8 Key Benefits of Upgrading to Bybit’s Unified Trading Account

Until recently, you may have been juggling multiple Bybit accounts to trade Spot, Derivatives and USDC Options. The launch of the Bybit Unified Trading Account (UTA) gives traders a powerful option to combine trading and cross-collateral margining under one single account.

Designed to simplify the trading experience for all users, from retail traders to professional institutional investors, the UTA supports one-click access to all Bybit core trading products — Spot, Spot Margin, USDT Perpetual, USDC Perpetual, USDC Options and USDC Futures.

This all-in-one solution streamlines the trading experience, offering a range of benefits that cater to both novice and seasoned traders. Read on to explore eight compelling reasons to make the switch to Bybit's UTA.

Key Takeaways:

The Bybit Unified Trading Account is designed to simplify the trading experience for all users. It supports one-click access to all of Bybit’s core trading products — Spot, USDT Perpetual, USDC Perpetual and USDC Options.

Some of the benefits of upgrading to a Unified Trading Account include exclusive access to various tools, such as Perpetual Protect, for enhanced security; optimized account risk calculations using maintenance margin rates; hands-on experience with demo trading; and a seamless repayment process for borrowed assets that features interest-free options.

Unified Trading Account vs. Standard Account: The Differences

The Standard Account is Bybit’s legacy account option. However, since September 2023, Bybit has begun gradually transitioning new users to the Unified Trading Account.

The Standard Account requires traders to hold specific assets for specific trading activities. In contrast, the UTA allows traders to use various supported margin assets (as collateral), which are then converted into USD for trading. This means traders don't need the exact settlement coin for a product, enhancing capital utilization and providing more flexibility and efficiency in trading.

The key differences between the two accounts are as follows:

