How to Steadily Increase Assets Using BTC Dollar-Cost Averaging Strategy

In the first article of this series, we introduced how to utilize Bybit's USDT savings plan to secure high yields and counteract the effects of currency depreciation. In this continuation, we explore how to consistently grow your assets using a Dollar-Cost Averaging (DCA) strategy. Recognized as the most trusted cryptocurrency, Bitcoin presents significant long-term growth opportunities. By implementing a BTC DCA strategy, you can spread your investment risk over time and achieve stable growth in your assets.

Key Takeaway:

Dollar-Cost Averaging strategy with Bitcoin is an effective way to mitigate risk against market volatility while capitalizing on Bitcoin’s long-term growth potential. This strategy is flexible and beginner-friendly, requiring no advanced trading skills, and provides a systematic approach to steadily accumulate Bitcoin.

Dollar-Cost Averaging (DCA)

DCA is an investment strategy used to reduce the impact of volatility on large purchases of financial assets such as stocks or cryptocurrencies. By following the DCA approach, an investor divides the total amount to be invested across periodic purchases of a target asset in an effort to reduce the risk associated with volatile price movements. The benefits of a DCA strategy include:

Accessibility for Beginners: It’s an excellent approach for beginners because it doesn't require timing the market, which can be difficult for new investors.

Reduces the Impact of Volatility: DCA helps in smoothing out the purchase price over time, mitigating the risk of investing a large amount in a single transaction at a potentially unfavorable price.

Lower Emotional Investing: By investing a fixed amount regularly, DCA reduces the emotional stress related to trying to time the market highs and lows.

Promotes Investment Discipline: A DCA strategy encourages regular investing, fostering a disciplined investment habit that can be beneficial for long-term portfolio growth.

Flexibility and Scalability: Investors can start with small amounts and gradually increase their investment as they become more comfortable with market conditions or as their financial situation improves.

As a market leader in the cryptocurrency space, Bitcoin is highly recognized and boasts the most liquidity in the crypto market, making it a favored choice among investors for its long-term investment potential. By employing a Bitcoin DCA strategy, investors can incrementally build their holdings without the need for significant initial capital or advanced trading skills to time the market. This approach not only mitigates timing risk but also capitalizes on Bitcoin’s potential for long-term appreciation.

