How to Navigate Upcoming Volatility Events

Why the Market Could Be Volatile Ahead of Tuesday’s PPI and Wednesday’s CPI Reports

Last week, the market experienced a significant sell-off, driven by growing concerns about the possibility of a recession. Equity investors are worried about deteriorating corporate earnings and their negative impact on enterprise valuations.

Weakening corporate earnings usually signal a weaker economy, which could potentially lead to earlier-than-expected rate cuts from the Federal Reserve. On the other hand, moderating inflationary pressures could also ease the hurdle facing the Fed, which has been primarily concerned about early rate cuts potentially reigniting inflationary pressures in the future. As a result, the market has become highly volatile.

Investors find themselves caught between two challenging scenarios. On one hand, a weaker economy would pose a headwind to the equity market, as fundamental earnings growth would fail to support the currently high valuations. On the other hand, rate cuts are generally welcomed, since they’re fundamentally favorable for the valuations of high-beta or smaller corporations.

The story becomes more complex, however, when it comes to cryptocurrencies. The impact of corporate earnings and inflationary pressures on the crypto market is uncertain. While recent crypto sell-offs have coincided with the broader equity market plunge, corporate earnings don’t directly affect the cryptocurrency ecosystem. Crypto sell-offs have more to do with other factors, such as selling pressures from institutional players like Jump Crypto and possibly other sources. Historically, cryptocurrencies have tended to perform better in cycles of loose monetary policies.

In summary, the current market environment is characterized by heightened volatility, as investors navigate the delicate balance between concerns about a weakening economy and the potential benefits of a more accommodating monetary policy stance.