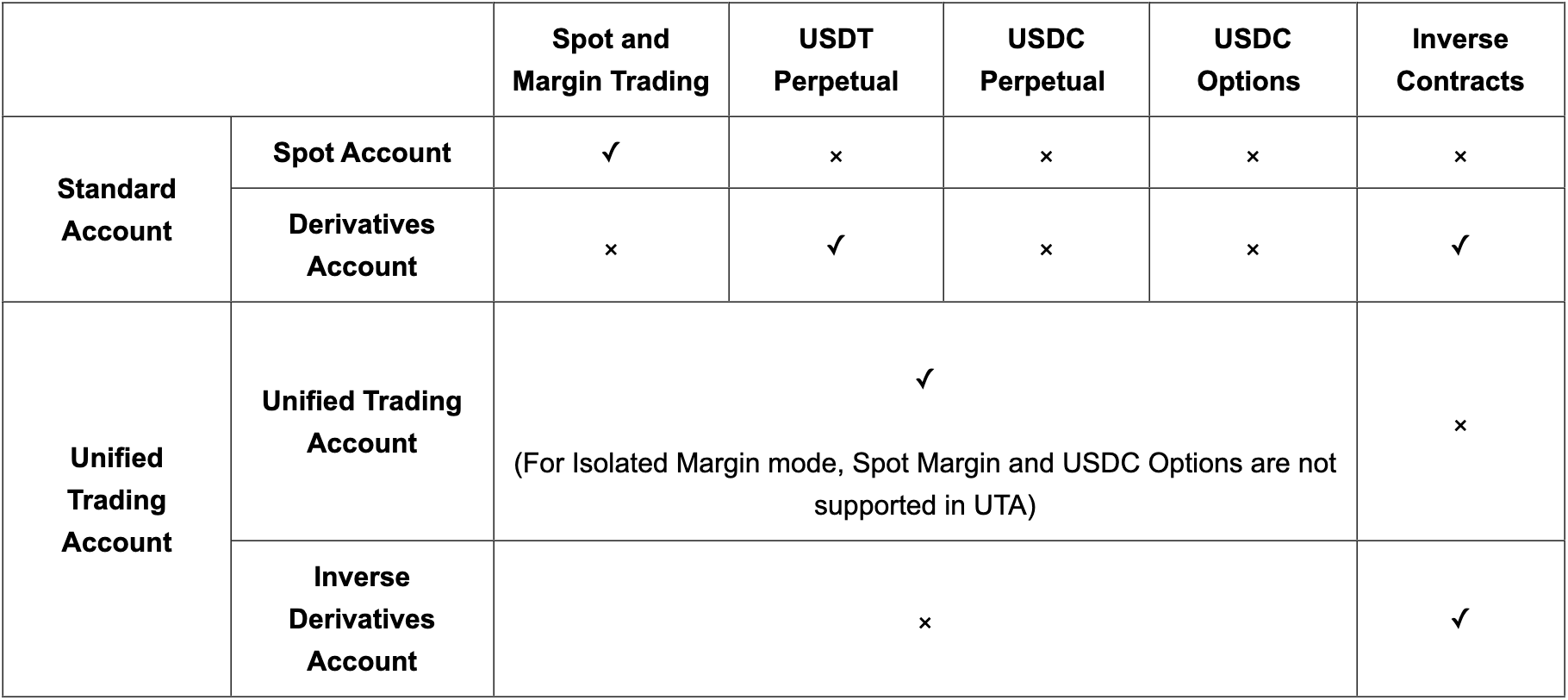

Available Trading Products: The Standard Account offers a segmented approach to trading products. Within the Spot Account, traders can trade Spot, Spot Margin and Leveraged Tokens, and the Derivatives Account supports Inverse Perpetual, Futures and USDT Perpetual contracts. In contrast, the Unified Trading Account supports a wider array of products, including Spot, Spot Margin, Leveraged Tokens, USDT Perpetual/USDC Perpetual/Futures contracts, and USDC Options. Additionally, the UTA's Inverse Derivatives Account is dedicated to Inverse Perpetual & Futures contracts.

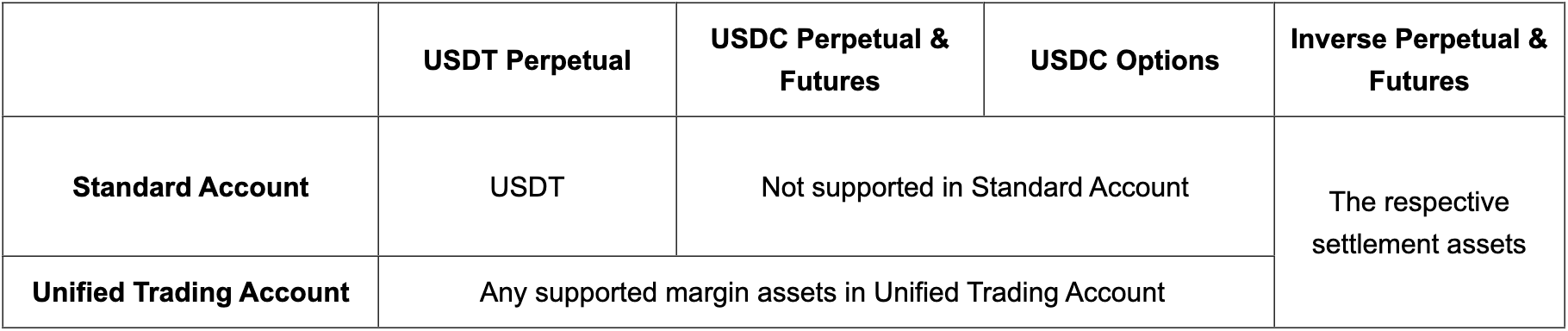

Assets as Collateral: For traders using the Standard Account, the requirement is clear-cut, as they need to possess the specific asset related to their desired trading product. For instance, USDT is required for USDT Perpetual contracts, and specific settlement assets are needed for other trades. The UTA, however, introduces more flexibility. Traders can use any of the supported margin assets within the UTA as collateral, eliminating the need for exact asset matching.

