How to Use Bybit to Navigate Through Yen Depreciation and Low Interest Rates

In the current economic climate, with Japanese interest rates remaining low and the yen experiencing prolonged depreciation against the U.S. dollar, many investors are seeking more effective asset management strategies to combat inflation and currency weakness. In this article, we explore how utilizing Bybit’s USDT Savings plan can provide a solution, offering high yields and other benefits that can help shield investors from the impacts of yen depreciation.

Key Takeaways:

Bybit's USDT Savings plan provides investors with a robust solution to grow their portfolios against the backdrop of a weakening yen and persistently low interest rates.

Supported by Bybit Loan, the USDT Savings plan offers an annual percentage rate ranging between 6% and 8%, in stark contrast to the typical annual yield of less than 0.1% from Japanese bank deposits, highlighting the plan’s competitive advantage.

Background

The Japanese yen has continued to depreciate, reaching a 34-year low in 2024. This persistent weakening can be largely attributed to Japan’s monetary policy, which has focused on prolonged quantitative easing and maintaining low interest rates.

Unlike Japan, other major economies such as the United States’ have increased rates, making their yields more attractive and contributing to the yen’s decline. Additionally, geopolitical tensions have further undermined the yen, leading to higher prices for imported goods, as well as an increased cost of living in Japan.

