How to Utilize Bybit Savings for Safe and Stable Revenue Year by Year

Demand for Passive Income Surge In Crypto

The demand for safe and reliable passive income in the crypto space is rising due to the following:

Market Volatility: Investors are seeking alternatives amid traditional investment uncertainty.

DeFi Growth: Platforms offer lending, staking and yield farming for higher returns.

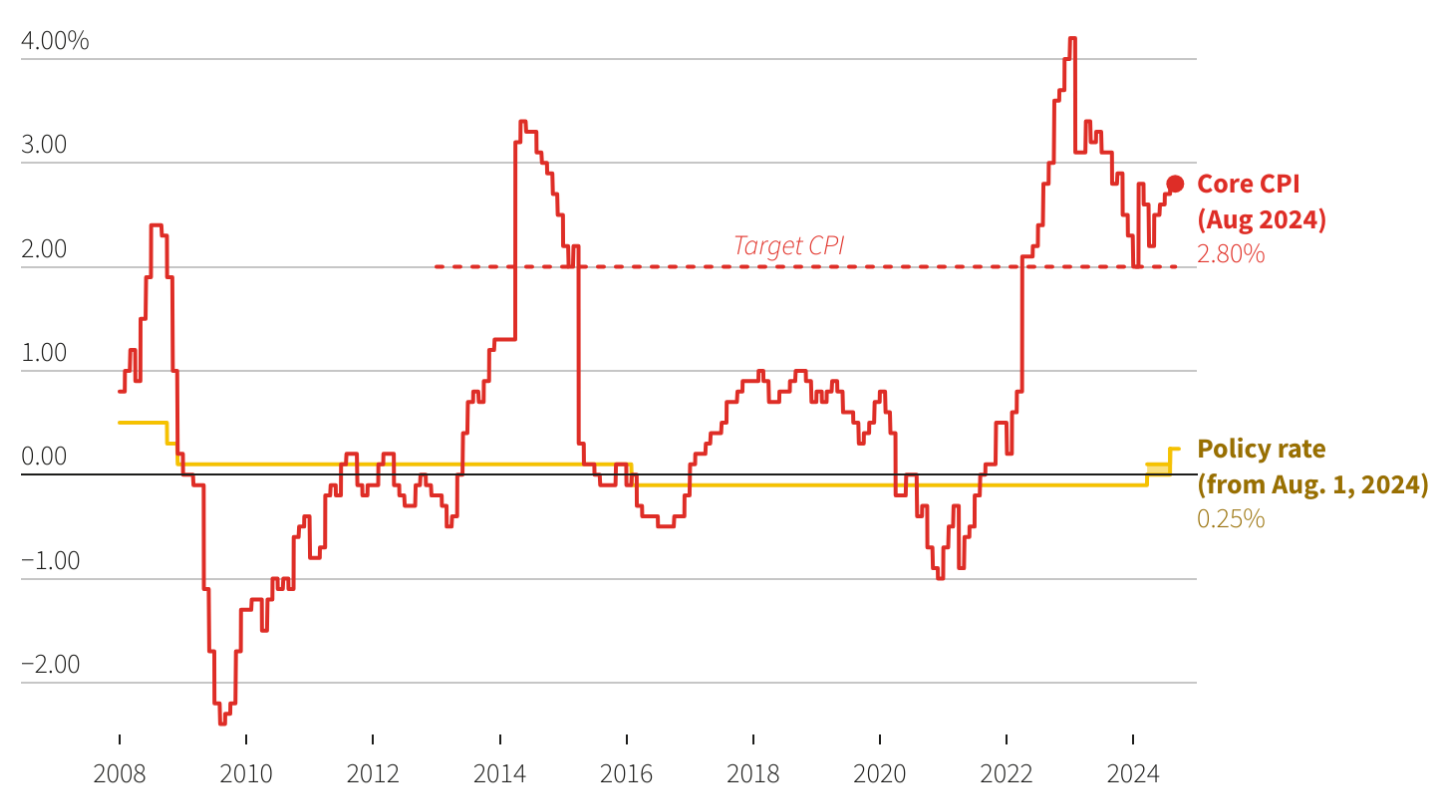

Low Interest Rates: Traditional savings yield minimal returns in some countries such as Japan, pushing investors toward crypto.

