Flux (FLUX): Scalable Decentralized Cloud Service

Blockchain technology boasts many great features, such as cryptographic security and decentralized control. However, the standard blockchain model also suffers from some drawbacks, including limited scalability and poor cross-chain compatibility. Flux is an innovative blockchain-as-a-service (BaaS) platform designed to address these limitations with its ability to connect up to 11 major blockchains.

Key Takeaways:

Flux provides a scalable, blockchain-based cloud service for cross-platform decentralized applications. It connects to 11 major blockchains, rewarding node operators with FLUX tokens for supplying computing resources.

Flux uses a Proof of Useful Work (PoUW) consensus mechanism to optimize mining and solve real-world problems, such as AI deepfake detection.

Its native token is FLUX, which is used to reward node operators for supplying computing resources, and for mining and staking. FLUX can be bought on Bybit as a USDT Perpetual contract.

What Is the Flux Ecosystem?

Flux (FLUX) is a cloud-based decentralized computational network designed for building and deploying scalable, cross-platform blockchain applications. Flux is based on its own Flux blockchain, and also operates on seven other chains.

Nodes on the Flux chain contribute their computing resources in exchange for crypto rewards. The computing resources are utilized by decentralized apps (DApps) within the Flux ecosystem. Thanks to the extensive network of participating nodes, Flux can offer DApp developers a highly scalable platform.

Flux is based on the BaaS concept and provides computing resources and blockchain infrastructure via a cloud-based model. In this regard, Flux is similar to cloud service providers such as Amazon Web Services (AWS) and Google Cloud. However, these cloud providers use the internet as their native environment.

In contrast, Flux’s services are based on blockchain. This allows Flux to enjoy the enhanced security and decentralization built into blockchain technology.

Flux maintains links to other blockchains using so-called parallel assets, which are tokens native to the other blockchains that form part of the Flux ecosystem. There’s one parallel asset token for each blockchain on which Flux operates.

Decentralized Apps on Flux

Flux is designed primarily to help developers create scalable and cross-chain–compatible DApps quickly. Currently, there are dozens of DApps built and/or operating on Flux.

Some of the well-known applications that have a presence on Flux include Yearn Finance (YFI), Aave (AAVE) and Minecraft servers. The first two are category-leading DeFi apps, with Yearn Finance being the largest yield aggregator, and Aave the largest lending and borrowing protocol. Minecraft servers provide gaming server environments for one of the world’s most popular video games, Minecraft.

Flux Origins and Rebranding

Flux was launched in 2018 as a fork of ZCash (ZEC), which in turn is a fork of Bitcoin (BTC). At its launch, the project was called Zelcash (ZEL). In March 2021, Zelcash rebranded to Flux, with the ZEL coin rebranding to FLUX.

The new coin ticker, FLUX, has caused some confusion, as two other crypto projects are also using the same ticker — Datamine Flux (FLUX), a decentralized finance (DeFi) protocol; and Flux Protocol (FLUX), an oracle-based service.

How the Flux Ecosystem Works

The Block Validation Method

As a fork of Bitcoin via ZCash, Flux is a blockchain based on the proof of work (PoW) block validation method. This means that some of the network nodes act as miners in order to validate transactions. There are, however, significant differences between the PoW mechanisms of Flux and its ancestor chains. In particular, Flux advocates green energy, and has come up with innovative solutions for the energy-consuming PoW model.

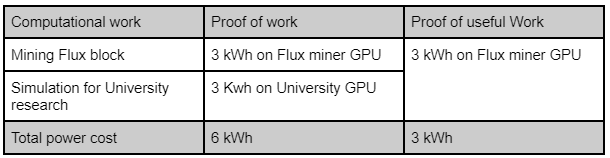

First, Flux implements proof of useful work (PoUW), which optimizes the current PoW mechanism by channeling energy expended in solving block puzzles to concurrently resolve real-life problems. For instance, PoUW can help with detecting deepfakes — a serious problem, with increasingly advanced AI technology — and aid research processes which often require heavy computational power.

Moreover, FLUX mining algorithm ZelHash is ASIC-mining resistant, unlike Bitcoin — and Ethereum, before its recent switch to a proof of stake (PoS) system — which can be mined with ASICs, leading to intensive energy consumption. Hence, as FLUX crypto is mined via GPUs rather than ASIC machines, less energy is consumed as a result.

The Overall Architecture

Flux operates as a multi-chain cloud infrastructure provider, with the Flux blockchain at its core and 11 other blockchains with links to it. These chains are Ethereum (ETH), Bitcoin (BTC), BNB Chain (BNB), Base (BASE), Solana (SOL), Tron (TRX), Polygon (MATIC), Kadena (KDA), Avalanche (AVAX), Algorand (ALGO) and Ergo (ERG).

Thanks to this multi-chain support, DApps developed on Flux feature a high degree of cross-chain interoperability. This interoperability is achieved via FluxOS, a distributed, cloud-based virtual operating system that links all of the platforms supported by Flux.

In addition to FluxOS, there are three other important elements within the platform’s architecture — running nodes, mining nodes and parallel assets, which we’ve touched upon briefly.