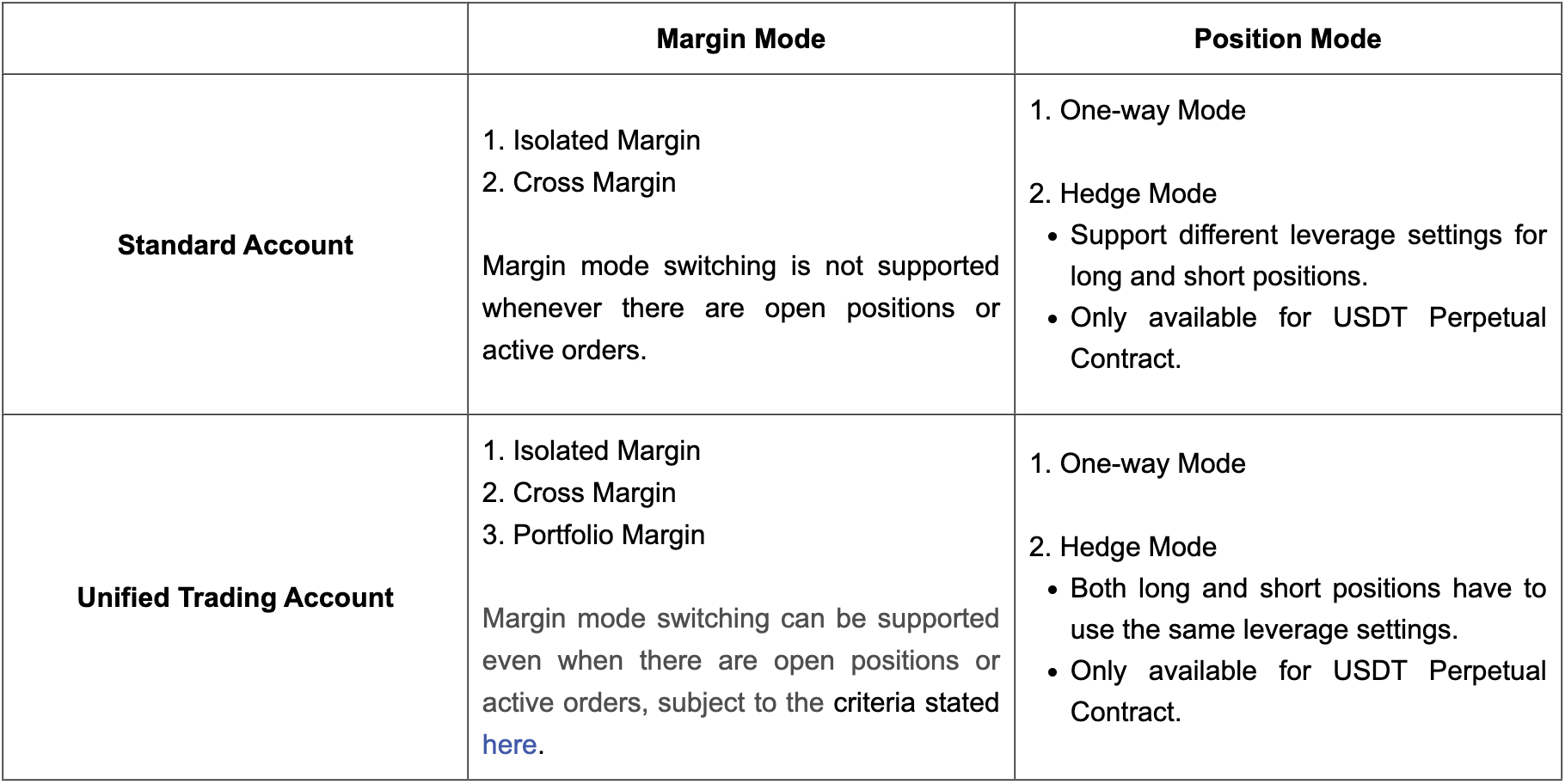

Position and Margin Modes: The margin system in the Standard Account is more rigid. It offers two modes: Isolated Margin and Cross Margin. However, switching between these modes isn't supported if there are open positions or active orders. The UTA, on the other hand, is more adaptable. It not only supports Isolated and Cross Margin but also introduces Portfolio Margin mode. Moreover, the UTA allows you to switch margin modes even with open positions or active orders, as long as certain criteria are met.