Increased Adoption: More individuals and institutions are exploring crypto.

Educational Resources: Improved access to information boosts investor confidence.

As the market matures, the search for dependable passive income options will likely continue to grow. Bybit Savings emerges as a solution for users to obtain passive income easily while sailing through market volatility.

Countries like Japan continue to experience low interest rates as compared to others. Fixed deposits in yen yield only 0.25%, prompting investors to seek higher returns to combat inflation.

What Is Bybit Savings?

Bybit Savings is an investment product on Bybit Earn that offers both flexible and fixed product terms with competitive and guaranteed APRs. The product supports BTC, ETH, USDT and other popular coins.

Users can choose fixed-rate products with Bybit Savings, further reducing their exposure to interest rate volatilities.

Compared to the 0.25% interest rate offered in the Japanese yen (central bank rates), Bybit Savings offers a much higher APR with greater stability.

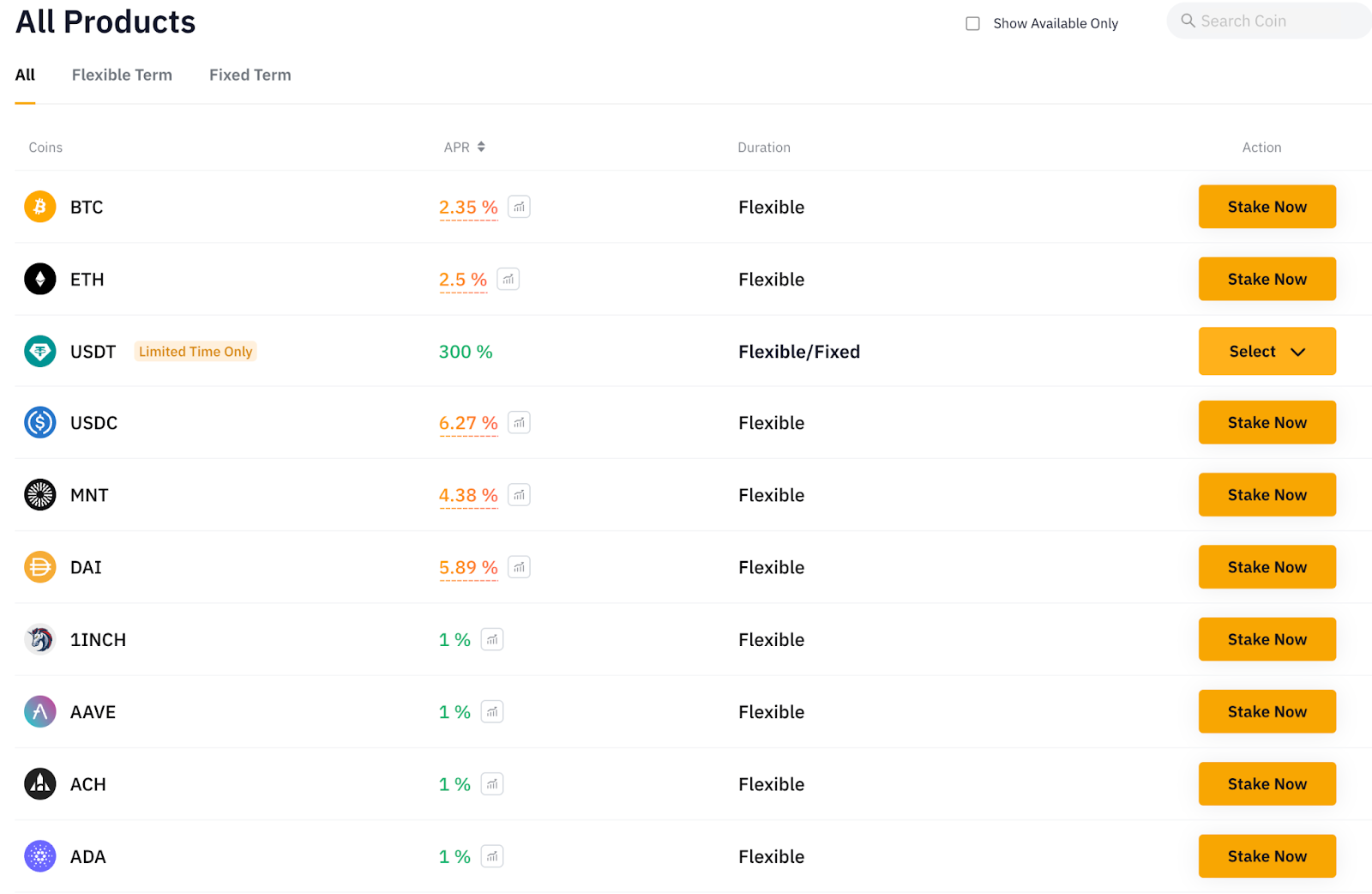

You can choose from approximately 170 tokens. Stake your tokens, select either a flexible or fixed term (depending upon availability) and start earning daily passive income.

For all details, please refer to our detailed guide here.

Why Choose Bybit Savings for Stable Revenue?

How Does Bybit Savings Compare to Bank Deposits or Money Market Funds?

Apart from the benefits we’ll highlight below, the key difference is that with Bybit Savings you can stake your favorite token while earning stable revenue.

Other benefits offered by Bybit Savings are as follows:

Higher Returns. The average interest rate offered by Japanese banks is currently lower than 0.25% (as of 2024). Given the low BoJ interest rate, Japanese bonds wouldn’t offer much higher rates either. This minuscule return on savings contrasts sharply with options available in the cryptocurrency market, such as Bybit Savings, which offers significantly higher interest rates — typically ranging from 1% in stablecoin to 5% per year — creating a much faster path to asset growth as compared to traditional banking options.