Market Metrics

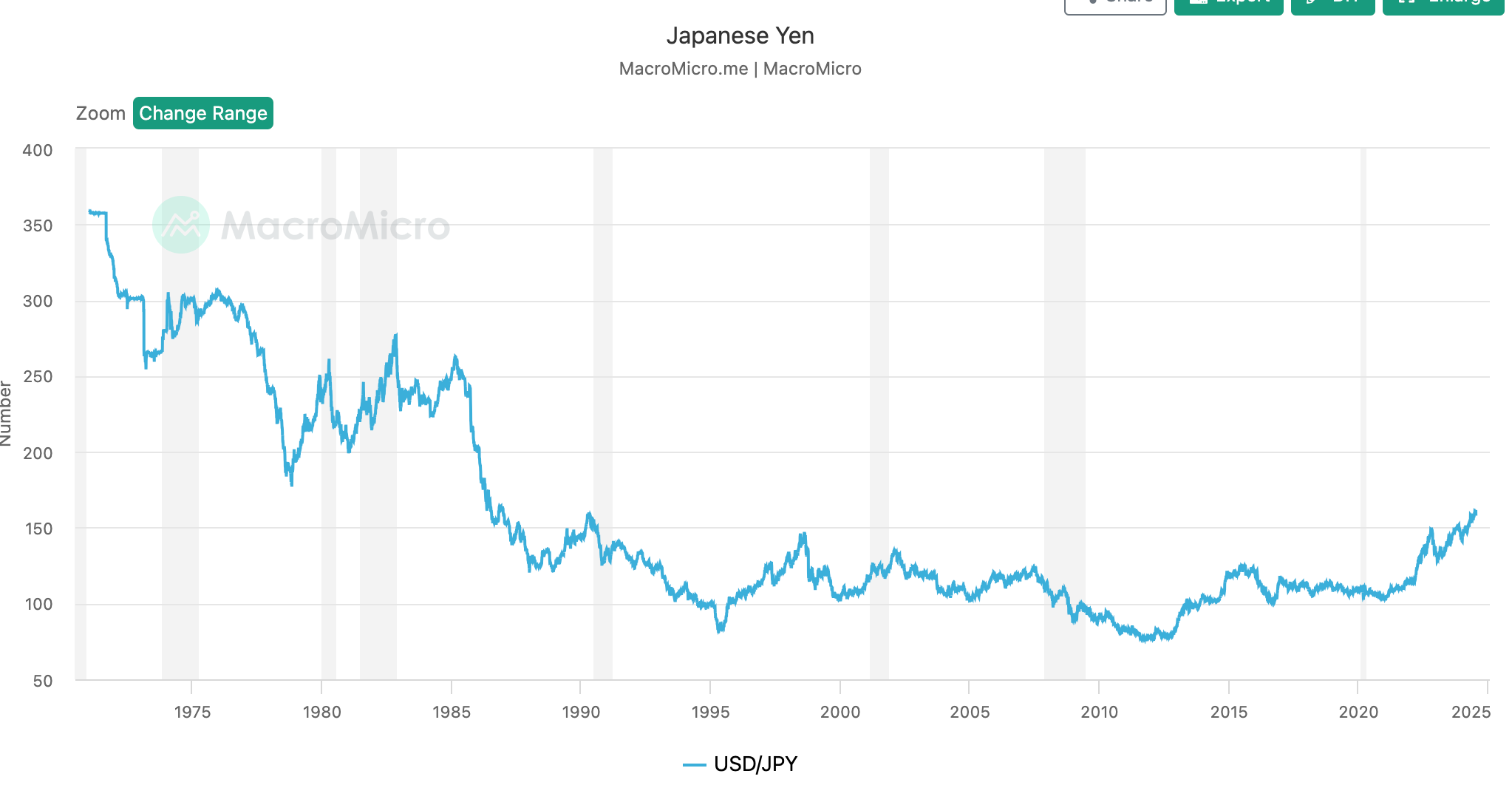

To examine the details, let's look at the chart below, which illustrates the USD/JPY exchange rate. We can see a clear trend of yen depreciation in recent years as the exchange rate climbed. Since 2020, the USD/JPY exchange rate chart has demonstrated a notable depreciation of the Japanese yen against the U.S. dollar, with the result that more yen are needed to purchase a single U.S. dollar as the exchange rate climbs. This depreciation can be attributed to a combination of Japan's continued loose monetary policy and the maintenance of low interest rates to support the domestic economy, in stark contrast to aggressive rate hikes by other major central banks, such as the U.S. Federal Reserve. The significant interest rate differential has encouraged carry trades, further pressuring the yen.