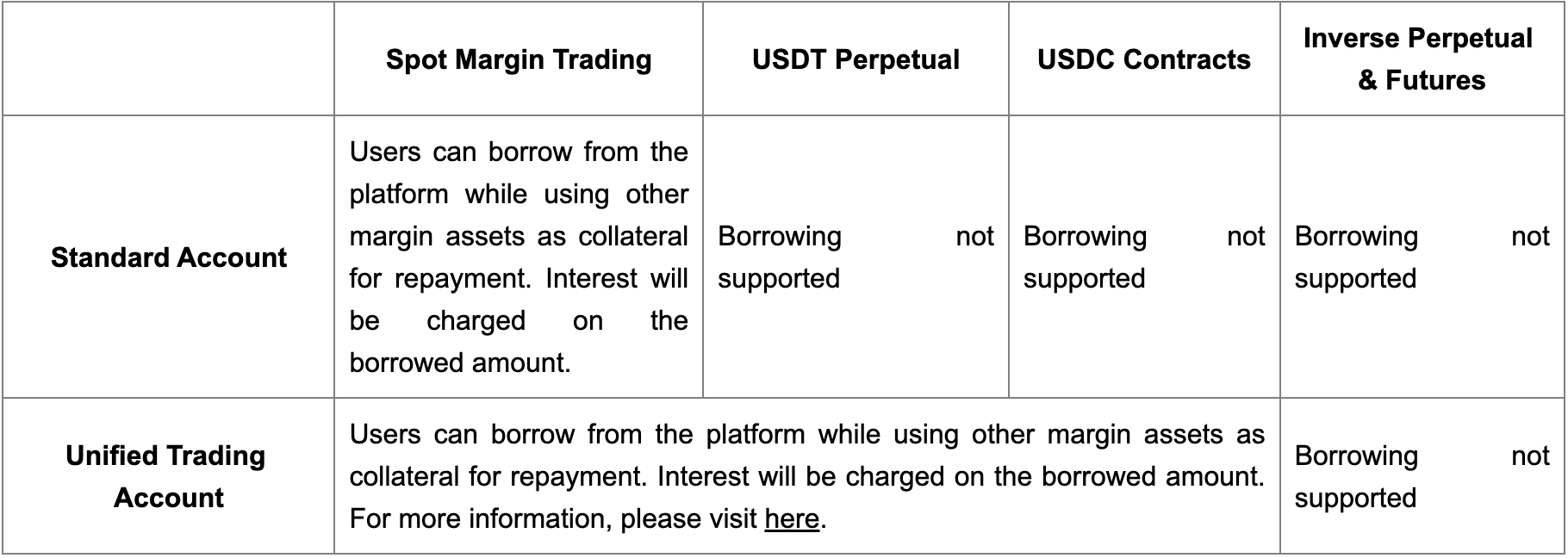

Borrowing and Interest: The Standard Account allows users to borrow from the platform by using other margin assets as collateral. Interest is then charged on this borrowed amount. This borrowing feature is available for Spot Margin trading, but not for other products, such as USDT Perpetual or Inverse Perpetual & Futures. The UTA retains this borrowing feature for Spot Margin trading and extends the same conditions, with interest charged on the borrowed sum.

