Investors Hold Breath Despite Crypto Markets Recoup From Sell-off

TL;DR

Volatility has drastically increased i recent days as BTC prices hit the lowest level in nearly six months on Monday, and ETH traded below $2,500. The decline amidst a backdrop of global risk-off sentiment and growing fears of slowing economic growth worldwide.

Despite the initial rebound in equity, the border crypto market recovered partially from the Monday sell-off as the Crypto Fear & Greed Index remains low, indicating a fear state..

Annualized staking yield of ETH surged as US10Y dipped, sparking renewed interest in locking up ETH to earn rewards amid market uncertainties.

What Is Happening?

Risk appetite has become noticeably lower among traders and investors this week as recent economic data weakness triggered a large scale of unwinds across different asset classes, including crypto. The Volatility Index (VIX) reached over 50 on Monday in the U.S. trading session, the highest level since Covid, before stabilizing in the 22 to 27 area.

Figure 1: VIX daily chart

Source: Tradingview

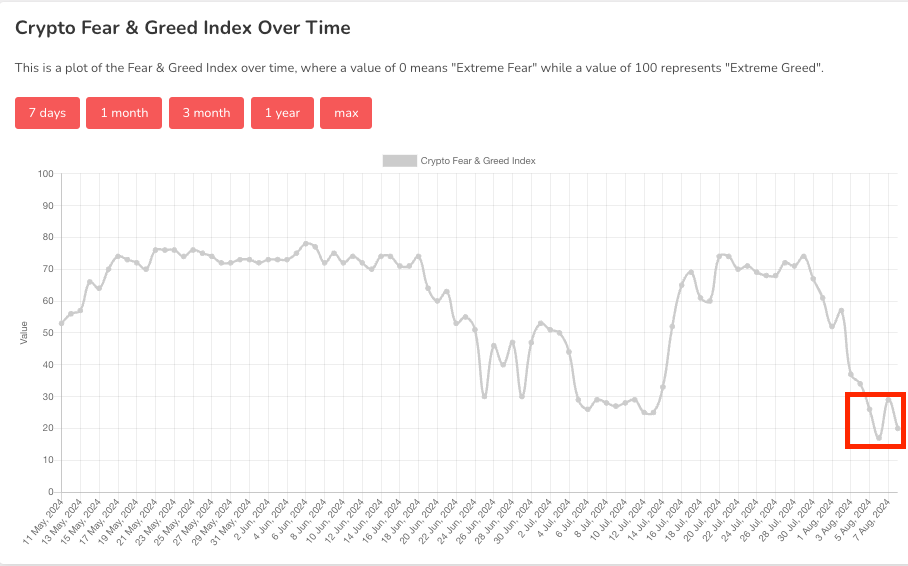

Figure 2: Crypto Fear & Greed Index

Source: Alternative.me

Risk-off was one of the major narratives in the crypto space as well. Crypto Fear & Greed Index, a widely used indicator for measuring investor sentiment in crypto, has touched 17, indicating risk appetite has been extremely low. Despite the index returning to the neutral zone on August 9th, it seems too early to assume normalcy has returned. Chatters among trading communities appear to be ready to embrace more short-term volatility.

Learn more about the Index and how it could affect trading decisions at Bybit Learn.

Major Events and Narratives

Bank of Japan (BoJ): Although the Deputy Governor played down the chance of a near-term rate hike earlier, the sharp recovery of the Japanese equity markets and rapid retreat of the yen could make the rate increase conversations back on the table sooner than expected, and the interpretation of the rates outlook could ripple to the crypto market, especially BTC.

Federal Reserve (Fed): Although there were conversations about an emergency rate cut from the Fed due to market volatility, some economists believe such an action could ignite a new round of panic in the markets. Traders are likely to keep a close eye on the economic data next week, including inflation rates and retail sales. On the other hand, JPMorgan CEO Jamie Dimon said an economic recession in the U.S. remains the most likely scenario in his mind.

ETH: As our analysts highlighted in our Daily Bits, Jump Trading continuing its ETH liquidations could be one of the short-term drivers for the leading alts. Besides, the reactivation of the Plus Token Ponzi-linked wallets also concerns ETH traders.

Revisit Staking at a Time of Uncertainty

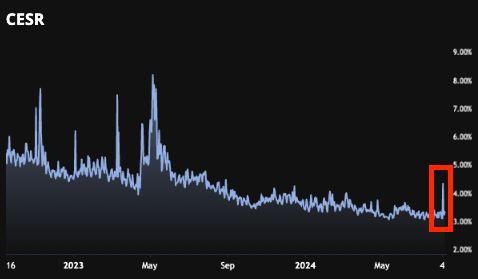

For some users, it could be unbearable when the risk pendulum swings rapidly from one end to the other. At a time of uncertainty, staking could provide lower-risk returns for crypto portfolios, and a recent development in the US10Y could make staking crypto a topic worth revisiting.

When the equity market sell-off happened earlier, the yield of the U.S. 10-year Treasury fell to below 3.8% at one point, marking it the lowest level since late last year. Interestingly, the annualized staking yield of ETH spiked at the height of this shaky market with the Coindesk Ether Staking Rate Composite, which measures the mean annualized percentage rate (APR) of staking ETH, surged to over 4.0%. While it’s arguable to say if that’s a trend reversal, the recent surge could bring back some interest in staking, especially at a time when market volatility could still be a concern.

Figure 3: US10Y Daily

Source: Tradingview

Figure 4: CESR Composite

Source: Coindesk Indices

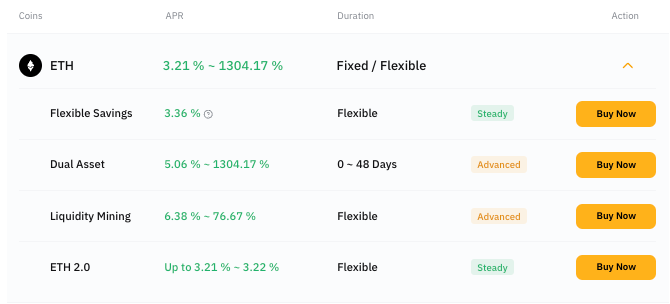

Bybit Earn offers a comprehensive suite of staking products, including Flexible Savings, Liquid Staking of ETH at attractive rates and flexible terms. Learn more about earn products at Bybit Earn.

Figure 5: ETH staking at Bybit Earn

Source: Bybit Earn

Disclaimer

The above calculations and examples are for demonstration purposes only. In order to deliver the message, the examples may simplify potentially complex scenarios, and the yield embedded in the mentioned products can vary over time when entering a contract. The actual performances and yields of these products may differ from the simplified examples provided, as real-world conditions are more dynamic and complex.