USD/JPY rate. Source: MacroMicro

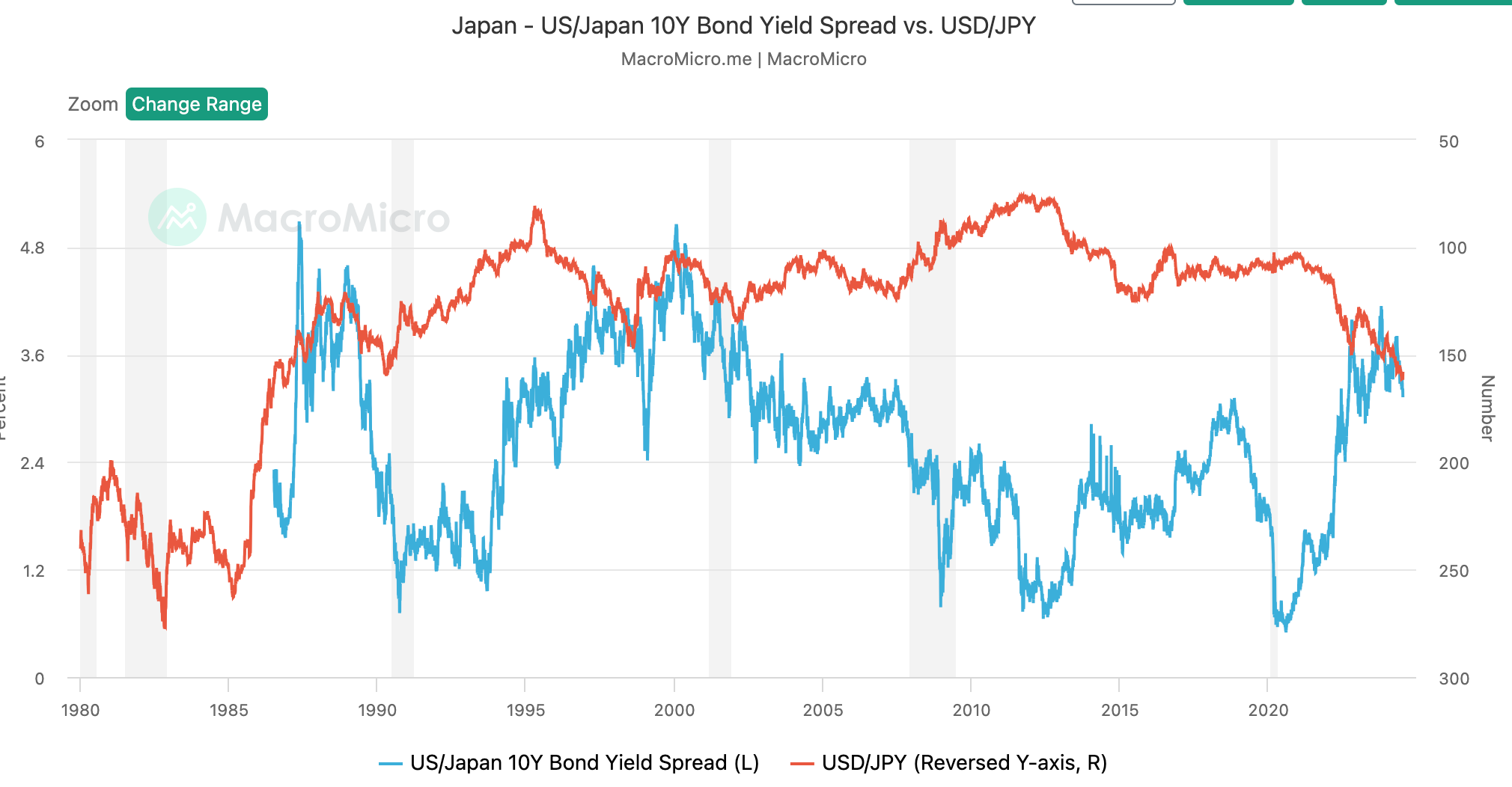

Looking at the chart of the yield spread between the U.S. and Japanese 10-year government bonds, we can see that this spread has been increasing, indicating that U.S. bonds are yielding more relative to Japanese bonds and reflecting the higher interest rates in the U.S. as compared to those in Japan. These higher rates in the U.S. make dollar-denominated assets more attractive to investors, driving demand for U.S. dollars as investors sell yen to purchase dollar-denominated assets — also leading to capital inflows into the U.S. from Japan and contributing to the yen's depreciation.

US/Japan 10Y Bond Yield Spread vs. USD/JPY. Source: MacroMicro

Given these circumstances, it’s crucial for investors to explore products and strategies that can provide stability and growth during economic downturns. Some common strategies include:

Carry Trade: Investors take advantage of the interest rate differentials between Japan and other countries. By borrowing yen at low interest rates and investing in assets with higher returns in other currencies, they can potentially achieve higher yields.

Diversification Into Foreign Assets: With the domestic market offering low returns due to depressed interest rates, investors can diversify their portfolios by buying foreign stocks, bonds and real estate.

Hedging Strategies: Investors can employ financial instruments like options and futures to hedge against currency risk.

However, for some retail investors — who might not be equipped with sufficiently advanced investment knowledge to execute the above methods, or just want to find a simple, yet effective strategy to use — Bybit’s products could offer a solution.

As a leading global cryptocurrency exchange, Bybit offers a compelling solution with its diverse range of products. The Bybit USDT Saving plan, in particular, is designed to cater to users seeking effective ways to combat low yields and currency depreciation, providing a robust option for enhancing asset growth amidst challenging economic conditions.

Bybit’s USDT Savings Plan

Introduced in 2022, Bybit's USDT Savings plan is a yield product supported by Bybit Loan, which has quickly gained popularity for its flexibility and high returns. Current data shows that the APR for Bybit's USDT Savings can range between 6% and 8%. In stark contrast, the typical annual yield from Japanese bank deposits remains below 0.1%.

