Gold as a Safe Haven: Navigating Economic Uncertainty With Bybit’s MT5

Throughout history, gold has been used not only as a medium of exchange but also as a store of value, sought after during economic turmoil and inflationary periods. Its intrinsic properties — durability, divisibility and portability — have contributed to its enduring appeal. As societies and economies have evolved, gold remains a critical asset, consistently viewed as a safe haven in times of uncertainty, preserving wealth across generations. Today, gold continues to play a vital role in investment portfolios, valued for its stability and its capacity to hedge against various financial risks.

What Is Traditional Gold Investment?

Gold’s spectacular run in 2023–2024 has spurred investor interest. The term “gold investment” refers to purchasing gold in order to generate returns or preserve wealth. There are several traditional ways to invest in gold.

Physical Gold: One of the most traditional forms of gold investment is that of buying physical gold, such as coins, bars or jewelry. Owning physical gold offers a sense of security, and eliminates reliance on financial institutions. It requires secure storage, however, and may incur insurance costs, which can affect liquidity as compared to other forms of investment.

Gold ETFs: Exchange-traded funds (ETFs) are another popular way to invest in gold. These funds trade on stock exchanges and are designed to track gold prices. ETFs provide liquidity, allowing investors to buy and sell as they would with stocks, while also obviating the need for physical storage. However, they typically charge management fees, and their prices may not always align perfectly with gold prices (due to market fluctuations).

Gold Mining Stocks: Investing in gold mining stocks offers indirect exposure to gold prices. This method can yield higher returns, due to the leverage associated with mining operations, and some companies even pay dividends. However, investors should be aware of company-specific risks, since factors like management decisions and operational challenges can significantly impact stock performance.

Futures and Options: Futures and options contracts allow investors to speculate on the future price of gold. These instruments offer high leverage, enabling control over large amounts of gold with relatively small capital. However, they require a solid understanding of the market, and carry risks of significant losses, especially with leveraged positions.

Trade With Bybit MetaTrader 5

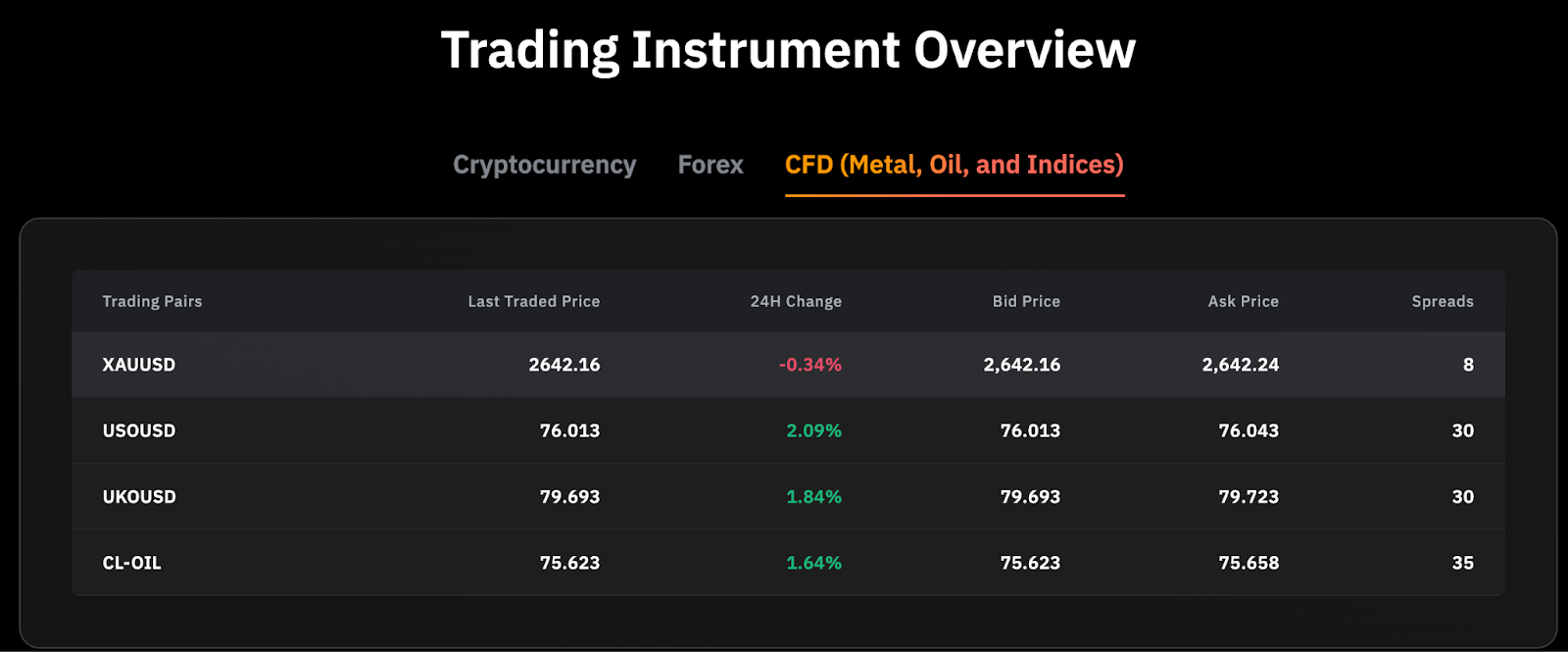

For crypto enthusiasts, there’s great news: you can now trade gold directly on Bybit! Bybit MetaTrader 5 provides access not only to cryptocurrencies and forex, but also to contracts for difference (CFDs). Following are the exceptional benefits offered by MT5 to trade gold’s price via the XAUUSD trading pair.

