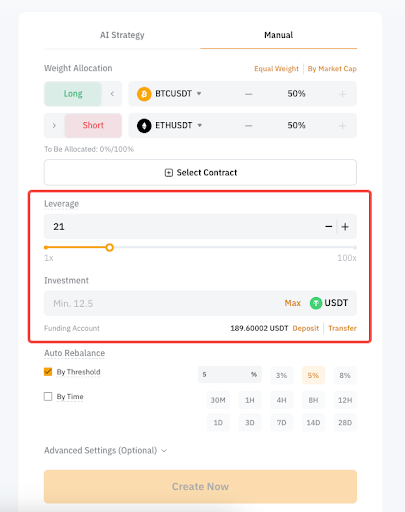

Step 4: Enter your preferred Leverage or slide along the slider. Then, input the amount you would like to invest.

Step 5: Configure the rebalancing mechanism by selecting By Threshold, By Time or both.

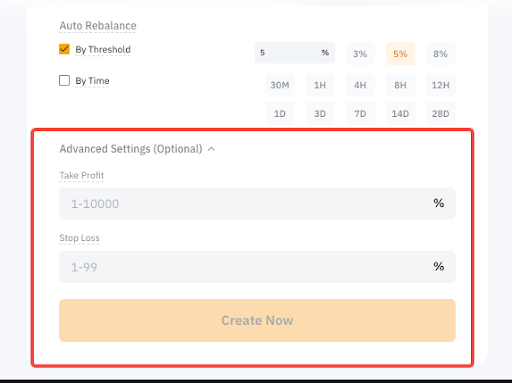

Step 6 (Optional): You may choose to enter a percentage of the total investment as the trigger condition for Take Profit and Stop Loss. Once all parameters have been entered, click on Create Now.

You have now successfully created a manual strategy for your Futures Combo bot.

How to Terminate a Futures Combo Bot

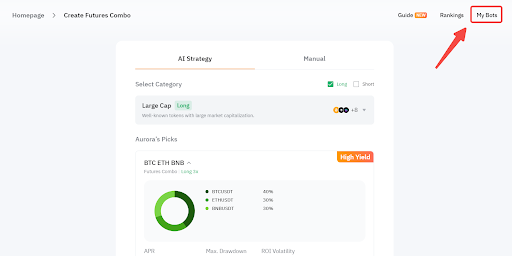

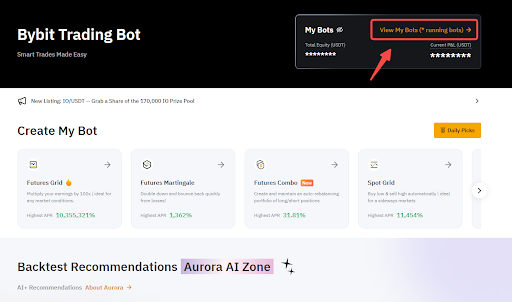

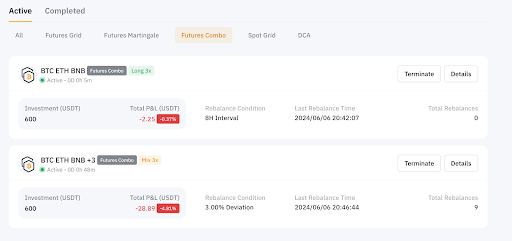

Step 1: Navigate to the Futures Combo page and click on My Bots in the top right corner.

Alternatively, you can also navigate to the Trading Bot homepage and click on View My Bots, followed by Futures Combo.

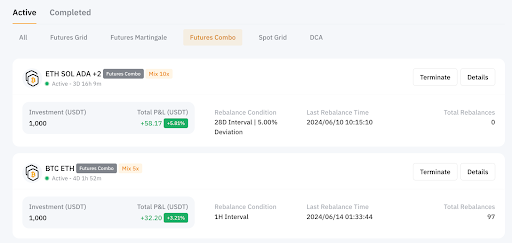

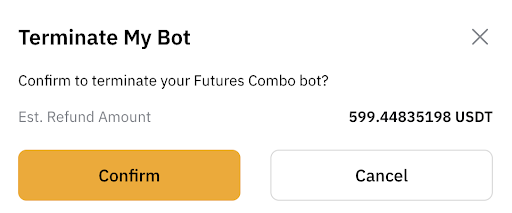

Step 2: Under the Futures Combo tab, click on the corresponding Terminate button of the bot you would like to terminate.

Step 3: Click on Confirm.

Alternatively, your Futures Combo bot will be terminated once the TP/SL condition is triggered, or if liquidation occurs.

How to View an Active/Completed Futures Combo Bot

Active Bots

Step 1: Navigate to the Futures Combo page and click on My Bots in the top right corner.

Alternatively, you can also navigate to the Trading Bot homepage and click on View My Bots,followed by Futures Combo.