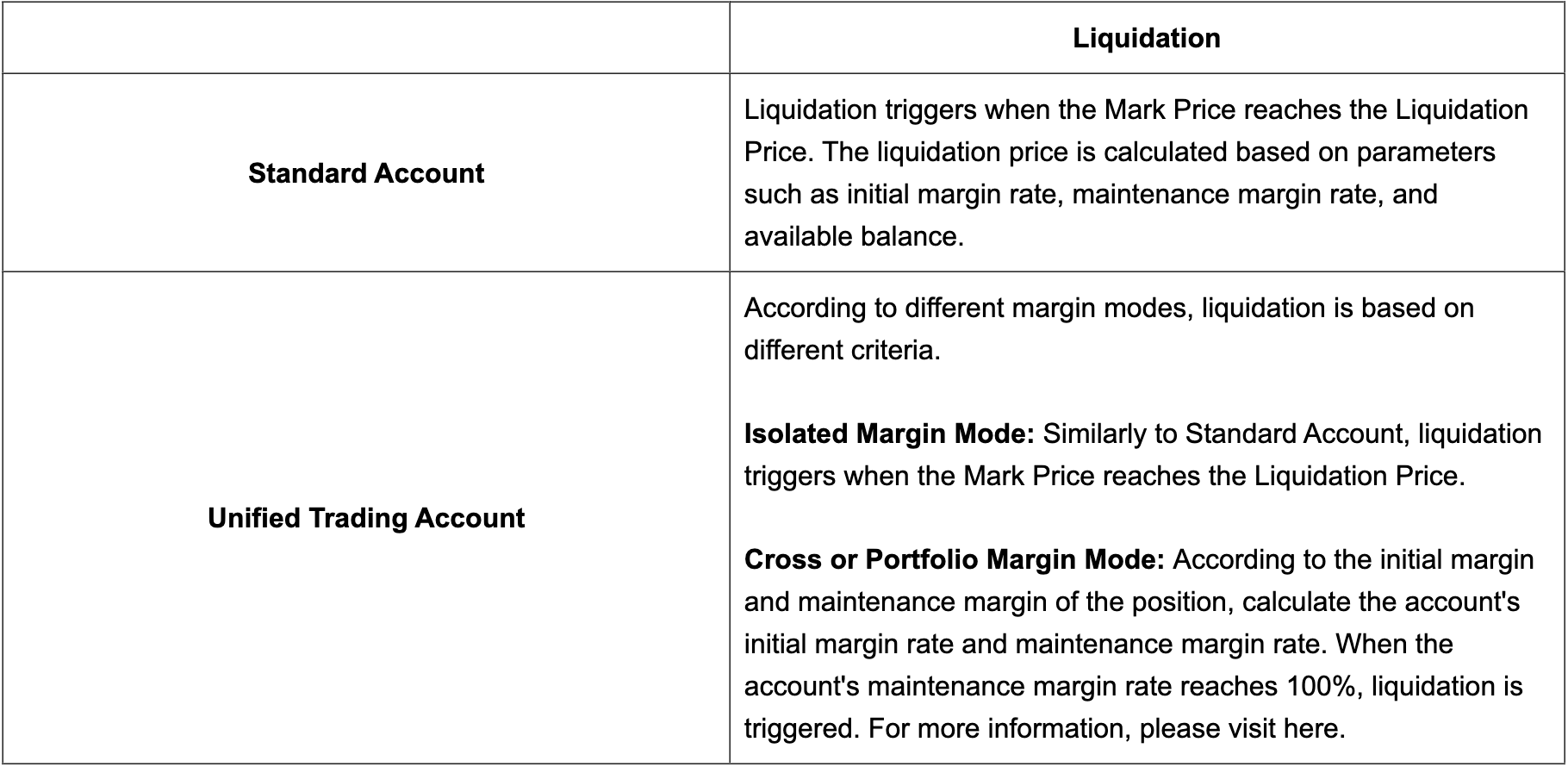

Risk Management: In terms of liquidation, the Standard Account has a straightforward mechanism. Liquidation is initiated when the Mark Price hits the Liquidation Price, which is determined by factors including initial margin rate, maintenance margin rate (MMR) and available balance. The UTA, however, varies its liquidation criteria based on the margin mode. For Isolated Margin mode, it follows a similar approach to the Standard Account, but for Cross or Portfolio Margin mode, liquidation considerations include the account's initial and maintenance margin rates.

Note: We recommend users upgrade their sub-account to UTA before converting their main account, as the function is not reversible.

Benefits of Upgrading Simple Mode to UTA

Aside from the operational convenience of combining all trading instruments into a single account, Unified Trading Accounts offer users several key trading benefits.

Simple Asset Management

The Bybit Unified Trading Account consolidates your trading activities, eliminating the need to juggle multiple accounts. With a single account, you can seamlessly trade Spot, USDT Perpetual, USDC Perpetual and USDC Options without having to transfer funds to multiple accounts for different product transactions. This unified approach simplifies asset management, letting you focus on trading strategies rather than account logistics.

Supports Three Margin Modes

Different traders have individual risk appetites and strategies. For this reason, the Bybit Unified Trading Account offers three margin modes to cater to every trader profile.

Isolated Margin: Ideal for traders who prefer individual margin calculations for positions and active orders.

Cross Margin: Preferred by those who use multiple margin assets as collateral.

Portfolio Margin:Designed for traders who want fully hedged positions across Derivatives products.

An innovative aspect of UTA is its support for Spot Hedging within the Portfolio Margin mode. This feature allows traders to include Spot holdings as part of their account equity, and to benefit from margin reductions due to the hedging of Derivatives positions with Spot risks. This advantage stems from the often-similar price movements of Spot and Derivatives products within the same cryptocurrency, whereby the risk of price divergence is typically lower than holding Derivatives alone.