500x Leverage: Unlock the potential to amplify your trading opportunities with leverage of up to 500x.

0-Pip Spreads: Take advantage of ultra-low spreads to enhance your potential returns.

100+ Popular Trading Pairs: Explore a wide range of financial instruments on Bybit's MT5 platform, including forex, cryptocurrencies, commodities and stock indices.

Customizable Fees: Enjoy zero fees for closing positions, with trading fees starting as low as 3 basis points. For forex and CFD instruments, minimum closing fees begin at just $3 per lot, along with exclusive VIP rates.

Top-Tier Liquidity: Experience efficient trade execution on our high-volume exchange platform, ensuring best-in-class liquidity and market depth to minimize price impacts during trades.

24/7 Customer Support: Get your questions answered around the clock by our multilingual customer support team, who are ready to provide you with exceptional assistance whenever needed.

Why Invest in Gold?

Investing in gold offers several compelling advantages, making it a strategic choice for many investors. Here are some key reasons to consider:

Hedge Against Inflation: Gold serves as a reliable hedge against inflation, its price often appreciating when the cost of living increases. As currencies lose purchasing power, gold's value tends to rise. Nevertheless, historically speaking the correlation between gold and inflation is not stable.

Deflation Protection: In times of deflation, gold can maintain its purchasing power. Historical data shows that during economic downturns, gold often outperforms other assets as people seek safe havens.

Geopolitical Uncertainty: Gold is viewed as a "crisis commodity." In times of geopolitical tension or economic instability, investors frequently turn to gold, driving up its price and providing a sense of security.

Intrinsic Value: Unlike fiat currencies, gold maintains intrinsic value over time. Its historical significance and demand in various industries — such as electronics, jewelry, aerospace and dentistry — contribute to its enduring worth.

Supply Constraints: The worldwide supply of gold is limited, and mining output has been declining since the early 2000s. This scarcity can support higher prices as demand continues to grow.

Increasing Demand: Rising wealth in emerging markets (particularly in countries like China and India) has boosted gold demand. Cultural significance and traditional practices further enhance its appeal.

Portfolio Diversification: Gold's low correlation with other asset classes, such as stocks and bonds, makes it an effective tool for diversifying investment portfolios, thereby reducing overall risk and volatility.

What Determines Gold's Price?

Gold prices are influenced by a complex mix of factors. Understanding these determinants can help investors make informed decisions.

Supply and Demand

The fundamental factor affecting gold prices is the balance of supply and demand. On the supply side, mining production is crucial, as the amount of gold mined each year impacts overall supply. Major gold-producing countries include China, Australia and Russia. A decrease in mining output can lead to higher prices. Additionally, gold can be recycled from old jewelry and other products, thus contributing to supply. Central banks also hold significant gold reserves, and their buying or selling activities can influence market supply.

On the demand side, jewelry represents a significant portion of gold consumption, especially in countries like India and China, where gold has cultural importance. Investment demand typically rises during economic uncertainty as investors seek safety in gold. Some industries also use gold for electronics and medical applications, although this industrial demand is less significant than that of jewelry or investment demand.

Economic Indicators

Gold prices are sensitive to various economic indicators that reflect the health of the economy. Rising inflation rates generally lead to higher gold prices as investors look to preserve their wealth. Conversely, lower interest rates reduce the opportunity cost of holding gold, making it a more attractive store of wealth. The strength of the U.S. dollar also plays a crucial role in gold’s price. A weaker U.S. dollar makes gold cheaper for foreign investors, often increasing demand.