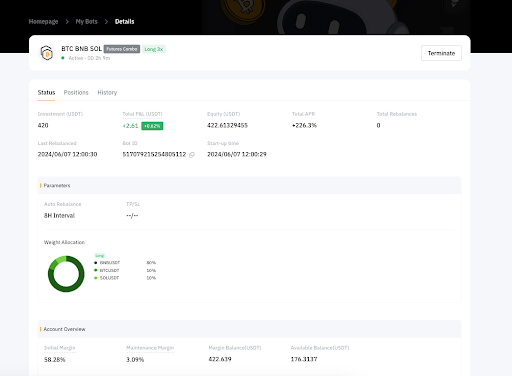

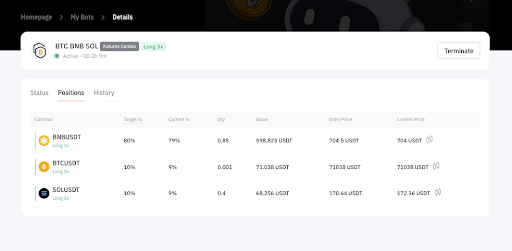

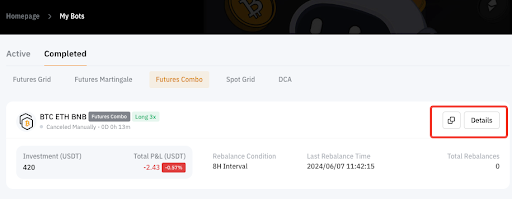

Step 2: View the status of your active Futures Combo bots under the Active and Futures Combo tabs. Click on Details to enter the Bot Details page.

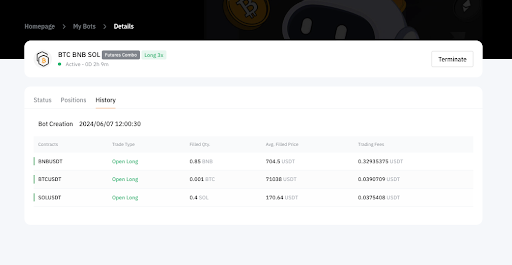

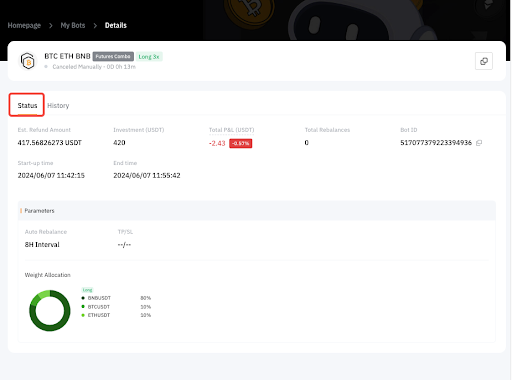

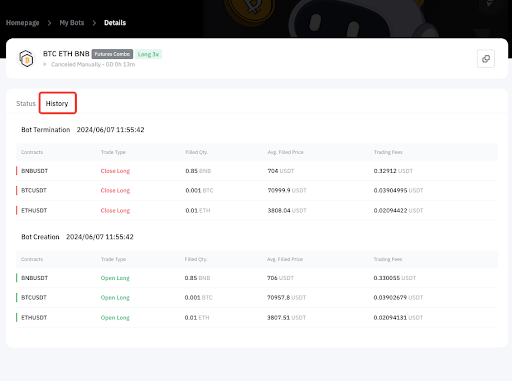

Step 3: Under Status, you’ll be able to view the bot’s performance. Click on Positions to view the contract positions in this Futures Combo portfolio, or click on History to review the rebalancing details in the previous rounds.

Completed Bots

Step 1: Navigate to the Futures Combo page and click on My Bots in the top right corner.

Alternatively, you can also navigate to the Trading Bot homepage and click on View My Bots, followed by Futures Combo.

Step 2: View the status of your completed Futures Combo bots under the Completed and Futures Combo tabs. Click on Details to enter the Bot Details page. Alternatively, you can click on the copy icon to replicate the parameters of this strategy in order to create a new Futures Combo bot.

Step 3: On the Bot Details page, you can click on Status to view the detailed performance of your completed bots, and on History to view the previous rebalancing rounds.

Should You Use Bybit Futures Combo?

Whether or not you should use Bybit Futures Combo hinges on your trading needs and preferences. Futures Combo automates portfolio rebalancing, maintaining desired asset distributions regardless of market changes, which streamlines operations and aids in handling complex strategies efficiently. This tool also promotes risk reduction through portfolio diversification, and offers customizable settings for tailored trading approaches. Furthermore, AI-driven optimization features are available to enhance your portfolio performance.

However, users are urged to do their own research and approach every investment with caution. Automated tools can react unexpectedly in volatile markets, and may not always align perfectly with personal trading strategies. It’s vital to maintain an understanding of the bot's settings and adjust them as needed. Regular monitoring and adaptation in response to market conditions are recommended to ensure that the bot's actions are in line with your trading objectives.

The Bottom Line

Bybit Futures Combo is not only a powerful tool for enhancing trading effectiveness, but also a pioneering first in the industry that’s setting a new standard for automated trading solutions. Its ability to automate complex portfolio management tasks allows traders to maximize their market engagement without the constant need for manual adjustment. This feature positions Bybit at the forefront of trading technology innovation, offering traders an unmatched tool to navigate the often volatile and unpredictable cryptocurrency market. As such, Bybit Futures Combo represents a significant advancement in trading technology, providing both novice and experienced traders with sophisticated means to optimize their trading strategies efficiently.

#LearnWithBybit