Low-risk passive income. Many investors are drawn to Bybit Savings for its potential to generate low-risk passive income. While the crypto market can be volatile, Bybit Savings is a safer option that provides more stability for users who stake their tokens.

Stable, predictable earnings over time. Users can expect stable and predictable earnings over time. This can help in financial planning and achieving investment goals without the fluctuations often seen in other crypto investments.

Opportunity to reinvest gains for compounding. By reinvesting the gains earned from interest, users can take advantage of compounding. This strategy can significantly enhance overall returns over time, making it an attractive option for long-term investors.

Secure platform with top-notch safety features. Bybit is known for its top-notch security features, ensuring that users’ funds are protected. This security is crucial for investors who prioritize the safety of their assets.

Availability of flexible and fixed options depending upon your strategy. The Bybit Savings platform offers both flexible and fixed options, depending upon individual investment strategies. This flexibility allows users to choose the best approach to align with their financial goals and risk tolerance.

Comparison With Other Crypto Investment Strategies

Compared to other crypto investment strategies, such as trading or investing in high-risk tokens, Bybit Savings provides a more stable and reliable way to earn passive income.

While trading can yield high returns, it also carries risks and requires active management. Bybit Savings, on the other hand, allows users to earn passive income with minimal effort, making it suitable for both novice and experienced investors looking for a safe way to grow their assets in the crypto space. Overall, Bybit Savings stands out as a compelling alternative for those seeking higher interest rates and a stable, low-risk investment strategy in the evolving cryptocurrency market.