Running Nodes

Running nodes, also known as FluxNodes, are one of the two key types of network nodes on Flux that power FluxOS. These represent users who provide their computing resources to the network for DApps to use. In return, these nodes are rewarded with FLUX crypto for providing resources. Half of the mining block rewards generated by miner nodes (covered below) are given to the running nodes.

The running nodes are critical to the Flux network as the system’s entire scalability and efficiency depend on them. FluxNodes can be run on a virtual private server (VPS), a home PC or server, or an Arm processor.

The computing resources you provide to the network will need to meet some minimum requirements. The more powerful specs your system has, the more you can earn in FLUX rewards by operating a running node.

There are three tiers of running nodes — Cumulus, Nimbus and Stratus. Cumulus is the lowest tier, and requires relatively modest computing specs. Among its key requirements are a processor with at least 2 cores, 8 GB of RAM and 220 GB of disk space.

On the other end of the “specs spectrum” is the Stratus tier. Suitable for experienced flux node operators, this tier's requirements include an 8-core processor, 64 GB of RAM and 880 GB of disk space.

Depending on the tier you choose, you’ll also need to provide some collateral in FLUX to run your node. The level of collateral is subject to change, and it’s worth noting that the platform has changed its requirements in the past. At the moment, the Cumulus tier only requires collateral of 1,000 FLUX ($840); the middle tier, Nimbus, requires 12,500 FLUX ($10,500); and the Stratus tier has a minimum requirement of 40,000 FLUX ($33,600).

While the more advanced tiers have higher technical and financial requirements, they also let you earn more rewards. As noted above, running nodes get 50% of the block rewards generated by the mining process, which is split into 30% for Stratus nodes,12.5% for Nimbus nodes and 7.5% for Cumulus nodes.

Flux also offers the option of Titan Node staking, a shared node program for users who can’t afford the base FluxNode staking tier. Titan Node allows users to stake as little as 50 FLUX, and pool their resources to run enterprise-level hardware. Its hardware requirement is the same as Cumulus, with a minimum of 2 cores, 8 GB of RAM and 220 GB of disk space.

The three running node tiers with their technical and financial requirements

Mining Nodes

Mining nodes provide vital block validation service to the Flux blockchain. Flux has considerably lower mining difficulty estimates as compared to Bitcoin (BTC), Dogecoin (DOGE) or other popular mineable cryptocurrencies.

Flux also has a much shorter block time of two minutes, compared to Bitcoin’s 10-minute block frequency. This means that miners can earn rewards on Flux more frequently than on Bitcoin. Each block reward on Flux is 75 FLUX. As noted earlier, this is split 50/50 between miners and running nodes. Thus, effectively, the standard reward for miners is 37.5 FLUX per block.

Besides FLUX rewards, miners can earn additional bonus rewards in the form of parallel asset tokens, as well as bonuses from Titan (Flux shared node program) claiming transactions. Essentially, for one block, miners can earn:

37.5 FLUX

37.5 parallel assets (sum of 3.75 from each of the 10 parallel assets — Note: As of September 2022, only seven parallel assets are currently actively distributed)

0.5 FLUX bonus from one Titan claiming transaction

Similar to Bitcoin, Flux has a reward-halving mechanism. Every 2.5 years, the mining rewards are halved.

Flux Parallel Assets

Parallel assets are a crucial part of the overall Flux architecture. There are 11 parallel assets from the major blockchains, including Ethereum, Solana and the latest, Bitcoin, issued on Taproot Assets, allowing for low-cost transactions on Lightning Network.

Each parallel asset token conforms to the native token standard of the host chain (e.g., FLUX-ETH is an ERC-20 token, while FLUX-BSC is a BEP-20 token, and so on).

Parallel asset tokens may easily be transferred from their host chains to Flux, and converted to the FLUX coin or another parallel asset via the Fusion app, a bridging DApp specifically designed for swapping FLUX tokens.

Fusion is a versatile app that has other important use cases for the Flux user community. Stored with Flux’s native crypto wallet, Zelcore, it also distributes parallel asset airdrops to FLUX holders and rewards to Flux node operators.

Flux Key Features

Flux Cloud

FluxCloud is Flux’s core feature. It functions as a user-friendly gateway to the various Flux services offered to users, and as a DApp portal where users can discover new apps and manage their deployed apps all at once. The products offered in FluxCloud include a decentralized WordPress, a decentralized storage solution (FluxDrive Pro) and Flux Marketplace. FluxCloud is powered by over 13,000 nodes in 78 countries, ensuring every DApp running on Flux is constantly online and accessible to users.

FluxAI

FluxAI is Flux's latest offering, released in late August 2024. It’s an open-source chatbot similar to ChatGPT that utilizes large language models (LLMs) to assist users with queries. While traditional chatbots like ChatGPT use user data to train their models, Flux — thanks to its decentralized network — is able to ensure that your conversations remain 100% private.