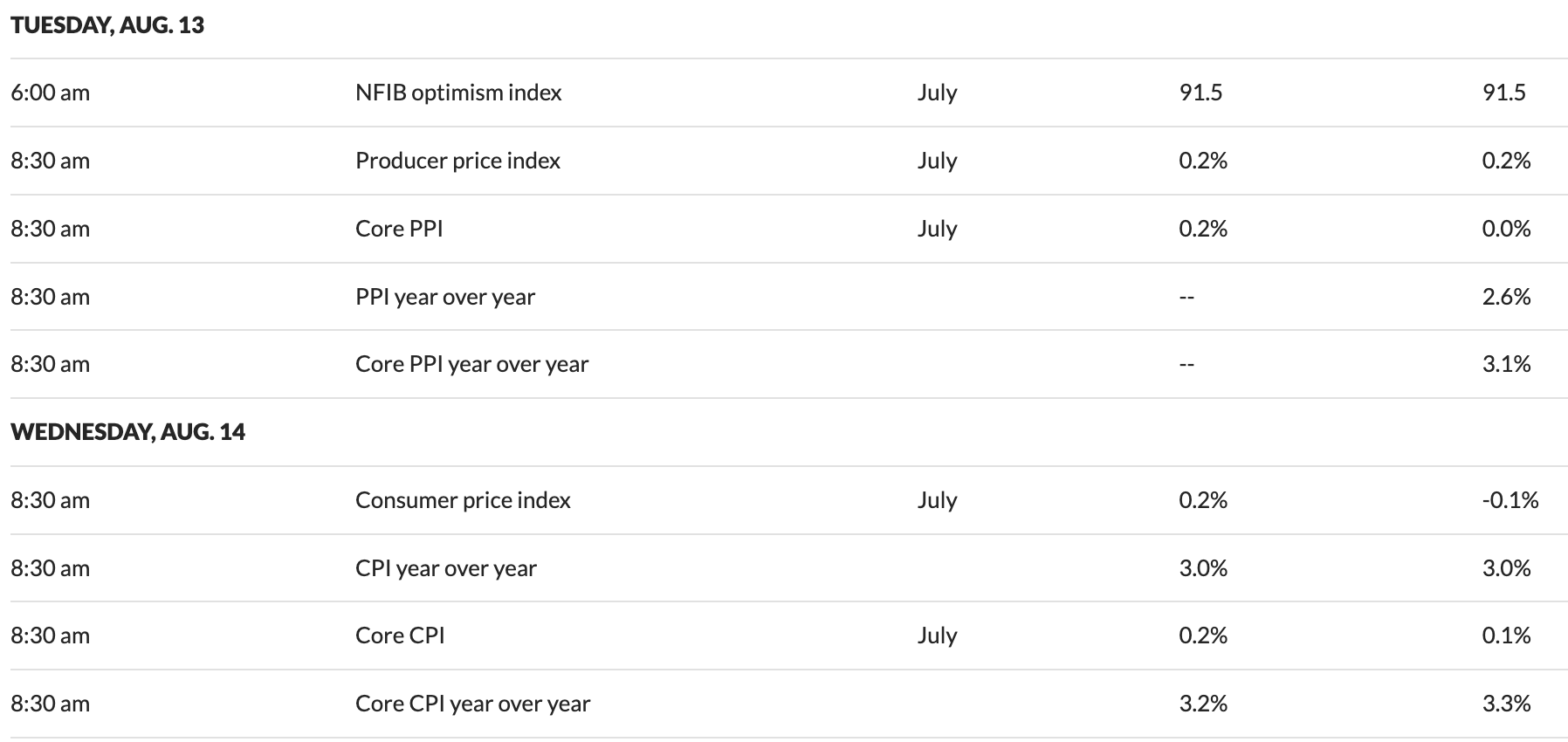

U.S. Economic Calendar. Source: MarketWatch

In the next two days, the releases of the U.S. Producer Price Index (PPI) data on Tuesday and the U.S. Consumer Price Index (CPI) on Wednesday are widely expected to increase market volatility.

Notably, the PPI and CPI data are closely correlated, often moving in tandem. Therefore, increased volatility typically begins with the earlier release of the PPI data.

Investors should be aware that the market's response to these macroeconomic data points can be unpredictable, even if the underlying trend is well established. Immediate price movements surrounding the PPI and CPI releases can be volatile, as market participants adjust their positions based on the latest information.

Why You Shouldn’t Bet on a Single Direction for This Type of Volatility Event

Riding on the back of a significant credit event can be a highly risky endeavor. The market is inherently unpredictable in the short term. Sometimes, even when all the fundamental factors seem to point in a particular direction, the market can end up moving the other way. Unless one has access to confidential or insider information, no one truly has a crystal ball to foresee the market's immediate reactions.

The well-known adage, "Buy the rumor, sell the news" is a rule that many market players tend to support. As a result, it’s often difficult to ascertain whether the latest information or news has already been factored into current market prices.

If an investor bets in the wrong direction in the short term, the increased market volatility surrounding events can often lead to liquidation of leveraged positions. As such, it’s critical for those holding leveraged positions to have appropriate risk management strategies in place to protect against the potential for heightened volatility.

The key message is that short-term market reactions to significant events can be highly unpredictable, even when the underlying fundamentals seem to point in a certain direction. Maintaining a cautious and well-diversified approach is essential to navigating these periods of heightened uncertainty in the markets.

How to Navigate an Expected Market Volatility Event

Since the beginning of the current bull market, there have been quite a number of market volatility events at certain critical junctures, driven by a combination of macroeconomic and crypto-specific factors.

Macroeconomic factors that have contributed to increased volatility include FOMC policy decisions, inflation data (such as CPI and PPI), economic growth indicators (GDP growth), retail sales figures and manufacturing data. These economic data points tend to induce exceptional market volatility when they begin to deviate from established short-term trends.

In addition to macroeconomic influences, crypto-specific events, such as Bitcoin halvings, Ethereum upgrades and Spot ETF listings, have also been known to spur heightened volatility in digital asset markets.

BTC Price. Source: Bybit

Take January 2024's Bitcoin Spot ETF approvals and April 2024's Bitcoin halving as examples. In the case of the Bitcoin Spot ETF approvals, the market initially responded with a sell-off on the day of the approvals, driving BTC’s price as low as $38,000. However, the price gradually climbed back and reached a peak in March 2024.

BTC Price. Source: Bybit

The April 2024 Bitcoin halving event led to an immediate surge in BTC’s price, which climbed to $67,000 in the first few days. However, it then mildly fell below $60,000 in the subsequent period.

While it’s widely believed that both the halving event and the price movements that follow it can improve Bitcoin's long-term price trend, short-term price actions immediately before and after such volatility events are generally considered unpredictable.

The key point to emphasize here is that short-term price fluctuations surrounding major cryptocurrency events are inherently difficult to forecast with a high degree of accuracy. Investors should be aware that the immediate price response to these types of events can be volatile and challenging to anticipate, despite their potential long-term implications.

Simple Strategy to Help You Sail Through Volatility Events

For novice investors, HODLing — that is, holding on to investments during market volatility — can be the most straightforward approach to navigating turbulent periods. However, this strategy may be most suitable for well-established blue chip assets, such as Bitcoin, which have fundamental solid underpinnings.

Experienced traders, on the other hand, may opt for more active strategies to manage market volatility. The key is to bet on volatility itself, rather than trying to predict the direction of the market. This can be achieved through the use of derivative instruments, such as straddles or spreads, which allow traders to profit from large swings in asset prices, regardless of the direction.

Specialized products are available for investors seeking more sophisticated tools to navigate volatile markets. These may include Smart Leverage and Double-Win from Bybit, which provide exposure to market volatility without the need for manual selection of individual contracts, expiration dates and strike prices.

More Sophisticated Bybit Tools to Help You Sail Through Unpredictability

Smart Leverage

Smart Leverage is a non-principal-protected structured financial product that helps users navigate extreme market volatility to place bets in a single direction, maximizing gains with high leverage while mitigating the risk of liquidation before settlement. Smart Leverage offers up to 200x leverage for selected coins, and is suitable for traders inclined to use high leverage during periods of sharp price reversals.