How to Get Started With Bybit Savings

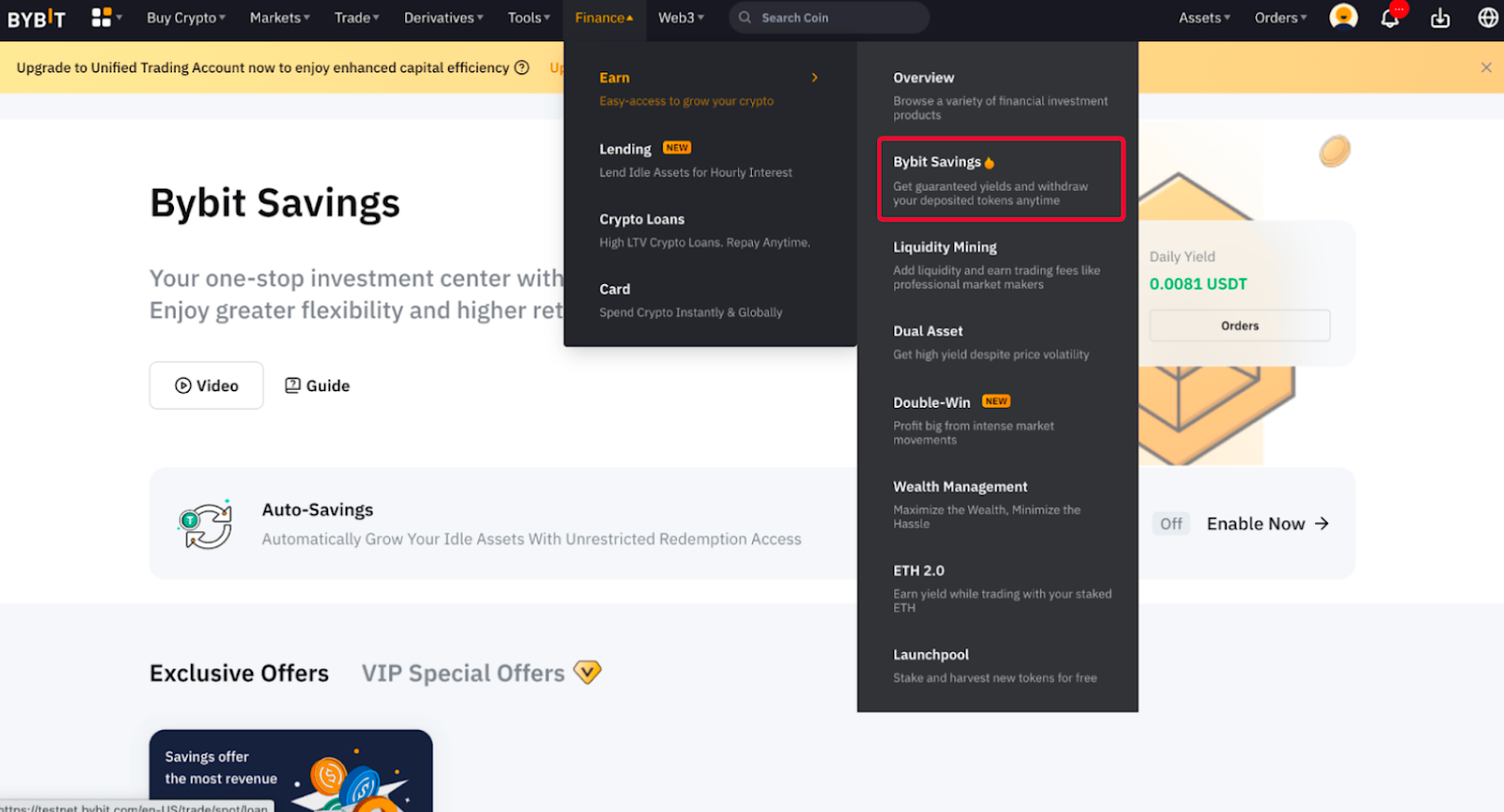

Step 1: Navigate to the Bybit Savings Page

Visit the Bybit Savings page by clicking on Finance → Earn → Bybit Savings in the navigation bar.