For example, consider a scenario in which a user operates under the UTA Portfolio Margin mode with a wallet balance of 50,000 USDT and holds the following Derivatives positions (assuming for simplicity that USDC, USDT and USD are equivalent, and disregarding transaction costs):

Contract

Quantity

Entry Price

Mark Price

Maintenance Margin

Unrealized P&L

BTCUSDT

−1

40,000

44,000

6,732

−4,000

In this situation, without any hedging, the user faces a potential maximum loss of 6,600 USDT and a Futures contingency risk of 132 USDT, resulting in a maintenance margin requirement of 6,732 USDT. However, if the user decides to engage in a funding rate arbitrage by exchanging 44,000 USDT for +1 BTC, this creates a hedged position with the −1 BTCUSDT Perpetual contract. In this hedged scenario, the Perpetual contract’s loss is offset by the Spot position, significantly reducing the maintenance margin to only the Futures contingency risk of 132 USDT.

Open Positions With Unrealized Profit

The UTA enhances capital efficiency by allowing traders to use unrealized profits to open new positions. This means that even if a position hasn't been closed, its unrealized gains can be leveraged for new trades.

For example, let’s assume that a user holds 3,000 USDT in their wallet and has three open positions:

| Quantity | Entry Price | Mark Price | Initial Margin | Unrealized P&L |

BTCUSDT | 4 | 25,000 | 25,000 | 1,000 | 0 |

ETHUSDT | −20 | 1,600 | 1,600 | 320 | 0 |

AVAXUSDT | 200 | 10 | 10 | 20 | 0 |

At this time, their available USDT balance to open new positions is as follows:

Available Balance = Wallet Balance (3,000 USDT) + Perp & Future Unrealized P&L (0 USDT) − Total Initial Margin (1,340 USDT) = 1,660 USDT

As the price fluctuates, there will be changes in their P&L:

| Quantity | Entry Price | Mark Price | Initial Margin | Unrealized P&L |

BTCUSDT | 4 | 25,000 | 26,000 | 1,000 | 4,000 |

ETHUSDT | −20 | 1,600 | 1,650 | 320 | −1,000 |

AVAXUSDT | 200 | 10 | 7 | 20 | -600 |

At this time, their available USDT balance to open new positions is as follows:

Available Balance = Wallet Balance (3,000 USDT) + Perp & Future Unrealized P&L (2,400 USDT) − Total Initial Margin (1,340 USDT) = 4,060 USDT

Over 80 Popular Assets Available as Collateral

With support for more than 80 popular assets as collateral, the Bybit Unified Trading Account ensures that traders don't miss out on opportunities. This feature also supports collateral asset customization, ensuring that trading activities are secured without the need to sell settlement assets.

Perpetual (Perp) Protect

Perp Protect is a unique feature exclusive to the Unified Trading Account. It's designed to enhance the security of your Perpetual contracts, and uses Options based on intelligent recommendations to shield your Perpetual contracts from potential risks.

Imagine you're trading in a highly volatile market, and are concerned about sudden price drops. Perp Protect can automatically buy Options for you based on smart algorithms, ensuring that your Perpetual contracts are safeguarded against unexpected downturns. This tool acts as an industry-first downside protection, ensuring that traders can operate with an added layer of security.