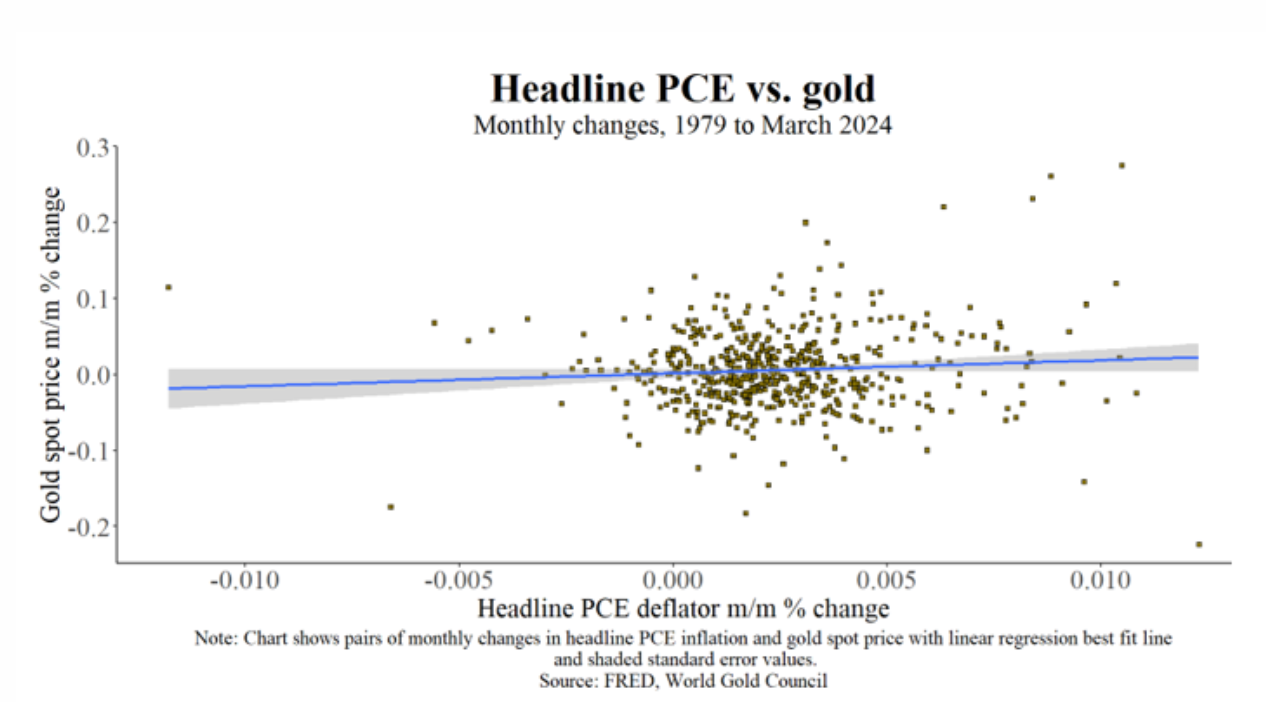

Research has indicated a complex relationship between gold and inflation, ultimately indicating that gold isn’t on average a reliable hedge against inflation. While gold's recent price surge has spurred interest in it as an inflation hedge, empirical evidence reveals no consistent correlation between gold prices and inflation rates over time. Analysis shows that gold doesn’t move predictably with inflation, as demonstrated through scatter plots of inflation data against gold prices from 1979 through 2024.

Additionally, research examining underlying inflation and economic conditions finds that gold doesn’t respond positively to persistent inflation caused by excess demand. Results suggest that, while there may be periods when gold acts as an effective hedge, these instances are unstable and not dependable. The article concludes that while gold can serve as a diversifier in investment portfolios, it shouldn’t be viewed as a guaranteed inflation hedge, further cautioning against blanket statements regarding its role in portfolio construction.

Geopolitical Factors

Geopolitical events can also cause fluctuations in gold prices. Political stability is vital, and uncertainty surrounding elections, government policies or conflicts can drive investors toward gold as a safe haven. Global conflicts, such as the Russia-Ukraine and Israel-Hamas wars, can further heighten demand for gold, pushing prices up.

Investor Sentiment

Market psychology significantly impacts gold prices. During periods of fear such as economic crises, demand for gold typically increases. In contrast, during bullish markets, investors may opt for riskier assets instead of gold. Technical analysis also plays a role, as traders analyze chart patterns and indicators to predict price movements.

Central Banks

Central banks are key players in the gold market. Their policies regarding gold reserves can significantly influence gold prices. Central banks hold substantial gold reserves, and their decisions to buy or sell can affect market dynamics. Additionally, their monetary policies — such as interest rate adjustments and quantitative easing —can have an impact on inflation and currency strength, indirectly affecting gold prices.

Speculative Trading

Speculative trading can lead to significant price fluctuations in the gold market. Futures and options markets allow traders to speculate on future gold prices, creating volatility that can influence current prices. The growth of gold-backed ETFs and increased institutional investment can also affect gold’s demand and price trends.

Final Thoughts

In conclusion, the enduring allure of gold as an investment is rooted in its rich history and intrinsic value, making it a reliable asset for preserving wealth and providing a hedge against economic uncertainties. With the launch of gold trading on Bybit MetaTrader 5, investors now have unprecedented access to leverage, low spreads and a diverse range of financial instruments. Bybit’s platform empowers traders to capitalize on gold’s potential with features such as 500x leverage and exceptional liquidity, ensuring efficient trade execution.

As the demand for gold continues to grow amid geopolitical tensions and economic fluctuations, now is the perfect time to consider incorporating gold into your investment strategy. Embrace the opportunity to trade gold on Bybit MT5 and secure your financial future with a time-honored asset that has stood the test of time. Start your trading journey today and harness the power of gold!