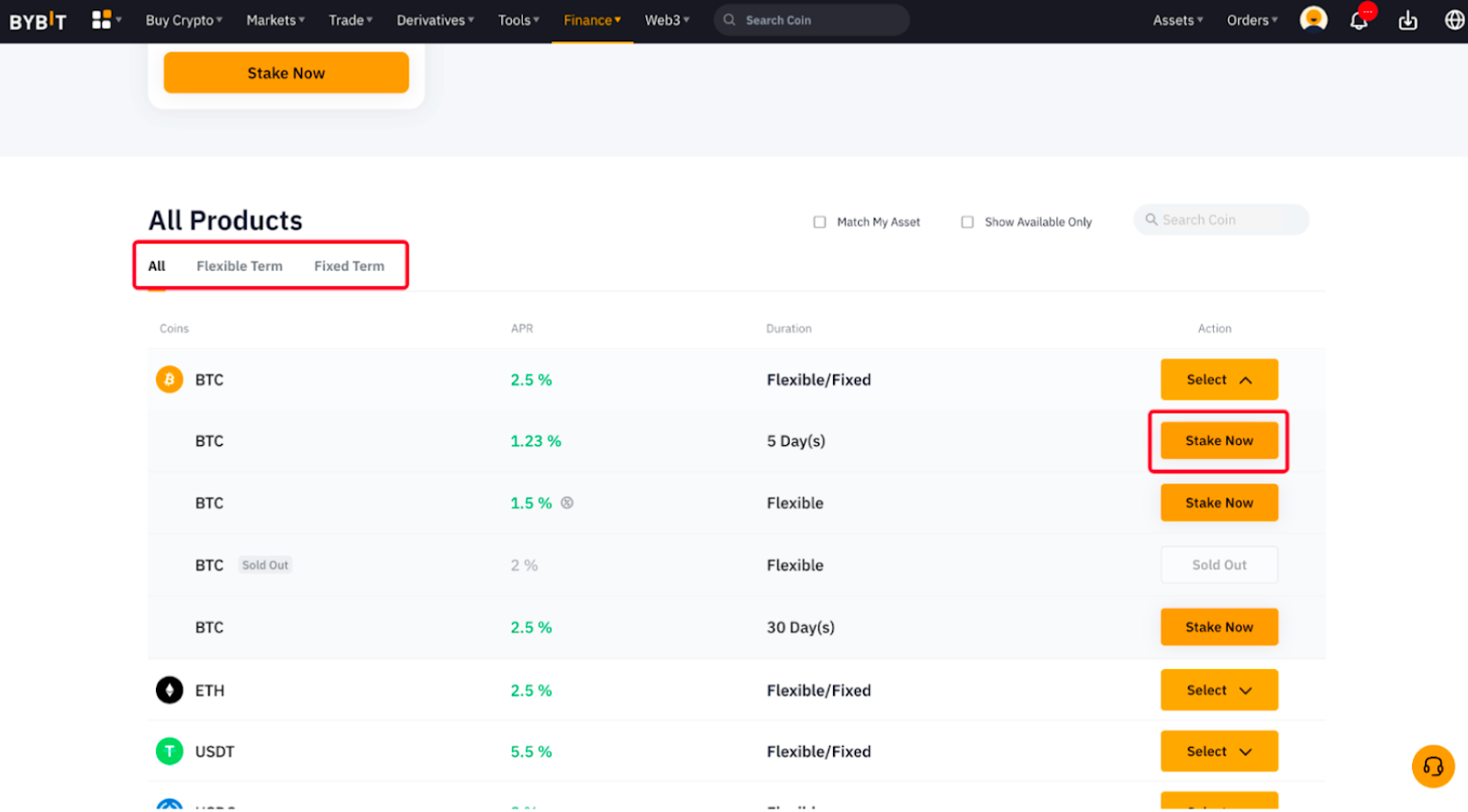

Step 2: Choose a Bybit Savings Plan

Explore the available plans based on Coin, Staking Period, APR and Term, and select the one you would like to purchase. Then, click on Stake Now.