Key Advantages

High Leverage: Amplify your earning potential with up to 200x leverage.

No Liquidation Before Settlement: Shield your investment from liquidation risks, from subscription to settlement.

Early Redemption: Redeem your earnings at any time before the end of the settlement period.

Please refer here for more details.

Double-Win

Double-Win is a structured financial product that allows users to position themselves for market movements in both directions, without principal protection. The concept is similar to binary options, whereby users receive a payout if the settlement price falls outside a preset range, or nothing at all if the price remains within it.

The key advantage of a Double-Win plan is that maximum risk is limited to the investment amount, while potential profits vary depending upon how far the underlying asset price moves. This makes it a suitable option in the following scenarios:

You anticipate significant market movements, but are uncertain about the direction, particularly around the release of major financial indicators or industry news.

You want to leverage or hedge against spikes in market volatility.

Unlike traditional trading strategies that require you to predict the exact direction of the market, Double-Win enables users to speculate on the magnitude of price movement, regardless of the direction. This can be a useful tool for traders who aim to capitalize on heightened market uncertainty or volatility while limiting their downside exposure to the initial investment amount.

Please refer here for more details.

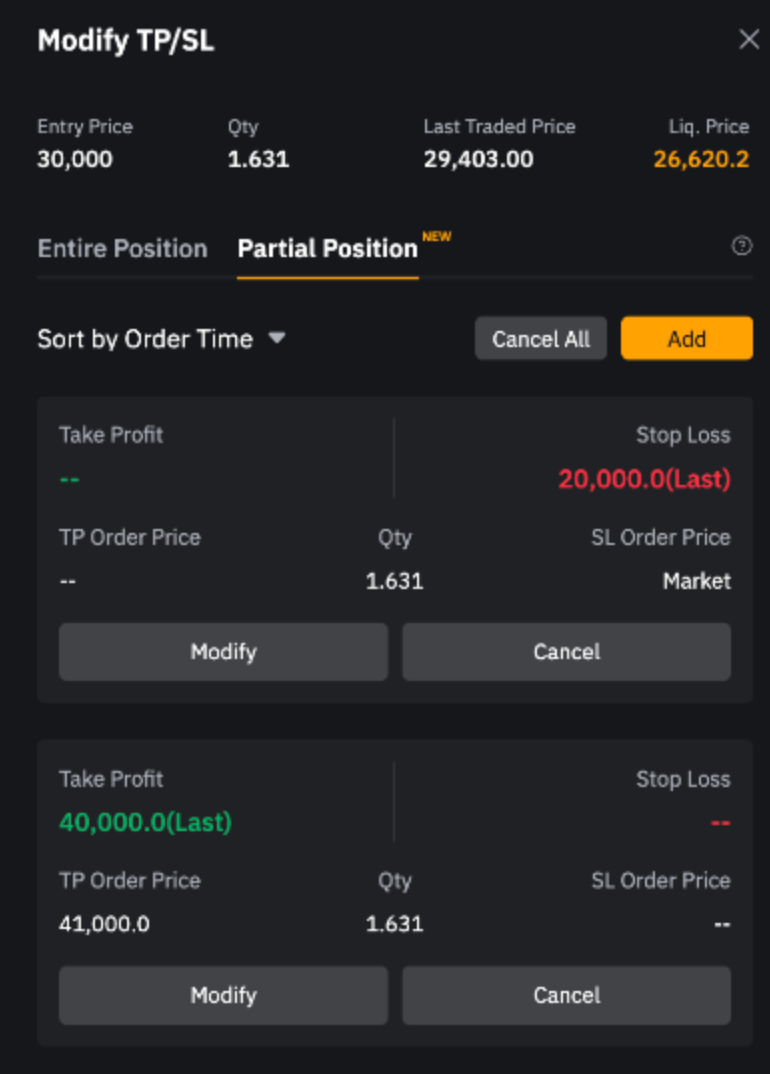

Take Profit and Stop Loss (Perpetual and Futures Contracts)

Bybit's Take Profit/Stop Loss (TP/SL) function empowers traders to manage their risks more effectively. It allows them to set TP/SL orders simultaneously, making it convenient for reducing the risk of unexpected financial losses.

Take profit orders are executed when prices reach a predetermined level. This enables traders to lock in their profits and exit the trade. Conversely, Stop loss orders are triggered when prices reach a predetermined level, automatically exiting the trade and protecting traders from excessive losses.

By combining take profit and stop Lloss orders, traders can establish a well-defined risk management strategy, ensuring their trades are executed according to their predetermined profit targets and loss limits. This can help traders maintain discipline and avoid emotional decision-making during volatile market conditions.