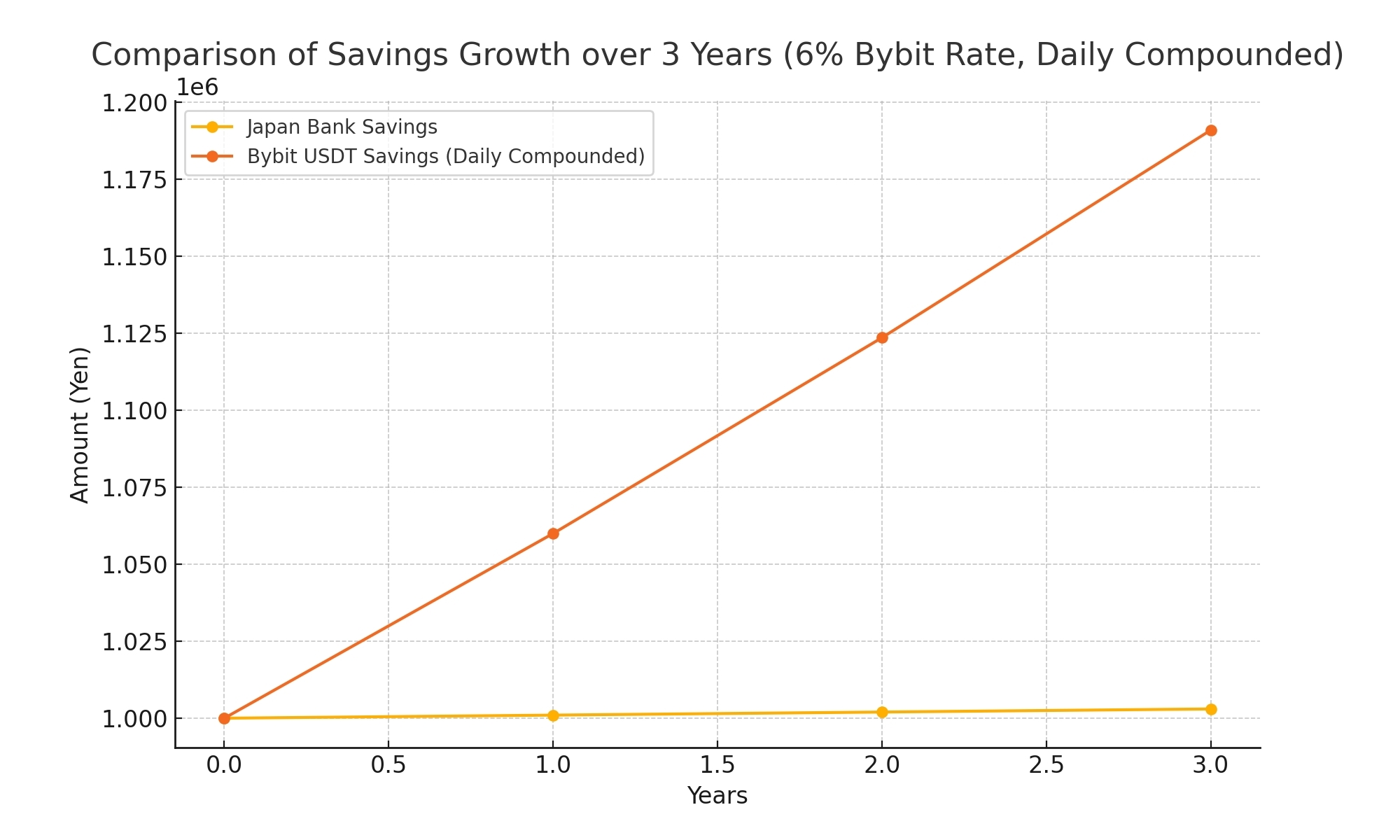

To illustrate the advantages of Bybit's plan, the following figure demonstrates the yield after three years when 1 million yen is deposited into a Japanese bank and into Bybit's USDT Savings account, respectively.

Source: Bybit

When comparing the returns from Japanese bank deposits and Bybit's USDT Savings over a three-year period, the difference in potential earnings is remarkable. Japanese banks offer an annual interest rate of 0.1%, resulting in an interest income of approximately 3,003 yen after three years. In contrast, Bybit's USDT Savings plan, with a 6% annual interest rate compounded daily, can generate about 191,016 yen in the same time frame. This means that Bybit’s USDT Savings yield is about 63.61 times that for a typical Japanese bank account, clearly showcasing the superior potential for growth with Bybit's offerings.

It's important to note that since Bybit's USDT Savings plan is backed by Bybit Loan on the platform, the APR may vary with market dynamics. Consequently, there may be periods when the APR adjusts to between 3% and 5%. Despite this variability, these rates are still substantially higher than the 0.1% typically offered by banks. Additionally, the plan includes other benefits that add value beyond the higher interest rates.

The Benefits of Bybit Saving Plan

High Yield: Bybit's USDT Savings plan provides a significantly higher yield as compared to traditional bank deposits. When compounded, this interest allows users to substantially increase their earnings over an extended period.

Stability: As a stablecoin tied to the U.S. dollar, Tether (USDT) maintains relative stability and effectively mitigates risks associated with exchange rate fluctuations.

Flexibility: Bybit's Savings plans offer users the flexibility to withdraw funds at any time without the need for long-term lock-in, with interest distributed daily. This flexibility allows users to manage and utilize their funds efficiently. Whether leveraging other yield products within Bybit or transferring funds for other purposes, users can perform these actions 24/7 without limitations.

Getting Started with Bybit’s Saving Plan

Account Registration and Verification: To begin your journey with Bybit, the first step is to create your account. Visit Bybit's official website to sign up, then complete your registration with Identity Verification.

Deposit USDT: Fund your Bybit account by depositing USDT via bank transfer, or by depositing crypto assets through your crypto wallet(s).

Earn with USDT Savings Plan: Go to Bybit Earn page, select a USDT Savings Plan and enter your deposit amount. Confirm your details to start earning competitive yields.

Conclusion

Amid the backdrop of a weakening yen and persistently low interest rates, Bybit's USDT Savings plan offers users high yields and protection against currency depreciation. Beyond its high returns, the plan also provides users with the flexibility to manage their assets effectively, capitalizing on the dynamic nature of cryptocurrencies. Consequently, Bybit's USDT Savings plan has emerged as an attractive option within the current economic landscape.

In our next article, we’ll delve into ways to leverage Bybit’s other asset management tools to optimize your investment portfolio. Stay tuned for more insights!

Disclaimer: Investing in cryptocurrencies involves a substantial risk of loss and isn’t suitable for every investor. Prior to making any investment decisions, please ensure you fully understand the risks involved, and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.