Step 3: Create Your Bybit Savings Plan

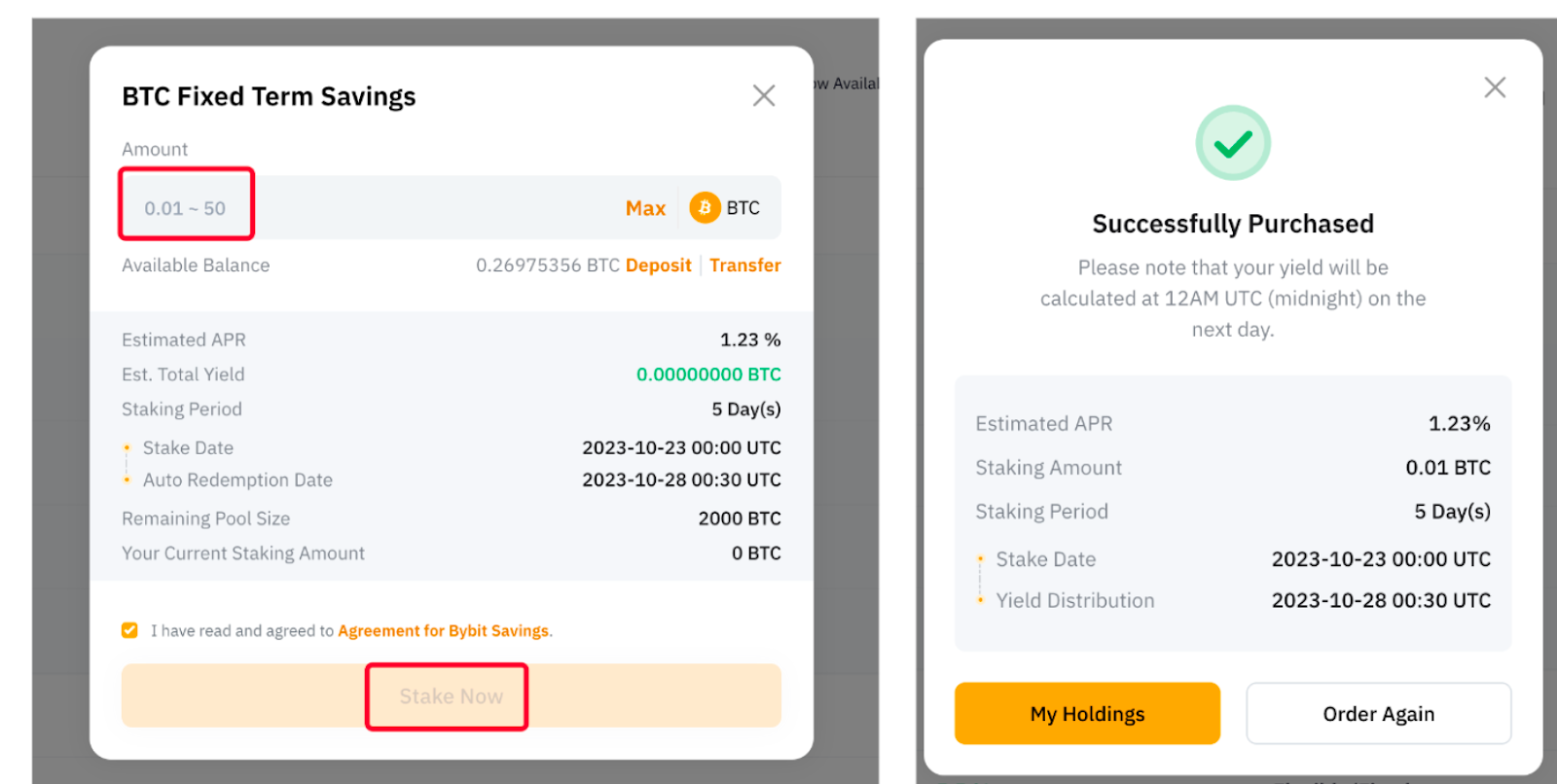

Enter your investment amount, and make sure you acknowledge all the parameters you’ve chosen. Then, click on Stake Now.