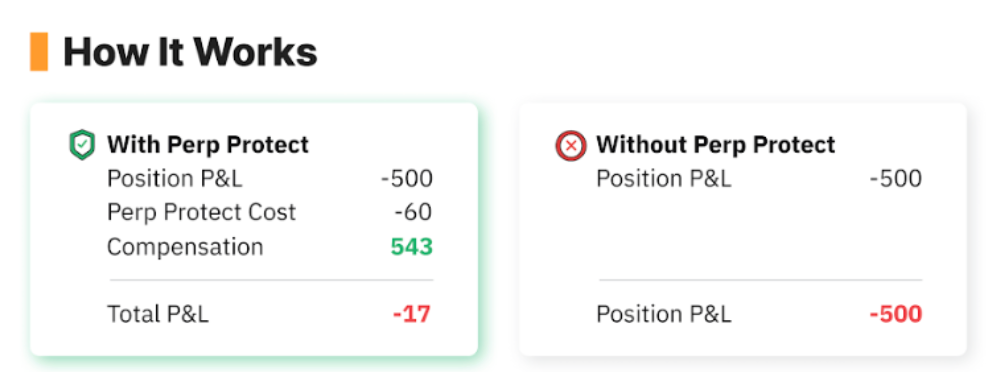

As an illustration of using Perp Protect, let’s say that you’ve encountered a trading position loss of $500. After choosing to use Perp Protect, you’d incur a cost of $60. However, the silver lining comes in the form of a compensation amounting to $543, courtesy of Perp Protect. When you factor in the cost of Perp Protect and the received compensation, you’re left with a significantly reduced total loss of just $17.

On the other hand, if you decide to navigate the markets without Perp Protect and find yourself in a similar situation with a loss of $500, that loss remains as is, without any compensation or mitigation.

Optimized Account Risk Calculation

The Bybit Unified Trading Account introduces an optimized way to calculate and monitor account risks, using the MMR to keep a closer eye on potential liquidation risks.

Let's say you're a trader who's always on the lookout for potential liquidation threats. With UTA, instead of constantly calculating and recalculating your risks the system uses the MMR to give you real-time insights into your liquidation risks. This means you can make informed decisions faster and with more accuracy.

Trial Experience With Demo Trading

For those new to the Bybit Unified Trading Account, or for users who want to test its features without any real-world risks, the UTA offers a Demo Trading mode. This simulates a real-world trading environment, allowing users to get a feel for how the Unified Trading Account operates.

Imagine you're a newbie to the world of crypto trading. Instead of diving headfirst into the market with real funds, you can use Bybit’s Demo Trading feature, which will provide you with more than $130,000 in simulated funds. This allows you to practice and understand the nuances of trading within the UTA environment. It's like a sandbox mode that lets you learn, make mistakes and refine your strategies without any financial repercussions.

Seamless Repayment Process for Borrowed Assets

The Bybit Unified Trading Account simplifies the process of repaying borrowed assets. With its efficient auto borrowing feature, traders can open trades without any interest (this is applicable only to USDT and USDC loans within the interest-free range). Additionally, the UTA offers flexibility in choosing which assets to use for repayment.

Suppose you've borrowed some USDT for trading, and now it's time to repay. Instead of going through a lengthy repayment process, the UTA supports interest-free auto borrowing, which means you can quickly and seamlessly repay your borrowed amount without incurring extra costs.

Furthermore, if you have multiple assets in your account, you can choose which one to use for repayment, giving you more control over your finances.

How to Upgrade to Bybit UTA

Upgrading to a Unified Trading Account is quick and easy. Simply follow our step-by-step guide below.

Before you start your upgrade:

Ensure there are no active orders in your Spot, Derivatives or USDC Account.

Ensure that you’re not participating in any trading competitions.

Clear any liabilities in your Spot Account.

Please note that the upgrade to the Bybit Unified Trading Account is irreversible.

To Upgrade to UTA:

Click on Upgrade to Unified Trading Account.

Your account will take approximately one minute to finish upgrading. While the upgrade is underway, please avoid trading or transferring assets.

After the upgrade is complete, you’ll be able to use your Unified Trading Account to trade Spot (including Margin), Leveraged Tokens, USDT Perpetual, USDC Perpetual and Options. You’ll also be able to use your Inverse Derivatives Account to trade Inverse Contracts. The function of the Funding Account will remain unchanged, and you’ll be able to make deposits or withdrawals via your Funding Account.

Before you start trading, make sure you've read and understood the risk management and trading requirements. After the upgrade, you can celebrate having more efficient capital utilization, enhanced risk management, and one-click access to a wider range of trading products.

The Bottom Line

More than just a trading account, the Bybit Unified Trading Account is a comprehensive trading solution. By consolidating multiple features and tools into one platform, Bybit gives you everything you need at your fingertips. Whether you're a seasoned trader or just starting out, the UTA offers a range of benefits that can enhance your trading experience. Upgrade today and discover the future of crypto trading!

#Bybit #TheCryptoArk