Example of a BTC DCA Strategy

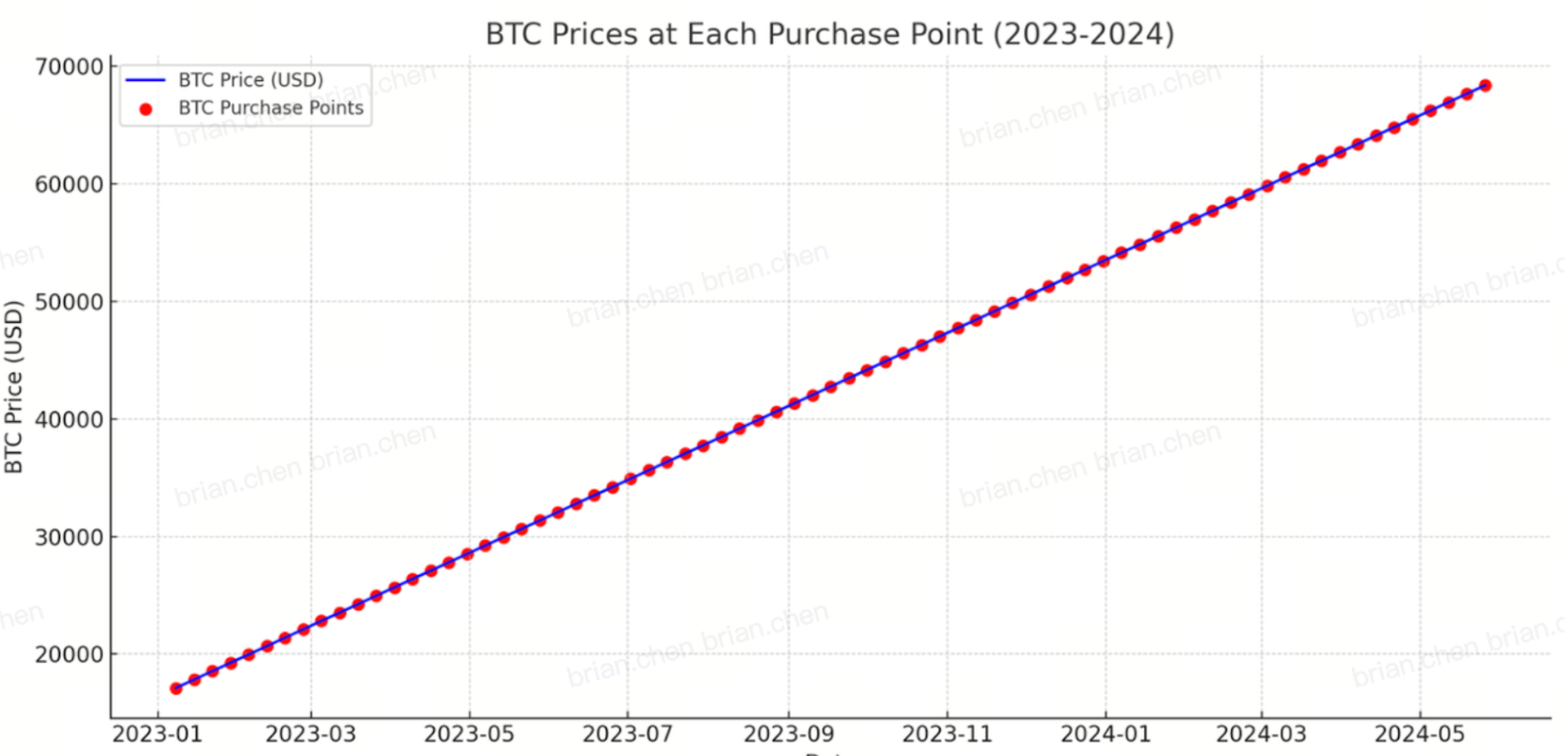

To better understand how a DCA strategy functions, consider the following example: this simulation demonstrates the outcome of investing 10 USDT into Bitcoin every week from January 2, 2023, to May 27, 2024.

Investment Amount: 710 USDT (10 USDT per week, 71 weeks in total)

Amount of BTC held: 0.01981724 BTC

Final Asset Value (calculated using BTC price in May 2024): 1355.04 USDT

Increase: 625.04 USDT

Increase rate: 1.86 times

BTC price at first purchase: 17,124.00 USD

BTC price at last purchase: 68,376.66 USD

Rate of increase in BTC for this period: 199.30%

Disclaimer: Due to varying BTC prices across different exchanges, this example should be considered a trend-based approximation and used for reference purposes only.

In this simulation, the significant rise in BTC price resulted in a substantial increase in the investment value over a period of one year and five months. Although the simulation coincides with a bullish market phase, enhancing the returns, the effectiveness of a DCA strategy in spreading risk and mitigating the impact of price volatility remains clear. This strategy is particularly valuable given BTC’s large volatility, and with its long-term trajectory leaning towards an uptrend, capitalizing on this potential using DCA could prove highly beneficial.

Conversely, if the same amount were held in Japanese yen, with its near-zero interest rate, the total investment value after one year and five months would remain roughly unchanged at 710 USDT. Furthermore, the real purchasing power of this amount might decrease due to inflationary pressures.

How to Implement a DCA Strategy for BTC Using Bybit

Account Registration and Verification: To begin your journey with Bybit, the first step is to create your account. Visit Bybit's official website (https://www.bybit.com/register) to sign up. Aftering signing up, complete the registration by finishing the identity verification.

Deposit Funds : Fund your Bybit account by depositing USDT via bank transfer (https://www.bybit.com/fiat/trade/express/home) or by depositing crypto-assets through your crypto wallets.

Set up a DCA Strategy: Set up a DCA strategy to buy BTC using Bybit’s DCA bot. (https://www.bybit.com/ja-JP/tradingbot/dca-create/Bybit)

Conclusion

Implementing a Dollar-Cost Averaging strategy with Bitcoin is an effective way to mitigate risk against market volatility while capitalizing on Bitcoin’s long-term growth potential. This strategy is flexible and beginner-friendly, requiring no advanced trading skills, and provides a systematic approach to steadily accumulate Bitcoin. The Bybit platform offers a DCA bot that simplifies the execution of this strategy, lowering the learning curve and facilitating a smoother path to asset growth.

Disclaimer: Investing in cryptocurrencies involves a substantial risk of loss and is not suitable for every investor. Prior to making any investment decisions, please ensure you fully understand the risks involved and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.