FluxEdge

FluxEdge is a scalable, decentralized computing marketplace for resource-intensive computing applications, such as artificial intelligence (AI), machine learning (ML) and rendering. It offers a diverse range of GPUs from various manufacturers, such as NVIDIA and AMD, ensuring that all customers' needs are met at low costs. FluxEdge connects providers and consumers in a peer-to-peer manner, allowing providers to leverage FluxCore to rent out their GPUs. By connecting their GPUs to FluxCore, providers can also engage in traditional PoW mining or use their devices for PoUW via FluxEdge.

To offer added convenience to Web 2.0 users unfamiliar with crypto and blockchain, Flux has incorporated fiat payment on top of FLUX payment. Customers can choose to pay in fiat currencies, which are then converted into FLUX assets of different token standards (Flux mainnet, FLUX-ERC20, FLUX-BEP20) by third-party providers. However, customers who choose to pay in FLUX enjoy a 10% bonus on their top-up amounts.

Providers then earn their rewards through FLUX tokens, which they can claim on their preferred blockchains.

Zelcore

As mentioned above, Zelcore, Flux's native noncustodial web3 crypto wallet, gives users a comprehensive overview of their crypto assets, thanks to its support for imported wallets. It’s also integrated with Ledger and Trezor hardware wallets, allowing users to manage assets stored in their offline wallets.

SSP Wallet

If you're looking for a highly secure wallet to protect your funds, Flux also offers the SSP Wallet, an open-source wallet-key combination with a multi-level security system, featuring industry-grade BIP48 encryption and dual signature mechanisms for a two-key authentication process. The SSP Wallet consists of the SSP Wallet itself, a Chrome extension and the “key,” a mobile application that can be downloaded from both the Apple App and Google Play Stores.

What Is FLUX Crypto?

The FLUX coin is the native Flux cryptocurrency, with multiple use cases. To hold FLUX and carry out key operations (e.g., staking), you’ll need to use Zelcore.

FLUX is used to pay out rewards to miners and FluxEdge providers, and for running nodes. It’s also used as the platform’s governance coin. FLUX holders may participate in the decision-making process concerning all changes and developments on the Flux platform. Meanwhile, governance is carried out via the XDAO, a decentralized entity controlled by the FLUX coin holder community.

FLUX coins may also be used for staking on the platform to earn additional crypto rewards. You’ll need to invest at least 50 FLUX to participate in FLUX staking. In addition, the current upper limit on the amount that can be staked by a node is 20,000 FLUX.

FLUX is a supply-capped coin, with a total and max supply specified at 440 million. The coin’s current circulating supply is around 353 million FLUX (as of Sep 23, 2024).

Where to Buy FLUX Crypto

FLUX can be bought on Bybit as a USDT Perpetual contract with up to 25x leverage (FLUXUSDT). You can trade FLUXUSDT via Bybit's Futures bots, such as Futures Grid, Futures Martingale and Futures Combo.

Flux Crypto Price Prediction

The FLUX coin was launched in mid-2018, at that time under the name ZEL, initially trading at around $0.03. For the first three years on the market, the coin didn’t experience any drastic upward or downward movement, staying largely under $0.30 until September 2021.

FLUX’s price then began a strong rise, its price exceeding $3 by early 2022. In January 2022, the coin registered its all-time-high (ATH) of $3.33. Throughout 2022, FLUX has receded from these heights. While it has occasionally surged over the past couple of years to exceed $1, it’s currently trading at $0.63 (as of Sep 23, 2024).

The turbulence experienced by FLUX within the past year is far from unusual for a crypto coin. While the overall cryptocurrency market is characterized by high volatility in general, the past year and a half has been marked by particularly drastic swings and crashes. As the market is now timidly recovering from this turbulent period, many promising cryptos — including FLUX — are likely to receive a boost in the mid- to long-term future.

We believe that FLUX has good future potential, thanks largely to the following factors:

As blockchain technology marches on and the universe of DApps expands, the cross-chain compatibility of Flux will attract more developers and companies. Very few other platforms in the blockchain world provide you with easy-to-deploy access to so many popular blockchains.

The Merge — Ethereum’s migration to PoS (completed on Sep 15, 2022) — has stranded a large number of GPU miners, now left without their primary source of mining income. It’s expected that many cryptos mined via GPUs, including Flux, will attract this newly idle crowd of miners.

With the development of technologies such as web3 and AI, demand for more computing resources and bandwidth is ramping up accordingly. Flux’s model, which provides computational resources in a decentralized renting format, is well positioned to meet this demand.

FLUX has two important deflationary characteristics — supply-capping and reward-halving — built into its functional mechanism.

Note that this is, however, not financial advice, so make sure to always do your own research (DYOR) before making any investment.

Final Thoughts

Flux is among the rare projects capable of providing a truly scalable decentralized cloud infrastructure. Packed with great features such as cross-platform compatibility and scalable computing power renting, Flux is one of the most promising projects in the blockchain world.

As the Flux ecosystem expands into additional chains in the future, its value to DApp developers will only increase. The rise of the decentralized internet and AI technology will also provide additional fuel for the growth of the Flux network.

#LearnWithBybit