Note: For Fixed Savings, please note that the plan you’ve purchased can't be unstaked or early redeemed until it expires.

For more details, please visit here.

Maximizing Your Revenue With Bybit Savings

Reinvesting Your Earnings for Compounding Interest

Reinvesting your earnings is a powerful strategy that leverages compounding interest. When you reinvest the interest you earn, your principal amount increases, leading to greater returns over time. This exponential growth can significantly enhance your portfolio’s overall value.

In the context of Bybit Savings, where interest rates can be considerably higher than those offered by traditional banks, the impact of compounding becomes even more pronounced. With Bybit Savings, you can choose to Auto-Reinvest the interest for those plans with flexible terms, and compound the return you’ll receive when you unstake those positions.

Additionally, Bybit Auto-Savings is a feature that allows you to automatically invest your idle assets into Flexible Savings products on Bybit. When activated, your specified idle assets will be invested into Bybit Flexible Savings daily at 10AM UTC. Once staked, these assets function similarly to Flexible Savings, enabling you to earn yields while retaining the flexibility to redeem your assets whenever you need to. Following is a list of tokens with the Auto-Savings feature.

Diversifying Your Portfolio Within Bybit Savings for Risk Management

Diversification is a key principle in risk management, and Bybit Savings provides various options to achieve it. By spreading your investments across different savings products within the platform, you can mitigate risk and optimize returns.

For example, you might allocate a portion of your assets to Fixed Savings for more predictable returns while placing another portion in Flexible Savings to capture higher rates when market conditions are favorable. This diversified approach allows you to balance the potential for higher gains with the security of more stable returns, ultimately enhancing your overall financial resilience.

Timing Fixed Savings Periods to Match Market Conditions

Timing your fixed savings periods can be crucial to maximizing returns. By strategically choosing when to lock in your funds based on market conditions, you can capitalize on periods of higher interest rates.

For instance, if you anticipate a rise in interest rates due to market trends, locking in your funds for a fixed period can yield more significant returns. Conversely, if the market’s interest rates appear to be declining, you might opt for shorter fixed terms or flexible savings options, allowing you to adapt quickly to changing conditions. This proactive approach can help you optimize your earnings and manage risk effectively.

How Flexible Savings Allows Easy Withdrawal Without Locking up Your Funds

One of the standout features of Bybit Savings is the flexibility it offers. Unlike traditional fixed savings accounts that require you to lock up your funds for extended periods, Bybit’s Flexible Savings allows you to withdraw your assets easily without penalties.

Flexible Term Products: Your staked coins can be unstaked anytime. They’ll immediately be auto credited to your Funding or UTA/Spot Account once they’re unstaked. To unstake, please head to Flexible Savings in Earn Account under Orders & Trade.

Fixed Term Products: You cannot unstake your staked coins once your product plan becomes effective. Your principal and yield will be credited into your Funding or UTA/Spot Account on the yield distribution date.

Risk Management and Security

You can invest confidently with Bybit Savings, since Bybit offers 360 Platform Security.

Triple-Layer Asset Protection & Platform Security

User funds are stored securely offline in cold wallets.

We protect your funds from unauthorized online access through a combination of advanced multi-signature, trusted execution environment (TEE) and threshold signature schemes (TSS).

We conduct regular proof of reserves (PoR) audits and publish them publicly for transparency.

Privacy Protection

We integrate a privacy-first philosophy into all our products and services.

We're up-front about how we collect, use and share your data.

Advanced Data Protection

Data is encrypted using desensitized query interfaces both in storage and transit.

All access is subject to strict authorization controls to ensure that only you have access to your personal and private information.

Real-Time Monitoring

Bybit’s risk controls monitor and analyze user behavior in real time.

As soon as suspicious activity is identified, withdrawals will be subject to strengthened authentication measures.

Security by Design

Our system places security first: it’s designed with a secure development life cycle, rigorous security testing and ongoing bug bounty programs.

In addition to Bybit's security measures, users can take several steps to enhance the protection of their assets:

Enable Two-Factor Authentication (2FA):

Activating 2FA adds an extra layer of security to user accounts. It requires a second form of verification, typically via a mobile app, making it more difficult for unauthorized individuals to access accounts.

Use Secure Wallets:

For long-term storage of cryptocurrencies, users should consider using secure wallets, such as hardware wallets, which remain offline and provide enhanced security compared to keeping your assets on exchanges.

Regularly Update Passwords:

Users should create strong, unique passwords for their accounts and change them regularly. Avoiding password reuse across different platforms can further reduce the risk of unauthorized access.

Stay Informed About Phishing Attempts:

Users should be vigilant about potential phishing scams. Always verify the legitimacy of emails or messages claiming to be from Bybit, and avoid clicking on any suspicious links.

Monitor Account Activity:

Regularly checking account activity can help users spot any unauthorized transactions or changes. Prompt reporting of suspicious activity can mitigate potential losses.

Conclusion

Bybit Savings offers a compelling solution for investors seeking reliable and higher returns in the cryptocurrency space. With features like competitive and guaranteed APRs, options for flexible and fixed terms and the opportunity to reinvest earnings for compounding interest, users can enjoy a stable and low-risk passive income stream. Furthermore, the platform’s top-notch security measures and user-friendly interface make it accessible for both novice and experienced investors.

As the demand for passive income continues to surge in the crypto market, now is the perfect time to explore Bybit Savings. By taking advantage of this innovative investment product, you can harness the potential of your idle assets and achieve your financial goals with confidence. Start your Bybit Savings journey today — and set yourself on the path to financial growth!

FAQ:

1. What is Bybit Savings, and how does it work?

Bybit Savings is a crypto-based savings program that allows users to earn interest on their cryptocurrency holdings. Users can choose between flexible and fixed-term savings, where flexible options allow easy withdrawal, and fixed options offer higher returns for locking in funds.

2. What are the differences between flexible and fixed savings?

Flexible savings allow you to withdraw your funds anytime, offering lower interest rates. Fixed savings, on the other hand, lock your funds for a set period in exchange for higher interest rates, providing more lucrative returns.

3. How can I start earning with Bybit Savings?

To start earning, create a Bybit account, deposit supported cryptocurrencies, navigate to the Savings section, and choose between flexible or fixed-term savings. Deposit your funds, and you’ll start accruing interest.

4. Is Bybit Savings safe?

Yes, Bybit offers top-tier security measures, including two-factor authentication (2FA), cold storage of assets, and risk management protocols. However, like any crypto investment, users should apply additional security measures on their end.

5. How much can I earn with Bybit Savings?

Earnings depend on the type of savings you choose (flexible vs. fixed), the cryptocurrency you're saving, and the current interest rates. Fixed savings typically offer higher rates, but the earnings can grow significantly through reinvestment and compounding over time.

6. Can I withdraw my funds anytime?

Yes, if you choose flexible savings. For fixed-term savings, your funds will be locked for the duration of the savings period, and early withdrawal may not be possible or could result in penalties.

7. How is Bybit Savings different from traditional savings accounts?

Bybit Savings offers much higher interest rates than traditional savings accounts due to the volatility and nature of cryptocurrency markets. However, it also comes with a different risk profile as it's tied to digital assets.

8. Can I lose my funds in Bybit Savings?

Bybit Savings is considered a low-risk way to earn passive income, but since it involves cryptocurrencies, there are still market risks involved, such as fluctuations in the value of the underlying assets.

9. What cryptocurrencies are supported on Bybit Savings?

Bybit Savings typically supports popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins such as USDT. The available coins may vary over time based on market demand.

10. How do I maximize my earnings with Bybit Savings?

Maximize earnings by reinvesting your interest for compounding returns, choosing higher-yield fixed savings options, and diversifying your savings across different cryptocurrencies to manage risk.

#LearnWithBybit